One of the keys to starting the 2024 bull market: Halving has arrived

Last year in 2023/October, the Biyan team published this article, pointing out the three key points of this bull market:

The key to unlocking the 2024 bull market! Halving, spot ETF, RWA, three major narratives of market capital increase

Here we briefly review

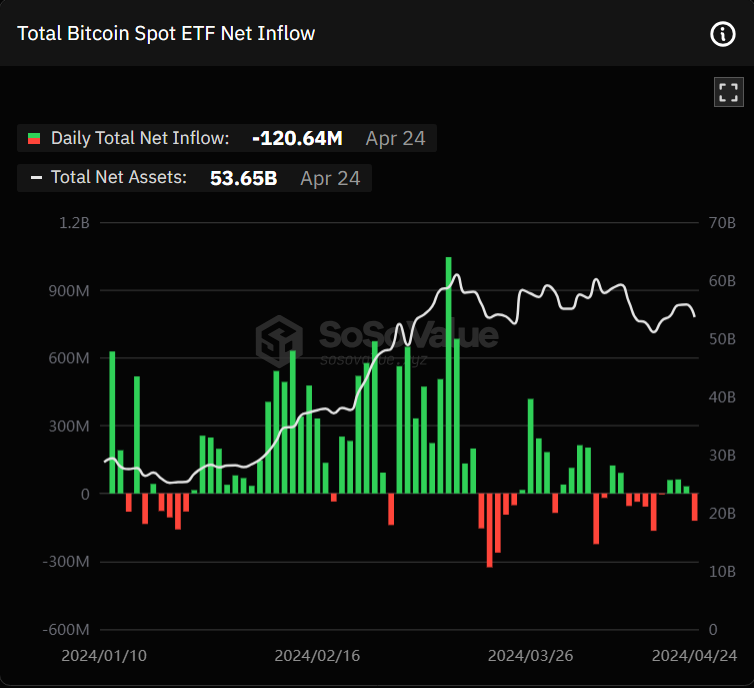

Spot ETF part: Total capital inflow this year is US$12 billion

Bitcoin Halving: Not yet fermented, but $BTC is undoubtedly one of the best-performing assets in the world this year

We can clearly see that Blackrock, an asset management and fund issuer, is strongly tied to the RWA market in the crypto by supporting the issuance of Bitcoin ETFs, the platform public chain (aptos) and the RWA project (Ondo Finance).

The Bitcoin halving that occurs every four years is a major event in the crypto. The fourth halving has occurred at the 840,000th block on 2024/04/20. The block reward has been reduced from 6.25 Bitcoins per block to per block. Block 3.125 Bitcoins, the average daily supply of new Bitcoins has been reduced from 900 to 450, and the cost of mining a new Bitcoin exceeds 100,000 US dollars.

The interesting thing is that after the halving, the block reward was reduced by half, but the miners’ income surged:

After the halving, the cost of mining one Bitcoin soared to more than 100,000, but miners’ income soared?

Review of market history after halving, will it be the same this time?

Why is halving a big event in the crypto? In addition to the iconic status of Bitcoin itself, another reason is that each of the past three halvings has been accompanied by high-volume halving prices.

The fourth halving has already occurred. Let’s quickly review the market trends of the past three historical halvings:

2012 First Halving | 2016 second halving | 2020 third halving | |

Number of days to peak after halving | 371 days | 526 days | 549 days |

Increase one month after halving | 9% | -10.5% | 12.8% |

Gains in three months after halving | 140% | -6% | 35.5% |

Growth in the first half of the year after halving | 960% | 38% | 74.5% |

Increase one year after halving | 8500% | 285% | 538% |

Increase to the highest point after halving | 9000% | 3050% | 800% |

Judging purely from the historical market conditions of the past three halvings, the bull market will continue for one to one and a half years after the halving, but the growth rate begins to increase rapidly. Both Mad Bull and Mad Cow started half a year after the halving. These few months will be a good time to lay out and adjust configurations.

But history is only a reference and will not necessarily be repeated again. While referring to history, we must also pay close attention to the different time and space background:

The very different thing about this halving is that Bitcoin hit a record high before the halving. This has never happened in the past halving market. Maybe this is a preview that this halving will go its own way, no. Then it’s a simple copy of the past.

Three major concerns about the market after the 2024 halving

The Bitcoin spot ETF was approved in January this year, and the fourth halving has also occurred. The 2024 bull market has already begun, and Bitcoin has also hit a record high. It is currently oscillating at a high level. The next focus turns to: Will the bull market continue? Three major focuses of the 2024 halving market:

Bitcoin Spot ETF Fund Flow

Macro-environmental factors

On-chain data indicators

Bitcoin spot ETF - opening up channels for traditional investors and gradually becoming a major player in the market

Why are Bitcoin spot ETFs important to subsequent market trends? There are two main reasons:

Open investment channels to traditional investors

It is too troublesome for ordinary people to understand how to open an account, open a wallet, deposit money, etc. Through spot ETFs, ordinary people can also directly participate in investing in Bitcoin from the stock exchange, which can bring in a large amount of funds. In the past, Canada, Germany and other countries have already opened up investment products such as ETFs, but the United States is the largest country in cryptocurrency trading. The adoption of US ETFs has greater influence and is undoubtedly an important signal to the world.The proportion of Bitcoin spot ETF holdings and capital volume is getting larger and larger. In just three months since January, the cumulative total of Bitcoin spot ETFs has reached nearly 60 billion U.S. dollars, and the single-day trading volume once exceeded 10 billion U.S. dollars. The trading volume is mostly in the billions of dollars; as ETFs become a bigger and bigger player in the market, their impact on the market will become greater and greater.

Because ETF has been one of the most important factors affecting the Bitcoin market, it can be observed in the past few months that when ETFs continue to have net inflows and large inflows, the market performs well. When ETFs start to turn into net outflows, the market performs well. There is a chance for fluctuations or declines.

Since ETFs are expected to bring a large amount of traditional capital investment, the focus is whether they will continue to bring capital inflows. Will the trend of capital inflows be interrupted or reversed? To observe Bitcoin ETF inflows, check out SoSoValue :

Not only are there capital inflow and outflow charts like the screenshot above, but there are also detailed data tables, which is very convenient.

The United States is currently the largest country in terms of cryptocurrency trading volume. Of course, we must focus on the Bitcoin spot ETF in the United States. Recently, Hong Kong also announced the adoption of spot ETFs. How it will develop in the future and whether it can bring a large amount of Asian funds to the market is also worthy of attention. Hong Kong’s The Bitcoin ETF is expected to be open for trading on 4/30. After that, attention needs to be paid to its trading status and funding amount.

Macro funds: U.S. Federal Reserve interest rate cut expectations

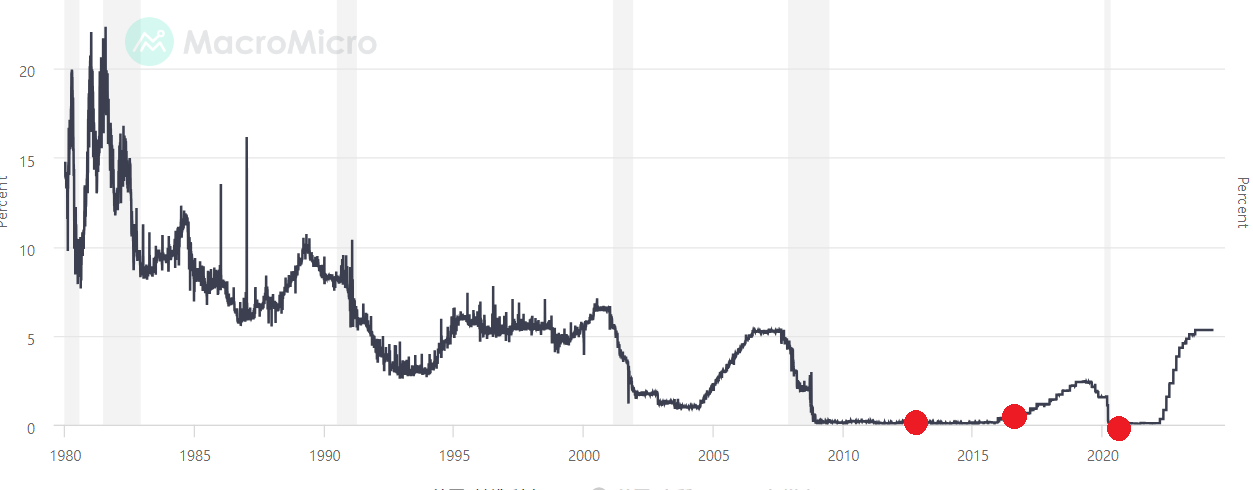

The previous three halvings have one thing in common: market capital interest rates are all at a low level. The 2021 bull market will be accompanied by interest rate cuts + a massive release of global funds, driving a wave of comprehensive rise in almost all risk assets.

During the first three halvings, the U.S. benchmark interest rate was close to 0%, which was a low interest rate environment; but the current U.S. benchmark interest rate is as high as 5.33%, and there is no clear time point for interest rate cuts.

Excluding factors such as technology and industrial development, capital is the core driving force for market growth. If we expect a wild bull like the previous three halvings, not only the various tracks in the cryptocurrency industry must have certain developments and breakthroughs, such as this year's hot RWA , AI, DePIN, restaking, BTC Layer 2, etc., also require matching of funding conditions. With the current high funding interest rate, the upward momentum will be limited to a certain extent.

Further reading:

Eigenlayer enters the next stage of growth and will help you interpret the upcoming AVS wave

The first three halvings almost all started to enter the bull market after half a year. The current market forecast is that the interest rate cut will start at the end of the third quarter or the fourth quarter. The timing is quite consistent. We need to continue to pay attention to the development of this part. If the interest rate is cut If interest rates continue to be postponed or even raised, and macro conditions do not match, it will become more difficult to sustain the bull market.

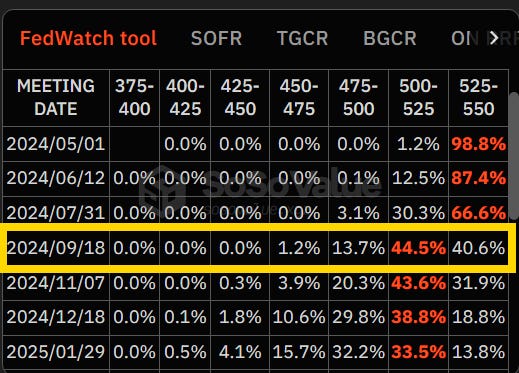

In addition to daily attention to financial news, related tools are also good tools launched by SoSoValue :

In the lower right corner of the page, shown is the probability distribution chart of market forecasts for the Federal Reserve interest rate. According to the picture, the probability of a one-digit rate cut in September is 44.5%, the probability of a two-digit rate cut is 13.7%, and the probability of maintaining the status quo is 40.6%. This is market expectation and can only be used as a reference, and the actual timing will be determined by the Federal Reserve.

However, market expectations will adjust with the Fed's attitude. We can regularly observe this table to judge the current direction of the Fed's announcement and the market's interpretation.

On-chain data indicators - determine the current market position

The first two focus on external factors, such as the general environment's capital interest rate conditions and whether external funds continue to enter the crypto. The third focus focuses on internal factors, judging the current market position from on-chain data.

There is a lot of data on the chain, and the focus is mainly on one: important market indicators.

Here is a brief introduction to three on-chain market indicators:

Exchange Bitcoin Stock

Source: https://www.coinglass.com/Balance

This refers to the total Bitcoin balance in wallets on centralized exchanges.

Why should you pay attention to exchange Bitcoin stocks?

Because you usually have to move to an exchange to trade, the lower the balance in the exchange, the fewer Bitcoins you want to trade, and the potential selling pressure is lower; the higher the amount of memory in the exchange, the higher the potential selling pressure .

However, after the adoption of spot ETFs, market participants have become more and more complex, and more and more institutions have entered the market for transactions. The Bitcoins they hold may not necessarily be counted in the exchange address. Under this general trend, exchanges The balance should continue to decrease. For this part, we can just observe the difference in large changes in the short term.

Market Value Realization Indicator - MVRV Z-Score

Source: Bitcoin - MVRV Z Score | MacroMicro Finance M Squared

MVRV calculation formula = (circulating market capitalization - realized market capitalization) / circulating market capitalization standard deviation

The circulation market value is easy to understand, it is the current market value of Bitcoin

The realized market value refers to the total value of the last transaction of Bitcoin on the chain. Simply put, it can be understood as the current purchase cost of all Bitcoins at that time.

Circulating market value - realized market value = current total book profit and loss

The MVRV indicator can be understood as the book profit and loss status of the overall Bitcoin holders. The higher the indicator, the higher the book profit, which means the higher the probability of profit-taking. When the indicator reaches a certain level, you must be vigilant. If the book profit is too high, there must be a wave of profit-taking momentum. This concept is very close to the moving average/deviation rate of the stock market. However, the moving average of the stock market is an estimated average cost, and the data on the chain can Calculate a more accurate realized market value (purchase cost).

At several bull market highs in the past, the MVRV indicator has exceeded 6 or even 10. The MVRV at the moment of writing this article is 2.16.

Bitcoin long-term holding (holding for more than one year) ratio

Phyrex, a well-known Twitter on-chain data analyst, has said in tweets many times: According to on-chain data, the highs of the bull market are bought by short-term holders.

Although long-term holders are usually the core value investors of Bitcoin, the peak of the bull market is inevitably accompanied by a large number of retail investors, and the high points are bought by short-term holders. Paying attention to changes in long-term holding ratios can allow us to judge whether we have entered the final peak of the bull market. It is also a basic and important on-chain indicator.

Here we only briefly list three basic and simple on-chain indicators. If you want to know more about Bitcoin indicators, you can refer to this article:

5 major Bitcoin indicators | Let you buy the dips and escape the top without asking for help | Buy and sell signals | What do you think of the indicators?

Summary of Dongdong - Crowd + Money = Long-term healthy bull market

Although the essential difference between "Bitcoin" and "other cryptocurrencies that are not Bitcoin" will become larger and larger. For example, Bitcoin will become more and more like a commodity, a commodity asset with both risk and hedging factors. Other cryptocurrencies such as Ethereum, other public chain coins, and protocol coins will become more and more like certain technology stocks.

But at this stage, for most people, they are all "cryptocurrencies" and will still be highly correlated, with market trends often linked. So no matter what currency you actually buy, you still have to pay attention to Bitcoin. As the leader of cryptocurrency, the rise and fall of the entire market is still deeply affected by Bitcoin.

General cryptocurrency market capital flows:

External funds flow into Bitcoin and enter the crypto

The funds entering the crypto look for profits and opportunities, and flow into other sectors such as DeFi, restaking, layer 2... and drive the sector to rise.

Coupled with some out-of-circle applications, they may not directly bring in funds, but attract a large number of new users to enter the crypto, such as gamefi, DePIN, AI... Like the previous wave of NFTs, the ICOs on the upper wave have attracted a large number of new users. who enter the field.

If there is only a wave of money but no crowds, it is a bubble that will burst quickly; if there is only a crowd but no money, the on-site game will become more and more serious, with each other fighting for the only resources. The tide of people + the tide of money will make the bull market go long and far . For those of us investors in the market, the focus is whether this bull market can continue to meet these conditions, and use this to arrange our investment cycles and strategies.