Written by Layergg

Compiled by: TechFlow

Meme is becoming an alternative to "VC, CEX and high FDV" in this crypto cycle. Community-driven + fair release has captured the hearts of retail investors and has begun to exert influence in the actual bidding stage.

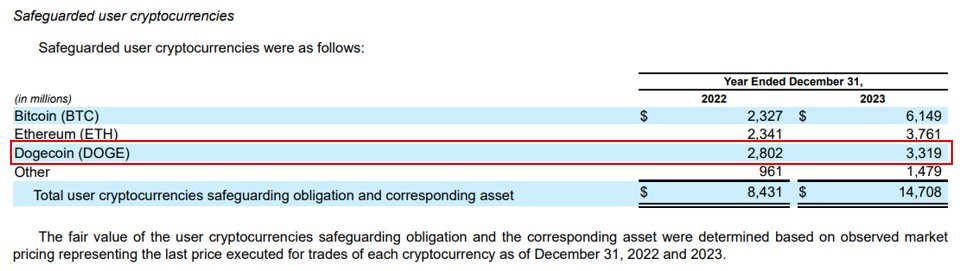

Large-cap memes have been among the top performers this year, maintaining strong returns even during market corrections. Memes are now a mainstream asset class, as evident by the holdings of Robinhood users.

One thing to consider is that global asset managers are only just beginning to enter the cryptocurrency space.

I think it’s unlikely that Wall Street veterans will be the exit liquidity for crypto VCs, they are more likely to disrupt the status quo, and memes will hopefully be one of the tools they use to do that.

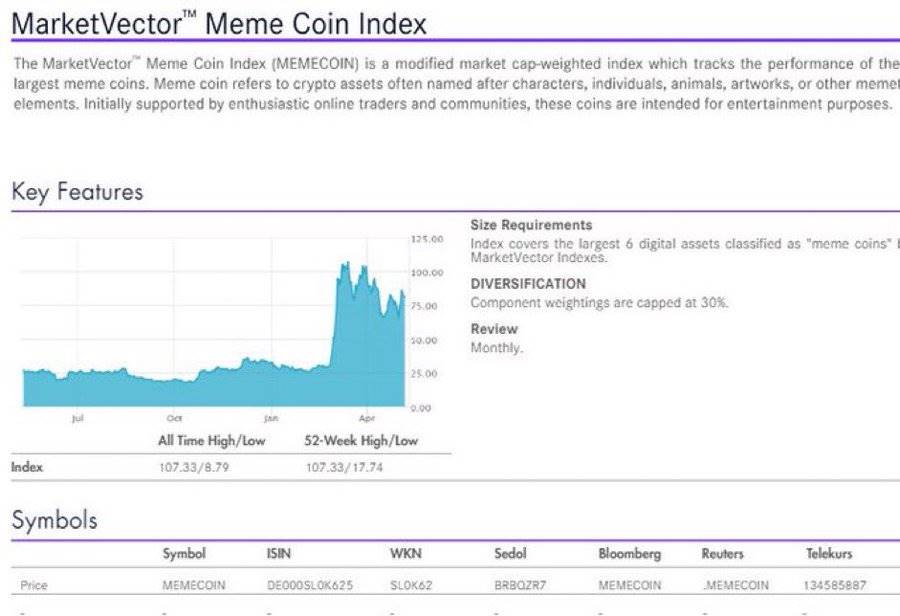

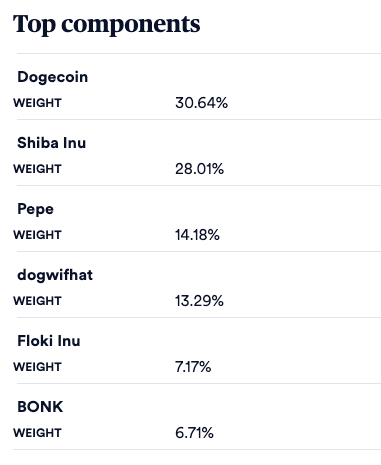

Two prominent examples are Franklin Templeton and VanEck.

a) VanEck's MarketVector recently launched the Meme Index.

b) Franklin Templeton continues to publish articles about Meme. An interesting case is Franklin Templeton’s promotion of $WIF .

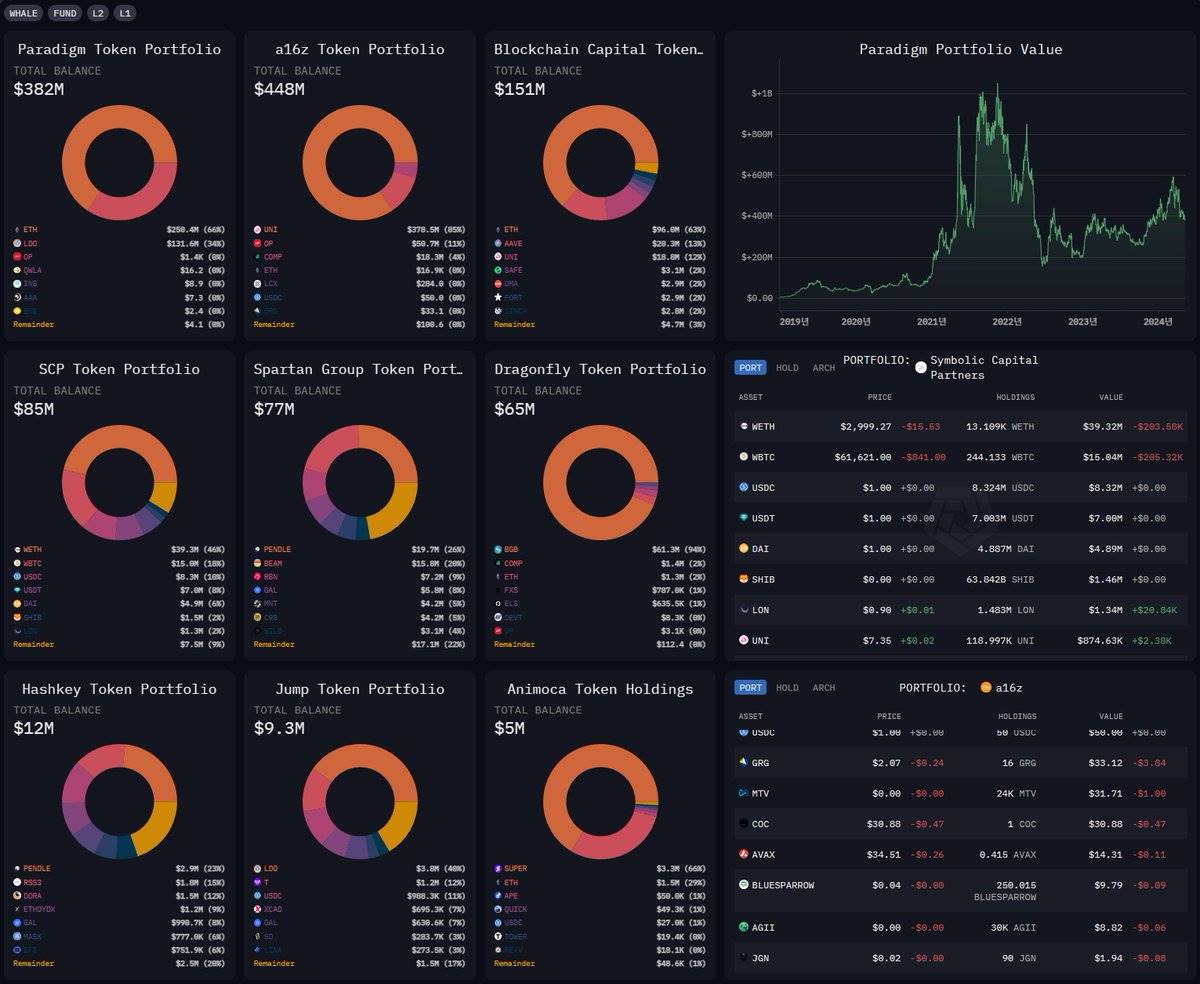

Surprisingly, traditional crypto VCs are still slow to embrace memes. Major memes like $WIF and $PEPE are nowhere to be found in the portfolios of top VCs. If they finally give in and decide to invest in memes, this could mark the beginning of the second wave of the meme cycle.

Perhaps the upcoming US presidential election will force VCs to make a painful choice soon (whether to add memes to their portfolios).

Although it is still uncertain whether Trump or Biden will win, every related event seems to be conducive to promoting the popularity of the meme.

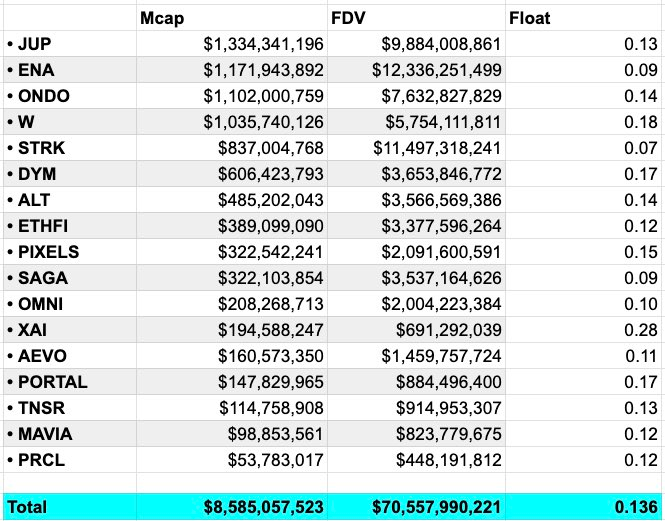

On top of that, retail investors are disappointed with “ low float, high market cap” projects. VCs advocate “seriousness/fundamentals!”, but the market response remains lukewarm. In this situation, hedge funds and market makers are under pressure to generate returns within a specified time frame.

“Is the meme over?”

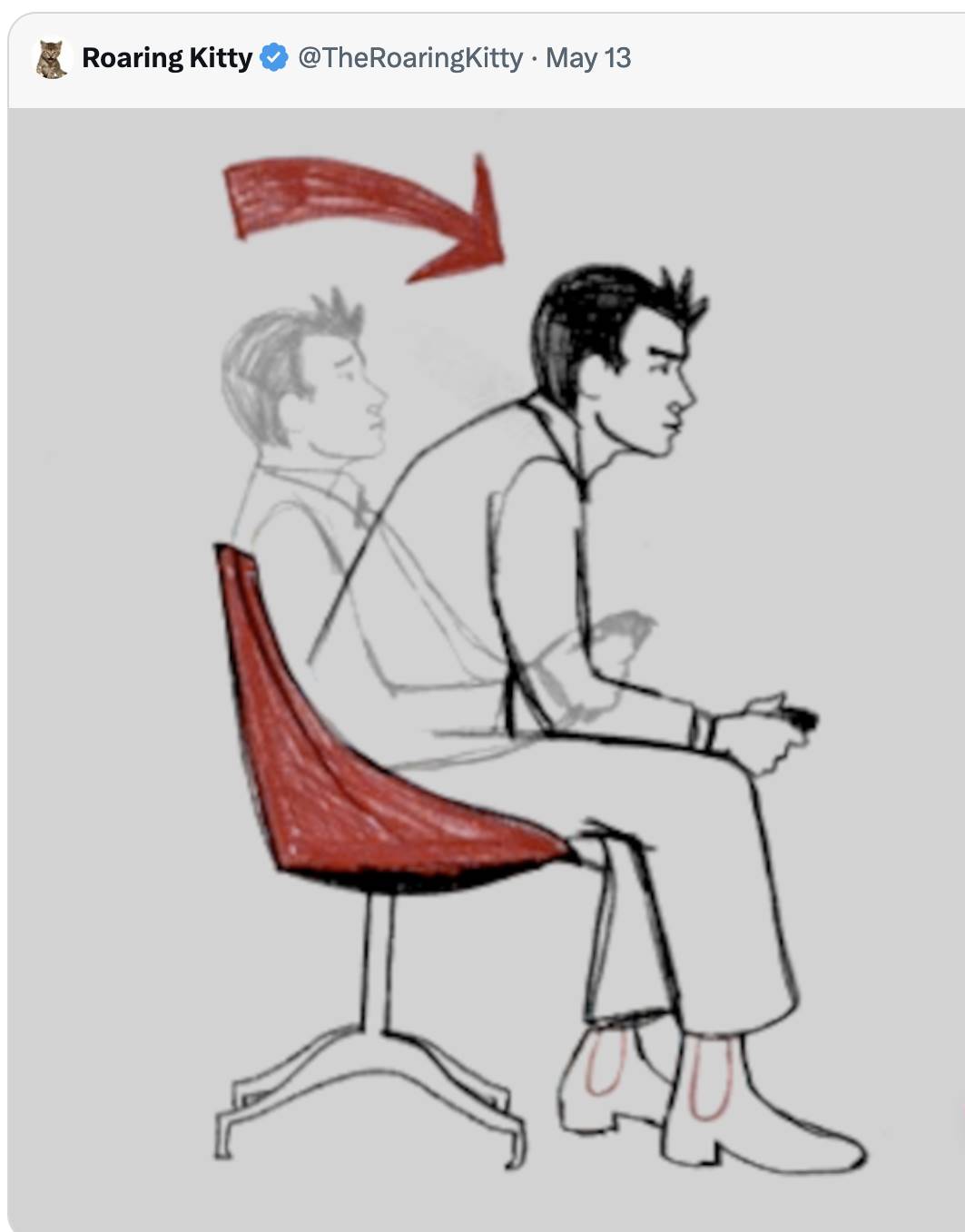

Today, Roaring Kitty of $GME fame posted for the first time in three years. His return may well herald the beginning of the second wave of the meme cycle.

Don't underestimate his influence.

From a technical analysis perspective, most major memes are still in the retest phase. Some important memes (such as $PEPE $WIF ) are expected to enter the top 20 soon.