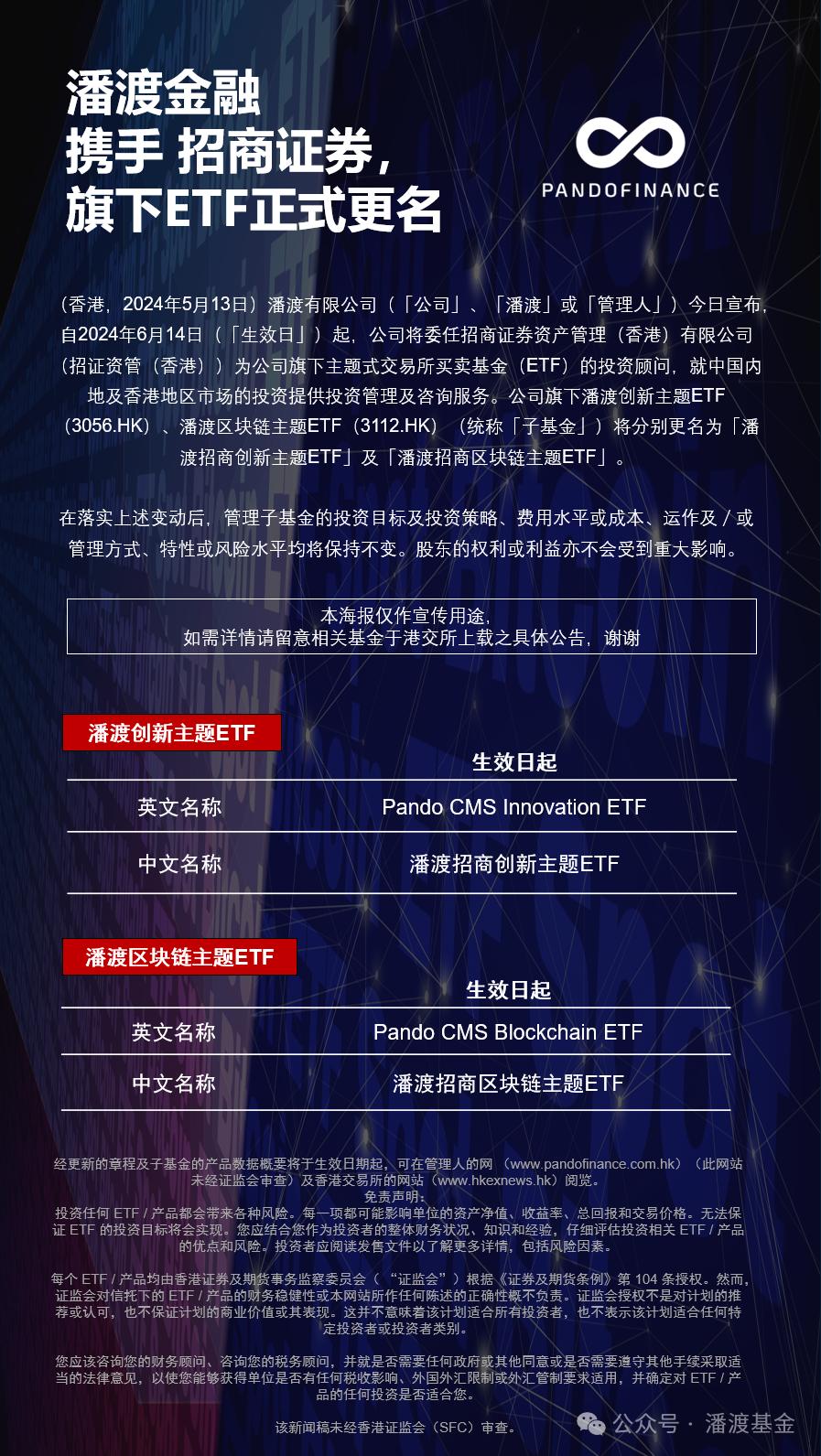

Hong Kong, May 13, 2024) Pandu Limited (the "Company", "Pandu" or the "Manager") announced today that from June 14, 2024 (the "Effective Date"), the Company will appoint China Merchants Securities Asset Management (Hong Kong) Co., Ltd. (CMSAMC (HK)) as the investment advisor for the Company's thematic exchange-traded funds (ETFs) to provide investment management and consulting services for investments in the Chinese mainland and Hong Kong markets. At the same time, the Company's Pandu Innovation Theme ETF (3056.HK) and Pandu Blockchain Theme ETF (3112.HK) (collectively referred to as the "Sub-Funds") will be renamed "Pandu CMB Innovation Theme ETF" and "Pandu CMB Blockchain Theme ETF" respectively.

This WeChat article is for promotional purposes only. For more details, please click to read the original text

01 Delegation

In order to more flexibly utilize investment expertise and provide more flexible professional investment management and consulting services, Pandu will appoint China Merchants Securities Asset Management (Hong Kong) Co., Ltd. as an investment consultant from the Effective Date to provide investment management and consulting services for the Sub-Fund's investment in the Mainland China and Hong Kong markets. China Merchants Securities Asset Management (Hong Kong) will have investment discretion over the Sub-Fund's investment in the Mainland China and Hong Kong markets to achieve the investment objectives of the relevant Sub-Fund and act in accordance with the investment strategies and restrictions stated in the Articles, subject to the control and review of the Manager.

China Merchants Securities Asset Management (Hong Kong) Co., Ltd. was established in 2008 and is a wholly-owned subsidiary of China Merchants Securities International Co., Ltd. China Merchants Securities Asset Management (Hong Kong) holds licenses issued by the Securities and Futures Commission to carry out Type 4 (providing advice on securities) and Type 9 (providing asset management) regulated activities. It is the main platform for China Merchants Securities International to carry out asset management services, providing customers with diversified cross-border asset management, investment consulting services and one-stop fund management and personal financial management solutions.

Currently, the Manager and the Investment Advisor are not part of the same fund management group. The Investment Advisor's fees will be borne by the Manager and will not be paid from the assets of the Company and the Sub-Funds.

02 Name Change of Sub-Fund

Based on the appointment of the Investment Advisor, the name of the Sub-Fund will be changed as follows from the Effective Date: (The short name of the Sub-Fund will remain unchanged)

After the implementation of the above changes, the investment objectives and investment strategies, fee levels or costs, operation and/or management methods, characteristics or risk levels of the Sub-Funds will remain unchanged. The rights or interests of shareholders will not be significantly affected. The updated Prospectus and Product Facts Statement of the Sub-Funds will be available for inspection on the website of the Manager (which has not been reviewed by the SFC) and the website of the Hong Kong Stock Exchange from the Effective Date.

03 About Pando

As a pioneer in the field of digital asset management, Pandu Asset, a subsidiary of Pandu Financial Group, established its headquarters in Zurich in 2022 and issued Pando 6 spot virtual asset funds, Bitcoin and Ethereum spot ETPs on the Swiss Stock Exchange; Pandu Limited, another subsidiary of Pandu Financial Group, obtained the Type 1 (Securities Trading), Type 4 (Providing Opinions on Securities) and Type 9 (Providing Asset Management) licenses and public fund qualifications issued by the Securities and Futures Commission in Hong Kong, and was approved to manage investment portfolios with more than 10% investment in virtual assets and issued several high-performance actively managed ETF products. Through in-depth strategic layout in this field, the company has accumulated rich experience in digital asset allocation and compliance, and is committed to providing diversified investment solutions. Through its continuous commitment to innovation, it has attracted many investors who seek to seize opportunities in the dynamically changing investment field. For more information, please refer to the official website .

Disclaimer:

Investing in any ETF/product carries with it various risks. Each of these may affect the NAV, yield, total return and trading price of the units. There is no guarantee that the investment objective of the ETF will be achieved. You should carefully evaluate the merits and risks of investing in the relevant ETF/product in light of your overall financial situation, knowledge and experience as an investor. Investors should read the offering documents for further details, including risk factors.

Each ETF/product is authorised by the Securities and Futures Commission of Hong Kong (“SFC”) under Section 104 of the Securities and Futures Ordinance. However, the SFC takes no responsibility for the financial soundness of the ETFs/products under the Trust or the correctness of any statements made on this website. SFC authorisation is not a recommendation or endorsement of the scheme and does not guarantee the commercial merits of the scheme or its performance. It does not mean that the scheme is suitable for all investors nor does it mean that the scheme is suitable for any particular investor or class of investors.

You should consult your financial adviser, consult your tax adviser and take appropriate legal advice as to whether any governmental or other consents are required or other formalities need to be complied with to enable you to acquire the Units, whether there are any tax implications, foreign exchange restrictions or exchange control requirements applicable, and determine whether any investment in the ETFs/Products is suitable for you.