Content source: X account Phyrex @Phyrex_Ni

After looking at the data today, I suddenly realized that both the data and the technical flow are very powerless to predict the future trend. Even if I see that the data on the chain is bearish, as long as tomorrow's CPI is lower than the previous value and lower than expectations, I believe the market will still rise under the expectation of a Fed rate cut. At this time, the role provided by the data is really too low.

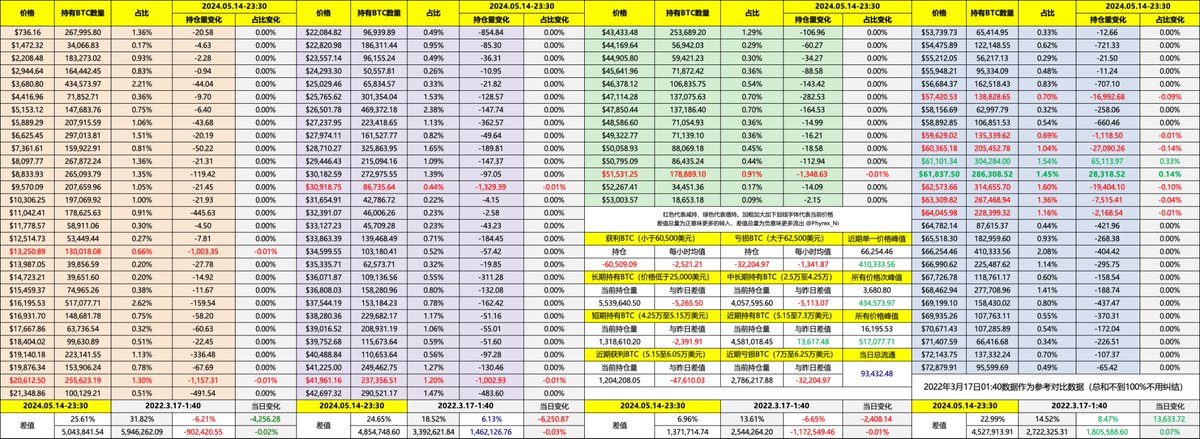

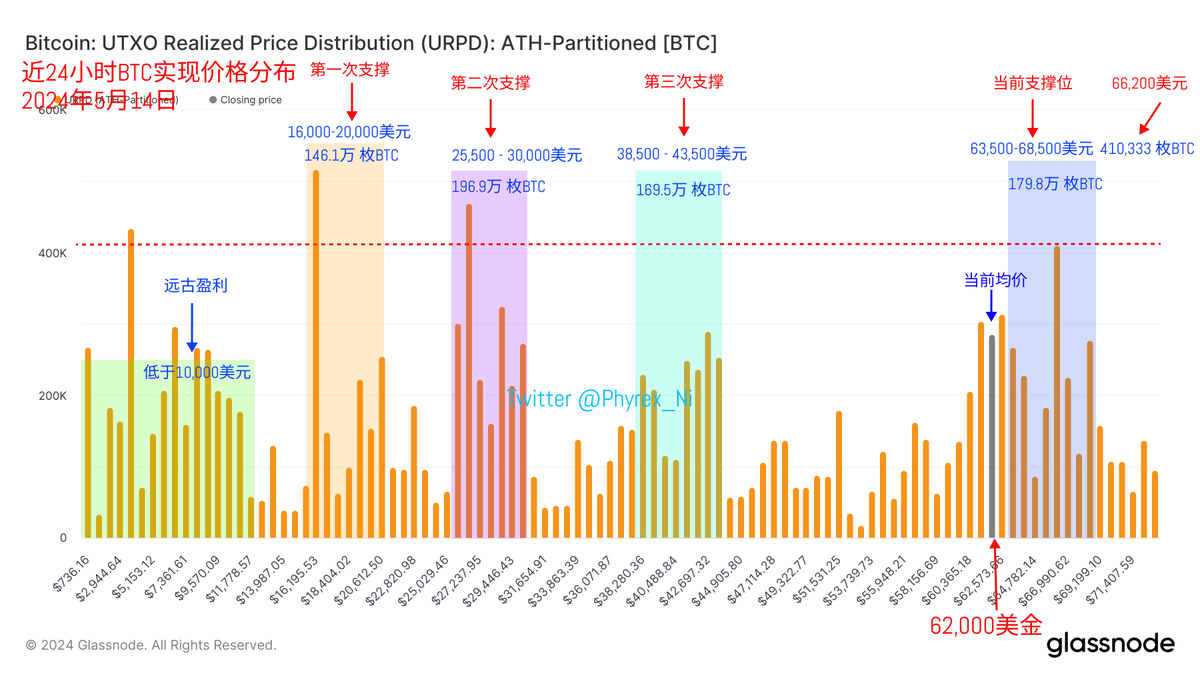

We can see from the data that if it rises, there is no upper limit for the time being, and if it falls, there may still be a lower limit. After all, after so long of fluctuations, those who should run have almost all run away. Now, there should not be many people left who are still worried about the Fed. Of course, this is also closely related to the bearish data. Today is Tuesday, and it is obvious that the volatility of #BTC on the chain has decreased by more than 40% compared with the same period last week. Those who should buy have bought, and those who should sell have almost all sold. If there is good news, it can also attract the attention of short-term investors. If there is bad news, these short-term investors will also run away in a swarm. The recent data has been very obvious. Except for short-term investors, there is really a trend of "no one plays" anymore.