Some people are talking about the "banana zone" (referring to the price starting to rise after passing the inflection point, like an upright banana with a curved bottom and a vertical top), so let me clarify it.

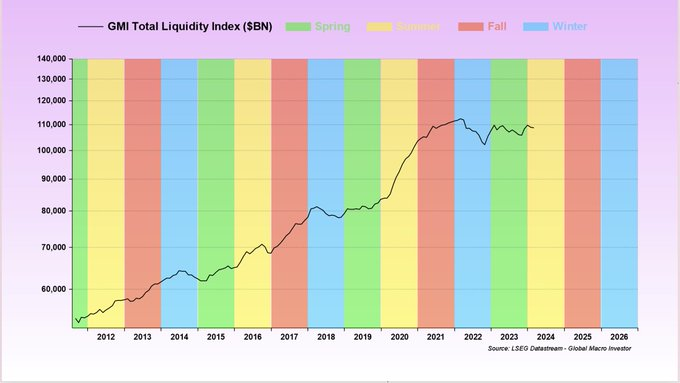

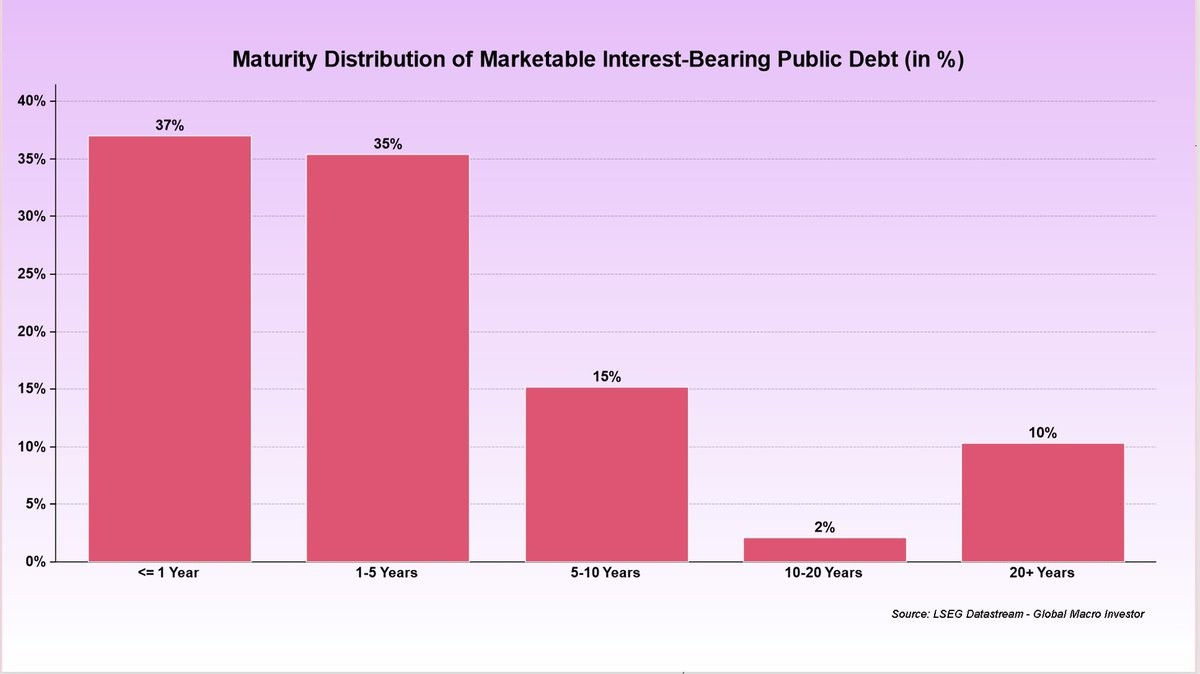

The macroeconomic summer and autumn are driven by the global liquidity cycle. Since 2008, the global liquidity cycle has shown a clear cyclical nature. Why choose to start the analysis from 2008? In this year, many countries around the world reset their interest payments to zero and adjusted their debt maturities to 3 to 4 years, creating a perfect macro cycle.

In the Institute for Industrial Supply Management index (ISM) we can observe the perfect cyclicality of the business cycle, which is one of the best indicators for studying macroeconomic cycles.

This is all part of “The Everything Code” where the business cycle repeats itself in near-perfect cycles as liquidity rises to devalue currencies in response to debt rotation. Without this mechanism, yields would be completely unanchored, leading to a debt spiral (which is to be avoided at all costs).

Note: The law of everything mentioned by the author is a macro theory that describes the working mechanism of the global economy, especially focusing on how monetary policy (especially currency depreciation) affects business cycles and debt management.

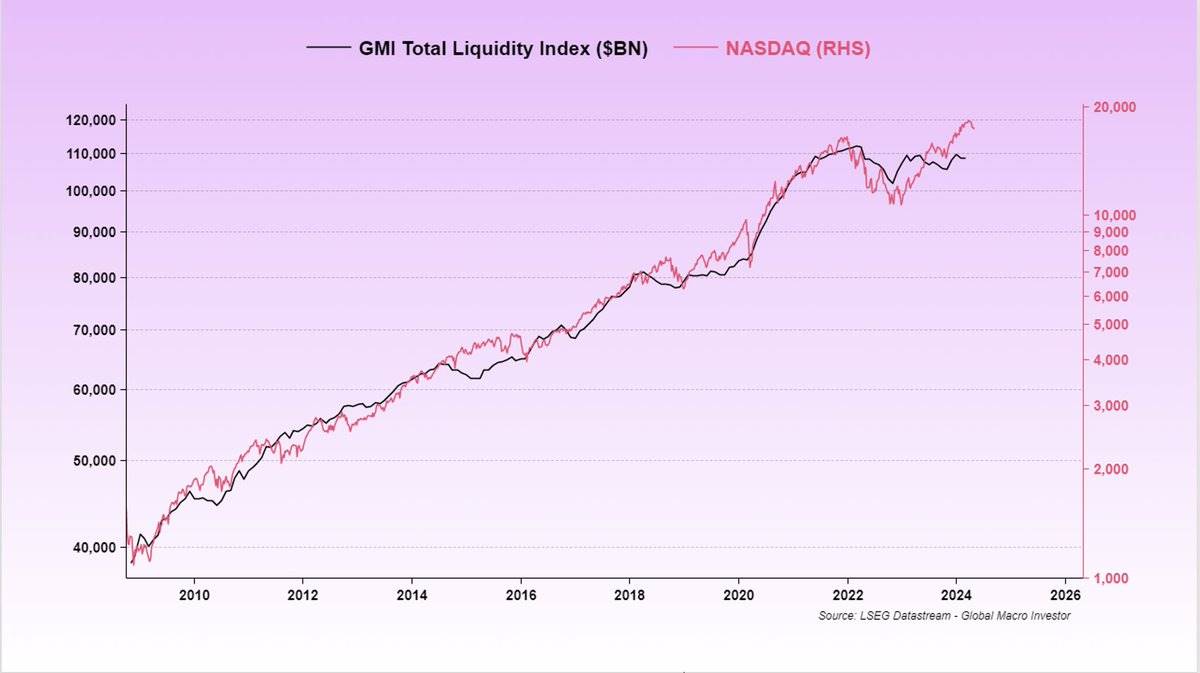

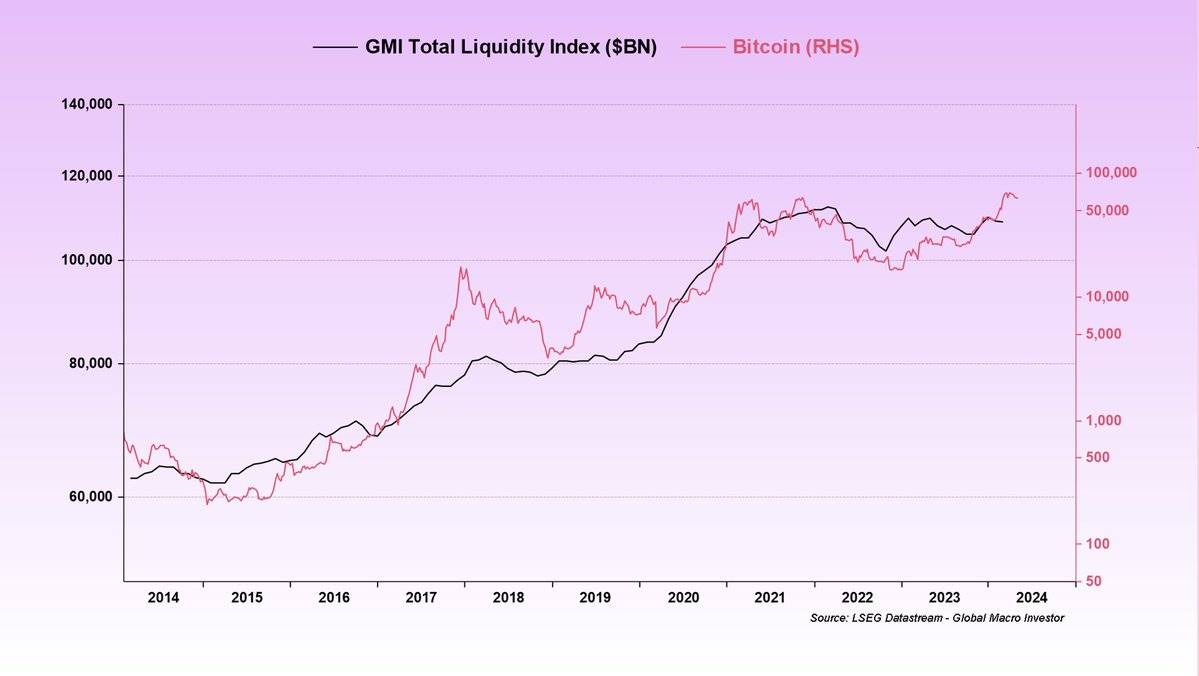

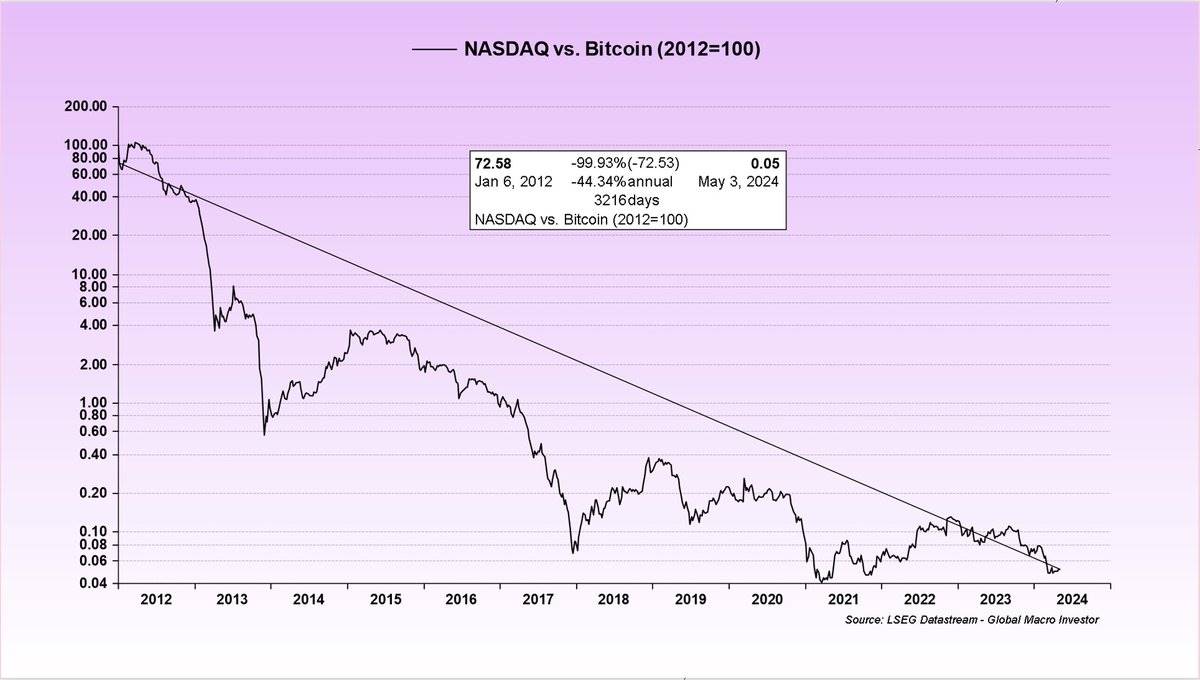

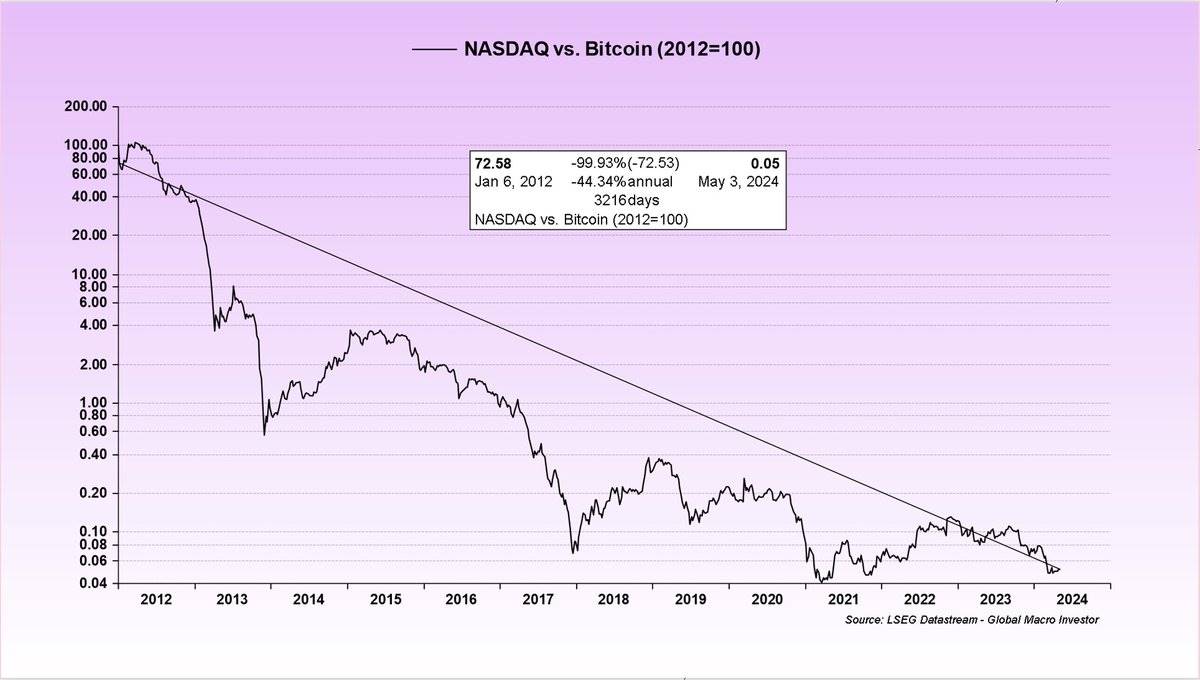

The effect of currency devaluation is to lower the denominator (fiat currency), which makes the asset price visually appear to have appreciated. Here is the performance of the Nasdaq Index (NDX) and Bitcoin (BTC):

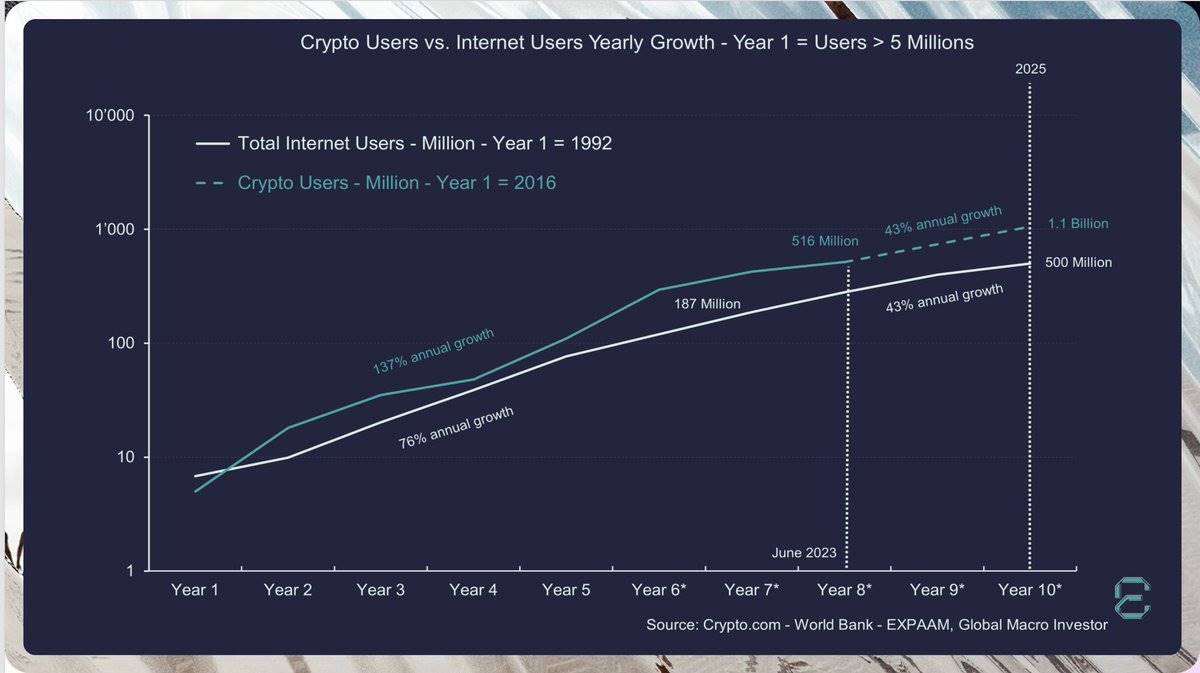

Growth assets (tech and crypto) perform best because they are in the midst of adoption-based secular trends (Metcalfes Law).

Growth assets (tech and crypto) perform best because they are in long-term trends based on adoption (Metcalfe’s Law).

That’s twice as fast as internet usage (comparing active wallets to IP addresses is an imperfect but comparable measure)

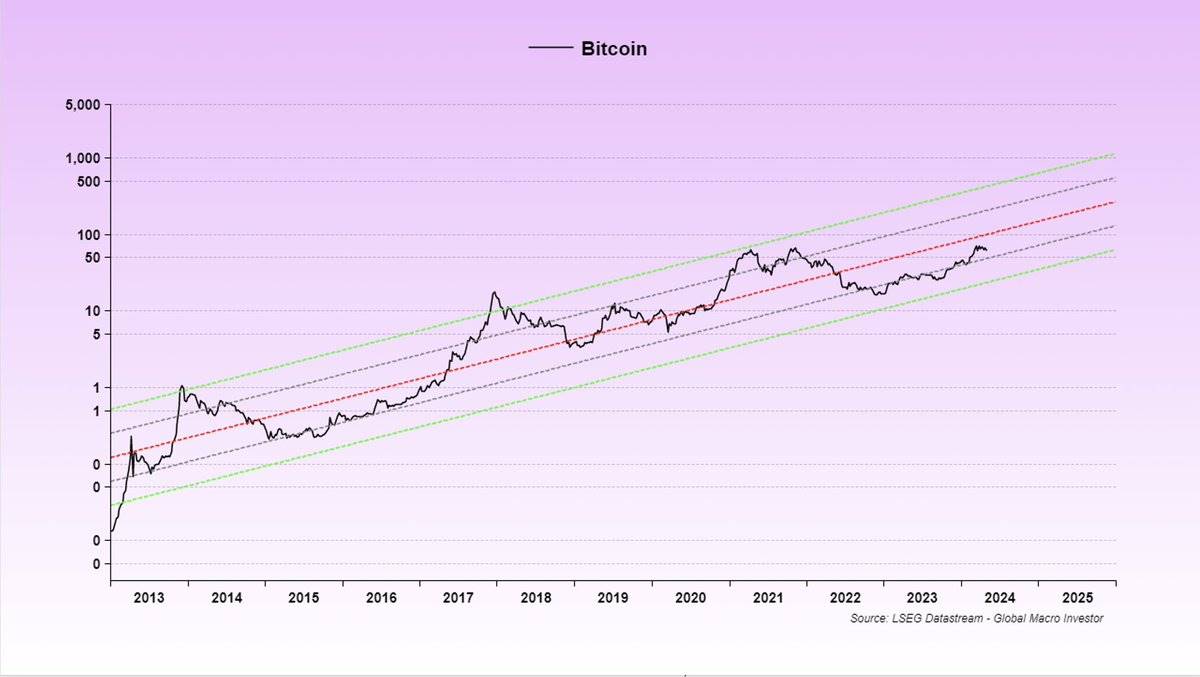

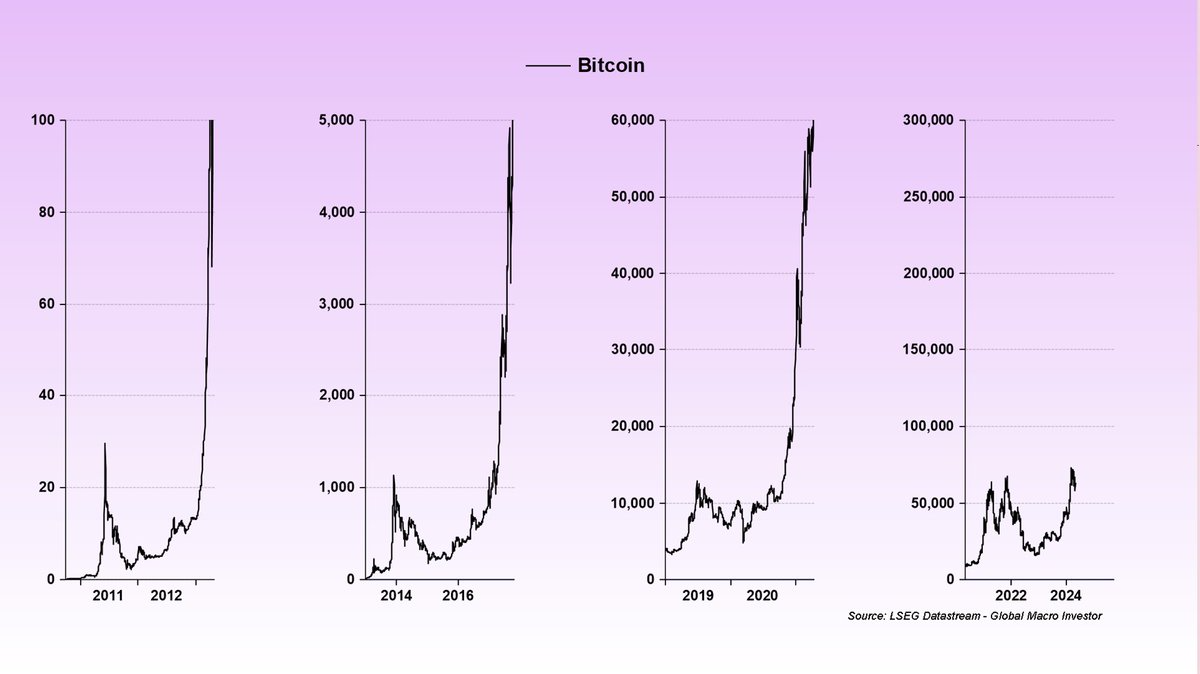

In the long term, it looks like this, and I think this is the adoption curve for crypto going from $25 billion to $100 billion.

Back to the banana zone, in the macro summer and fall, technology stocks performed very well and had their own small banana zone, with the fall being the most significant.

But because cryptocurrencies have outperformed tech stocks, the banana zone is more pronounced in cryptocurrencies.

The transition to macro summer is relatively predictable due to the repeating cycle, again emphasizing the “law of all things”.

This has led to an increase in liquidity.

At the same time, the growth of liquidity also tends to create new banana zones in the crypto market.

The odds of this changing significantly are low due to the current debt rollover, elections, and global issues like China. However, nothing is perfect and we cannot tell the structure or nature of the last leg of the fall, whether it will be an explosive rally or a stagflation cycle.

Ah, the mysteries of the markets… you can’t always get what you want. But The Everything Code is the best framework for understanding it all, and I think it has a pretty high probability of success. But there will be surprises along the way (sharp corrections, long periods of sideways markets, etc.).

The secret of the market is that you can't always get what you want. But the "rule of everything" is the best framework for understanding it all, and I think it has a pretty high probability, but there will be surprises along the way (dramatic corrections, long periods of sideways markets, etc.).

But if you have the right time perspective, proper portfolio management, and enough patience , the chances of you screwing up are slim.