A. Market View

1. Macro liquidity

1. Macro liquidity

Monetary liquidity improved. The minutes of the Federal Reserve meeting showed that policymakers were concerned about insufficient progress in reducing inflation, suggesting that the wait-and-see attitude of maintaining high interest rates should last longer. Expectations of interest rate cuts have been repeated, and the US dollar index fell on a weekly basis. US technology stocks continued to lead the market, and all three major stock indexes hit record highs. The crypto market rebounded strongly following the US stock market.

2. Market conditions

2. Market conditions

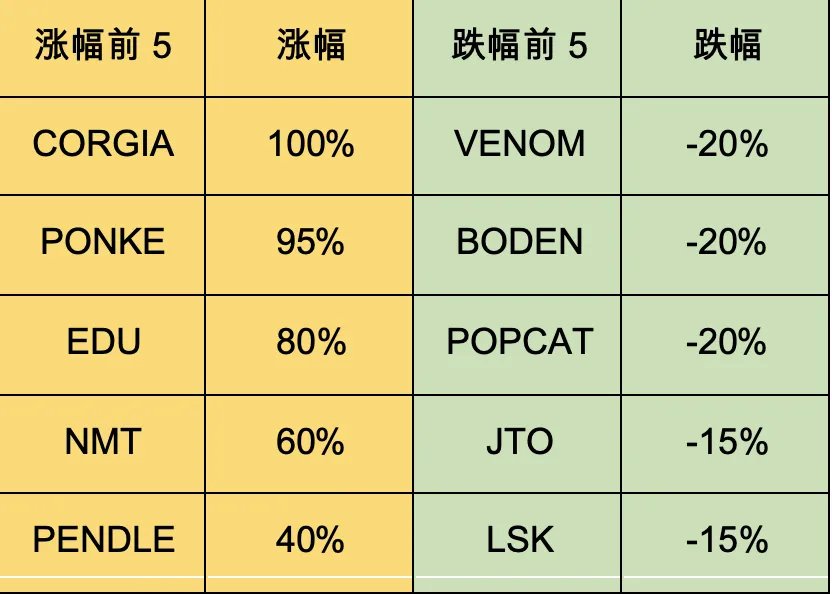

The top 100 companies with the highest market capitalization:

BTC rebounded this week, and ETH led the gains significantly. The main trend of the market revolved around ETH and Meme sectors.

1. ETH: The US SEC requires the accelerated update of ETH ETF application documents, and the probability of ETF approval has increased from 25% to 75%. The deadline for several ETFs to pass has been changed from May 23 to August 7. However, Bloomberg predicts that the ETH ETF will only reach 10% of the size of the BTC ETF. 2. ZKSYNC: L2's Zksync plans to airdrop in June, with a total of 21 billion tokens and a market value of 10 billion US dollars. ARB, OP, and STRK in the same track are all worth about 12 billion US dollars. 3. LISTA: Binance Exchange Metadrop platform will list LISTA, which is a liquidity pledge and decentralized stablecoin protocol. Metadrop's latest two BB and LISTA are both projects made by the original Bsc chain Auction and Hay team, and are slightly lacking in innovation.

3. BTC market

3. BTC market

1) On-chain data

The number of long-term BTC holders has decreased, while the number of short-term holders has increased. The market has seen local divergences, with the rate of new capital inflows slowing down and long-term volatility converging.

The market value of stablecoins remains flat, and long-term funding fundamentals remain positive.

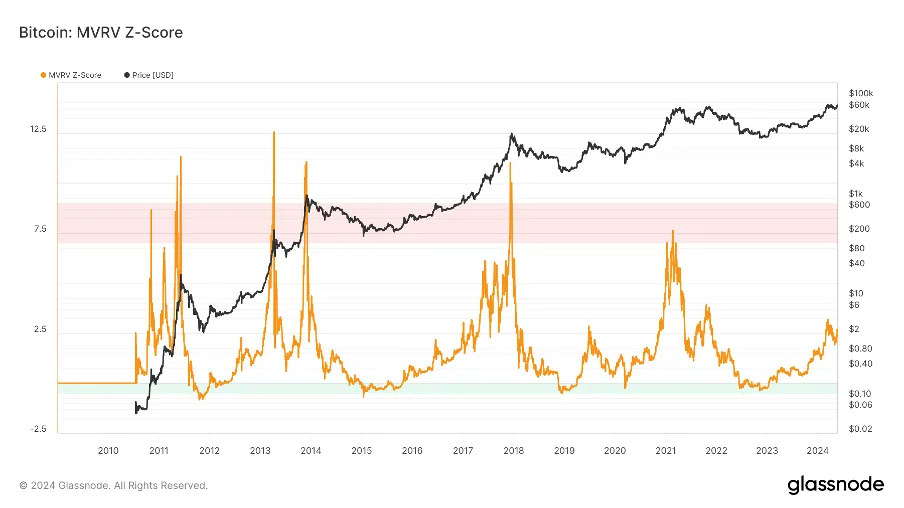

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV falls below the key level of 1, and the holders are generally in a loss state. The current indicator is 2.5, entering the middle stage.

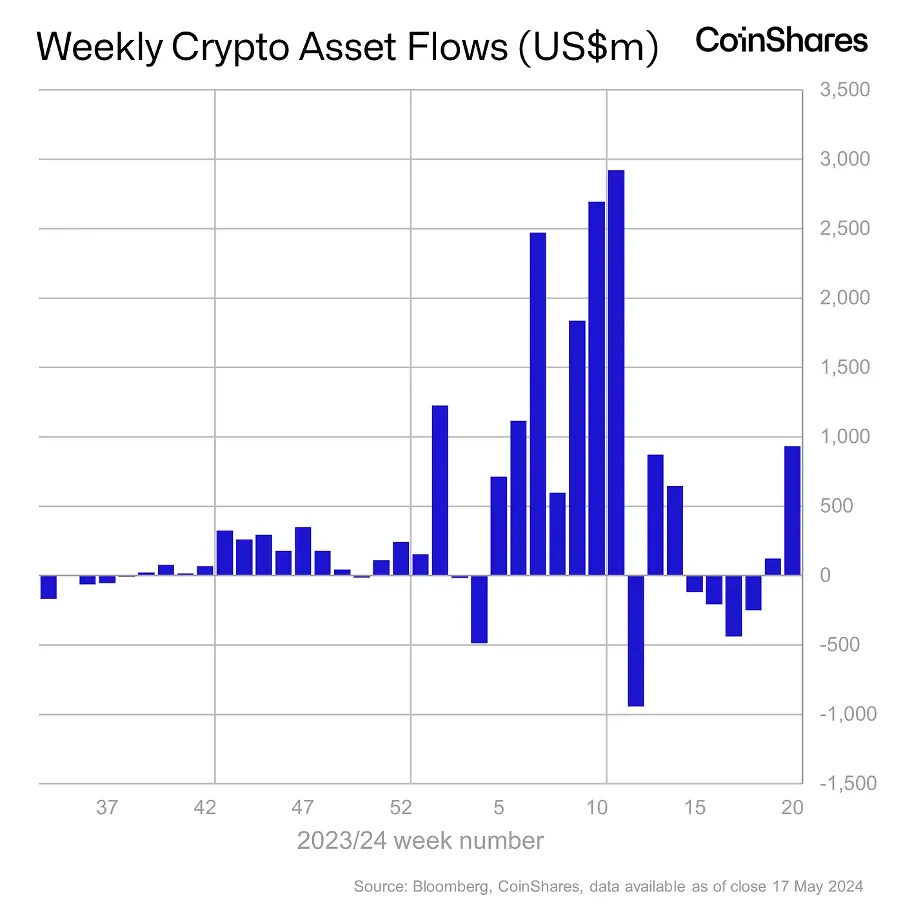

Institutional funds reversed the trend of capital outflow for two consecutive weeks, and investors are optimistic about the outlook.

2) Futures market

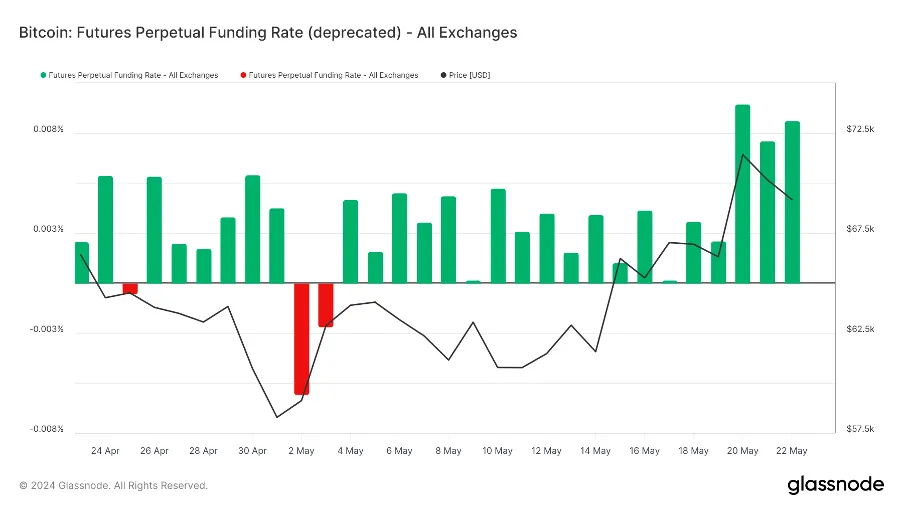

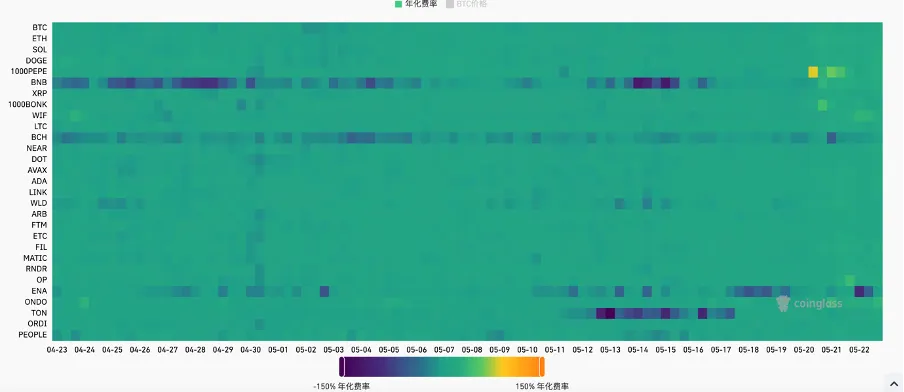

Futures funding rate: This week the rate increased slightly. The rate is 0.05-0.1%, with more long leverage, which is the short-term top of the market; the rate is -0.1-0%, with more short leverage, which is the short-term bottom of the market.

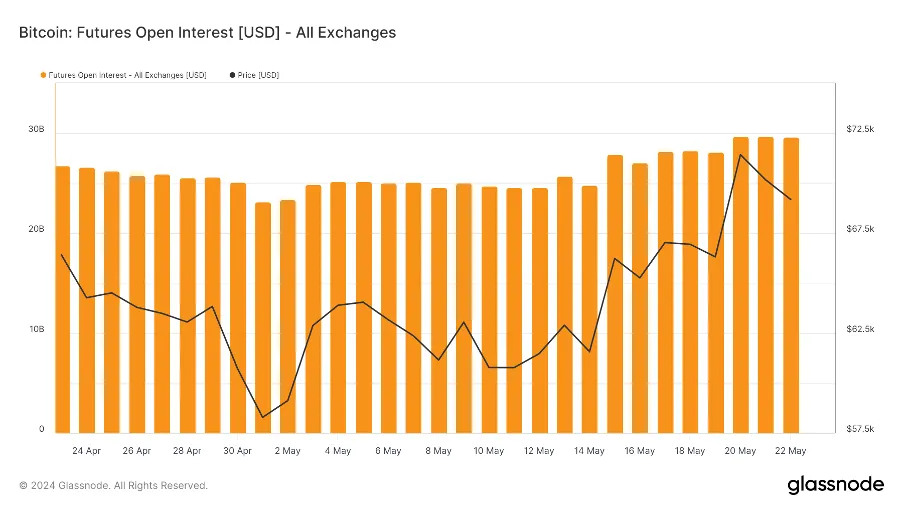

Futures open interest: BTC open interest increased significantly this week, with major market players entering the market.

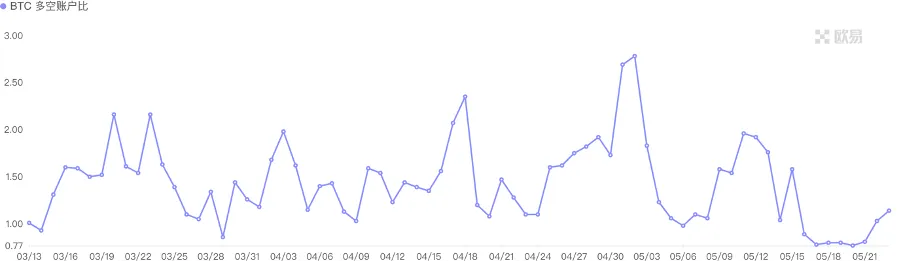

Futures long-short ratio: 1.3, market sentiment is neutral. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more panic, above 2.0 is more greedy. Long-short ratio data fluctuates greatly, and its reference value is weakened.

3) Spot market

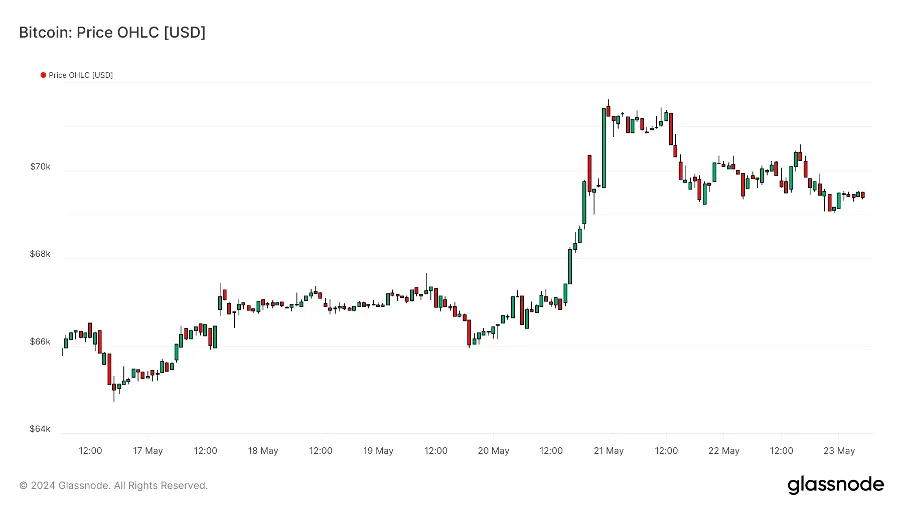

BTC rebounded to a near-new high. The probability of ETH spot ETF passing increased significantly, triggering a general rise in the altcoin season.

B. Market Data

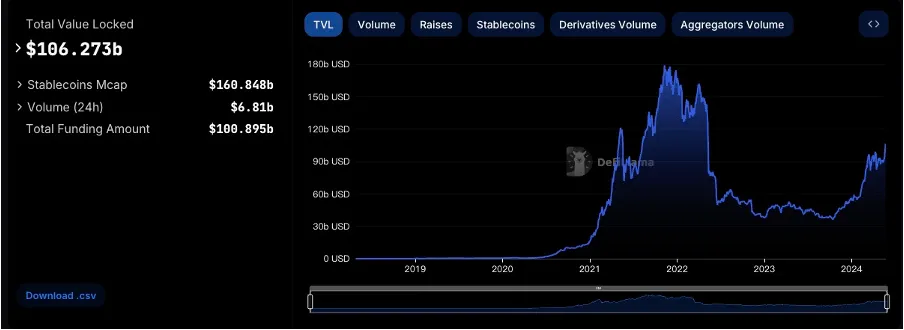

1. Total locked-up amount of public chains

1. Total locked-up amount of public chains

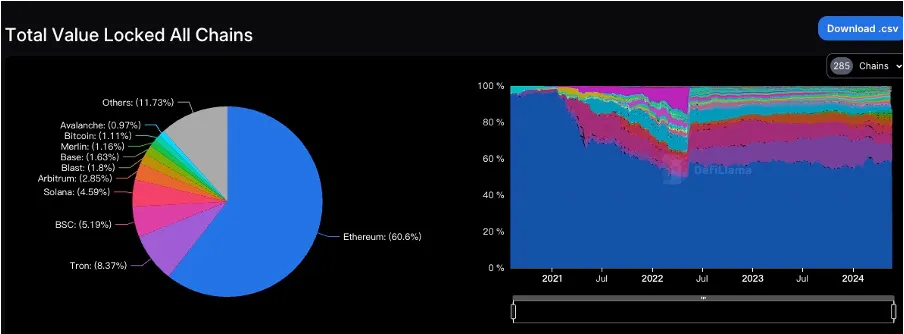

2. TVL Proportion of Each Public Chain

2. TVL Proportion of Each Public Chain

This week, the total TVL was $106.3 billion, up about $13.1 billion, or 14%. This week, ETH rose by nearly 30%, directly breaking through $3,800, and ETH led a small climax in the market. This week, the TVL of mainstream public chains all rose, with the ETH chain up 20%, the TRON chain up 3%, the BSC chain up 9%, the SOLANA chain up 7%, the ARB chain up 18%, and the BLAST chain up 28%. The most outstanding MERLIN chain soared 171% this week, among which Merchant Finance's TVL increased by 41,730% in the past week. Merchant Finance is a financial lending platform developed on the Merlin chain that allows users to borrow and lend through smart contract interactions.

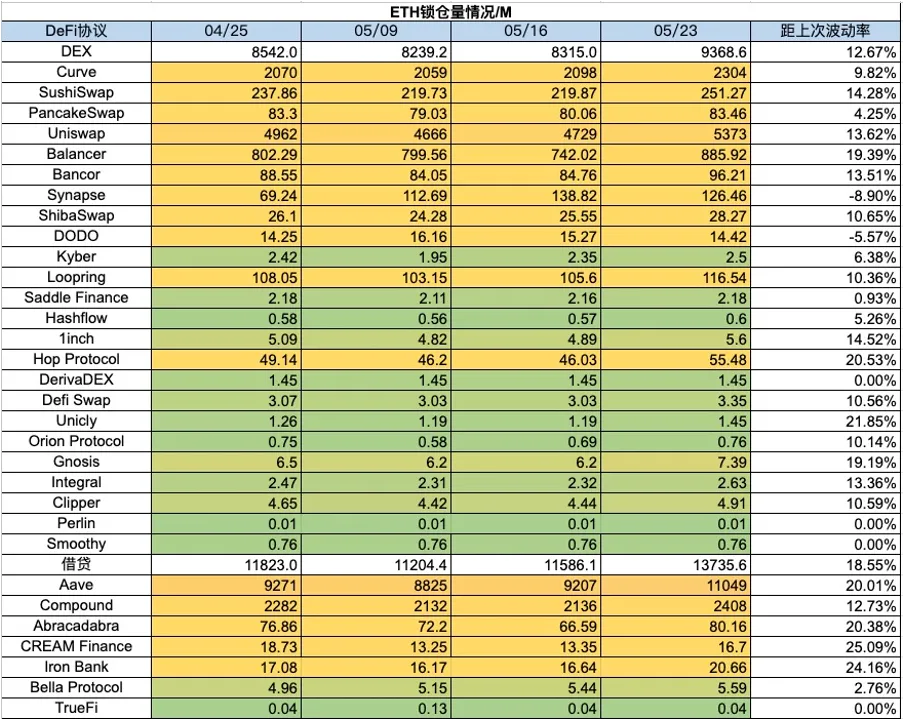

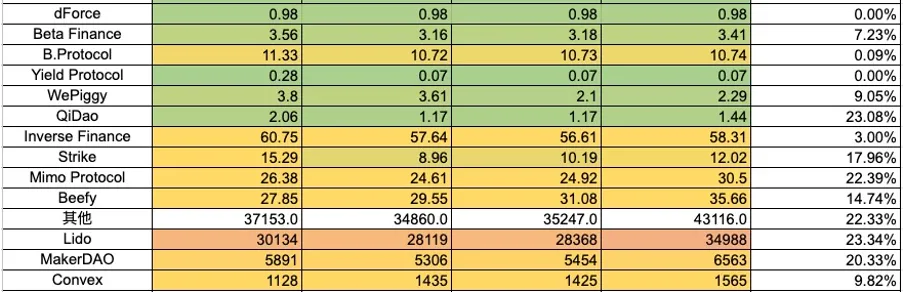

3. Locked Amount of Each Chain Protocol

3. Locked Amount of Each Chain Protocol

1) ETH locked amount

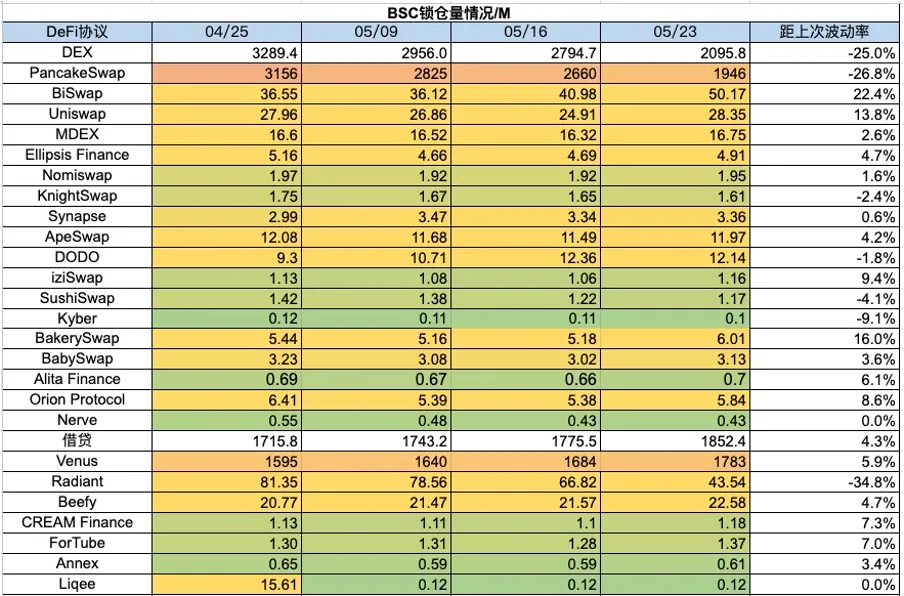

2) BSC locked amount

3) Polygon locked-up amount

4) Arbitrum locked amount

5) Optimism locked amount

6) Base lock-up amount

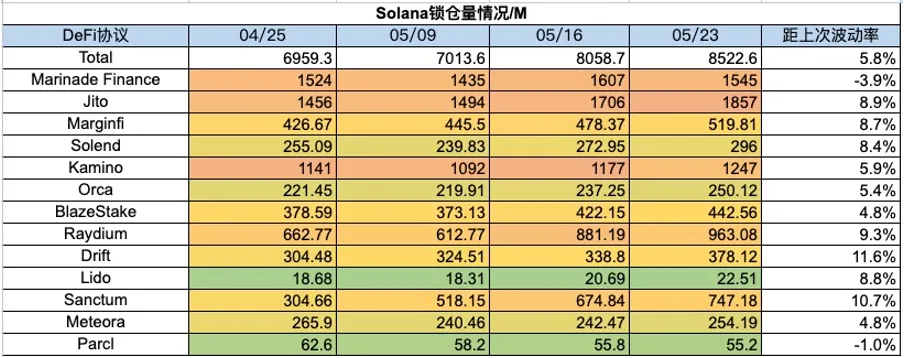

7) Solana locked amount

4. Changes in NFT market data

4. Changes in NFT market data

1) NFT-500 Index

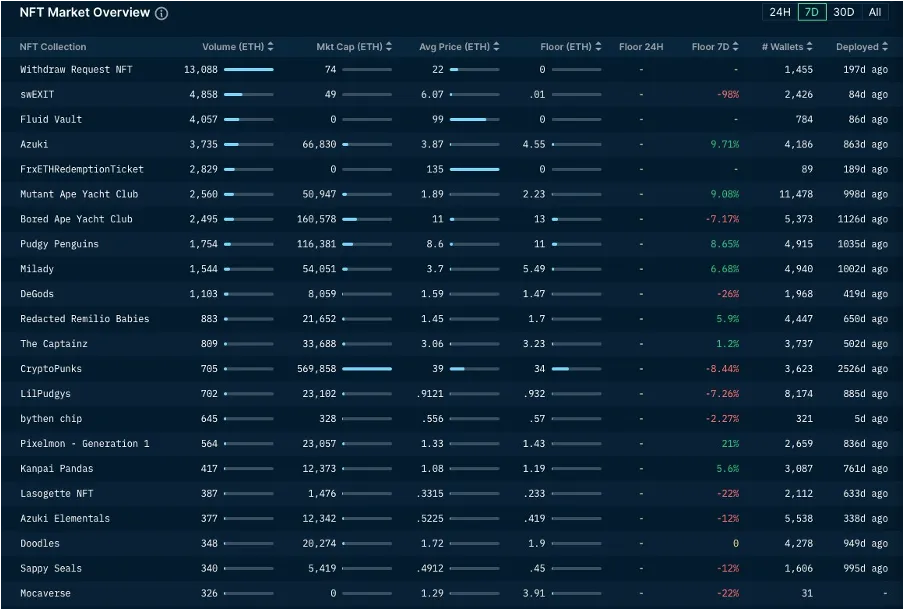

2) NFT market situation

3) NFT trading market share

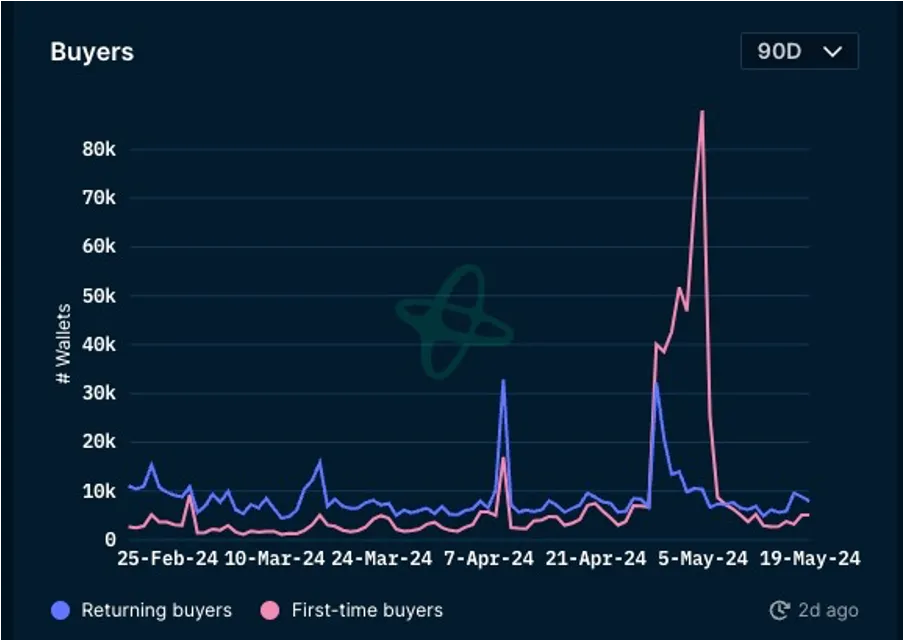

4) NFT Buyer Analysis

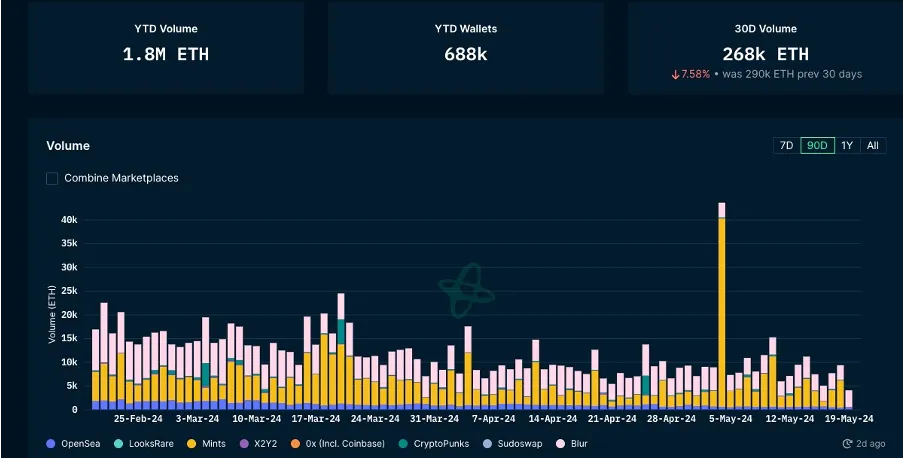

This week, the floor prices of blue-chip projects in the NFT market have risen and fallen, and the overall market performance is still sluggish. ETH's leading rise this week did not bring any signs of recovery to the NFT market. This week, BAYC fell 5%, CryptoPunks fell 12%, DeFrogs fell 3%, LilPudgys fell 8%, Pudgy Penguins and Azuki both rose 10%, Milady rose 27%, MAYC rose 6%, Pixelmon rose 21%, and DeGods fell 29%. The transaction volume of the NFT market continued to decline, and the number of first-time and repeat buyers did not rebound significantly .

V. Latest project financing situation

6. Post-investment dynamics

1) MYX Finance — DeFi

MYX_Finance is a revolutionary derivatives protocol featuring high scalability, cost-effective matching pool mechanism (MPM)

2) Morph — Layer 2

Morph will be working with @LaMultisig to host the Consumer Chain Day event on Wednesday, May 29th at 11:00 GMT. At the same time, the Morph Zoo Season 1 event has released multiple opportunities to earn Morph Points, and corresponding airdrop opportunities will be unlocked in the future.

3) Oyl — Wallet

Oyl launches Oyl Wallet and redefines the Bitcoin wallet experience to adapt to the new wave of the BTC ecosystem. With the launch of the private beta, Oyl is inviting early users to experience Ordinals and Bitcoin DeFi.

Oyl Wallet is redefining the way to interact with Bitcoin: All-in-one platform: Integrates all essential functions (such as purchases, logins, and UTXO management) directly into the wallet, reducing reliance on external applications and markets. Advanced trading tools: Make complex trading tools simple and intuitive, turning complex multi-app experiences into smooth one-click functionality.

Bitcoin DeFi: Providing in-wallet tools for professional traders and enthusiasts, constantly innovating what users can do in a single application. Oyl Wallet is based on the powerful infrastructure of Sandshrew and Metashrew. Features such as market aggregators, batch signatures, and custom indexes allow developers to seamlessly integrate and try new protocols and applications.

About Foresight Ventures

About Foresight Ventures

Disclaimer: All articles of Foresight Ventures are not intended as investment advice. Investment involves risks. Please assess your personal risk tolerance and make investment decisions prudently.

Disclaimer: All articles of Foresight Ventures are not intended as investment advice. Investment involves risks. Please assess your personal risk tolerance and make investment decisions prudently.