Markets appear to be pricing in the decision to approve a spot Ethereum ETF after Bloomberg analyst Eric Balchunas hinted the US Securities and Exchange Commission (SEC) could “turn 180 degrees.” Accordingly, ETH price spiked on Monday, surpassing resistance at $3,500, before a rally on Tuesday pushed the price above $3,900 for the first time since its March peak.

Ethereum was also bolstered by last week's unexpectedly positive ruling, which appeared to clarify the nature of the network as a decentralized entity and therefore not a security – as was argued in the lawsuit between the SEC and Robinhood. This ruling was interpreted by some investors as regulators unintentionally allowing Ethereum to push prices up.

With the SEC now approving rule changes that will pave the way for Ethereum ETFs, some analysts predict an optimistic price move for ETH similar to BTC following the approval of a Bitcoin ETF in January 2019. now. That rally took Bitcoin past a record $68,990 thanks to Capital into Bitcoin spot ETFs from fund managers like BlackRock (BLK) and Franklin Templeton (BEN).

According to analysts, the decision to approve an Ethereum ETF could have a deeper impact on the market, given that ETH 's market Capital is smaller at $450 billion compared to Bitcoin's $1.4 trillion. more sensitive to changes in demand. The scarcity of ETH may also be a factor – only 9.9% of the total supply is believed to be tradable.

The bullish case is even further strengthened when XEM the structure of the Ethereum network, after the network switched to a Proof of Stake (PoS) mechanism in 2022 and became more deflationary due to the decrease in overall supply. Given these conditions, even modest inflows from traditional financial institutions into the newly approved Ethereum ETF could have a significant impact on the price trajectory.

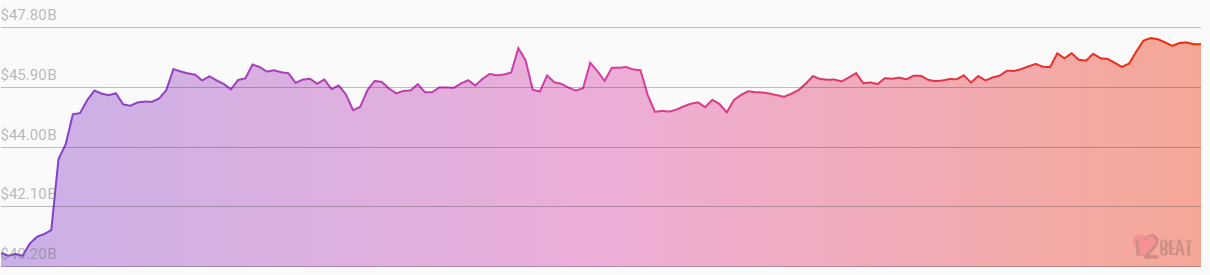

The Total Value Locked of Ethereum Layer 2 has reached a historic record of $47 billion.

According to L2BEAT data, the current TVL of all standard connected, externally connected, and natively minted Token on the Ethereum Layer 2 network is $47.45 billion, setting a new all-time high.

Source: L2BEAT

Chia down by network, Arbitrum One leads the ratings and has a TVL of $19.3 billion. Mainnet OP ranked second with $7.88 billion. Base ranked third with $6.94 billion TVL.

Other blockchains with TVL exceeding $1 billion include Blast, Mantle, Linea, and Starknet. L2BEAT indicates the total value locked across all layers has increased by 17.39% over the past seven days.

At the time of writing, ETH continues to increase in price and is trading at $3,929 – after breaching that mark on May 21. Analysts note that bullish pressure persists, as shown by prices remaining high above the 100-day EMA. The price is also close to the upper Bollinger band, suggesting overbought conditions and a sign that a correction may be imminent. This is supported by the RSI crossing the 70 mark into the overbought zone.

Source : Deriv MT5

Traders should also note that Bollinger bands are widening – a sign of impending volatility. If the buying pressure continues, buyers may face some resistance at the $4,000 resistance level, a price level they have previously had difficulty sustaining.

On the other hand, further declines could trigger more short-term selling and profit-taking, pushing the price down to last week's $3,078 level. If the market does not react to the SEC's ruling immediately, the price could slide back to the $3,300 to $3,800 range.

You can XEM ETH price here.

Join Bitcoin Magazine's Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Home home

According to FXStreet