Author: William Suberg Source: coindesk Translation: Shan Ouba, Jinse Finance

Bitcoin begins a new week with pressure on key resistance levels as the monthly close for May approaches. BTC price action keeps bulls on their toes as old all-time highs struggle to convert into support. Can a break above $69,000 occur before June?

At the beginning of this week, it was Memorial Day in the United States, and institutional activities were suspended until May 28.

However, macroeconomic catalysts will heat up later, especially the release of US data, which will be the key focus of cryptocurrencies and risk assets as always. Meanwhile, Bitcoin faces its own challenges - consolidation below all-time highs has lasted for more than two months, and a solution to the status quo remains elusive. There are many optimistic BTC price predictions on the market, and some predictions include a six-digit target for BTC/USD in 2024, but concerns about a deeper correction remain.

With the market at a critical point, Cointelegraph takes a look at factors that could influence market movements as May ends.

BTC price seizes key $69,000 mark

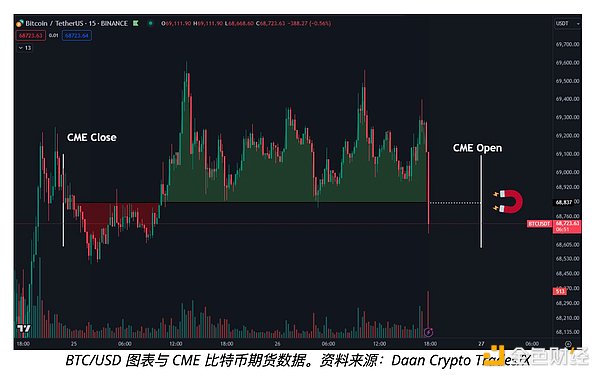

Bitcoin experienced classic weekend price action, breaking above $69,000 but falling back after the weekly close, according to data from Cointelegraph Markets Pro and TradingView.

In doing so, it effectively closed the latest “gap” in CME Group’s bitcoin futures market, even as the U.S. market was closed for the Memorial Day holiday. “Basically weekend price action so far,” Daan Crypto Trades, a prominent trader, responded on X (formerly Twitter).

Nonetheless, the weekly close at around $68,500 was Bitcoin’s strongest weekly close since early April. Commenting on the latest development, trading resource Material Indicators highlighted the need for $69,000 to be converted into solid support.

“BTC’s green weekly close is accompanied by another failed attempt to convert $69,000 into support and a new trend premonition (downside) signal on the W chart,” X’s post read in part, referencing one of Material Indicators’ proprietary trading tools. “For me, a breakout above $71,250 would invalidate this signal.”

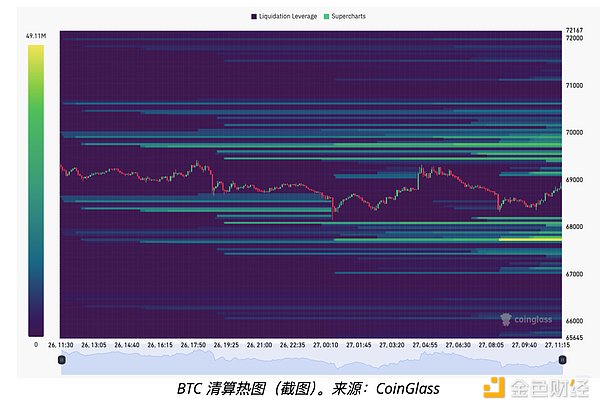

Meanwhile, the latest data from monitoring resource CoinGlass shows that key liquidity areas are accumulating around the spot price - leaving traders guessing which zone will be hit first.

As of May 27, $68,100 and $69,800 are key levels of focus, with the latter being in the middle of the order book’s liquidity “cloud.”

“Bitcoin is designed to consolidate at these levels,” Michaël van de Poppe, founder and CEO of trading firm MNTrading, summed up the day. “Where is the buy? Breaking $66,000, I think we will test the range low and buy again. This is the level you are ready to buy.”

Breakthrough or collapse?

Where Bitcoin will go once it leaves its current range is a major focus for some market watchers. A consensus is forming that Bitcoin will break out to the upside, but how high the market will go remains a topic of debate.

As Cointelegraph reported, calls for a June target of $95,000 and even $150,000 by the end of the year are being reinforced by their respective sources. Last week, the originator of the former forecast, well-known commentator BitQuant, suggested ignoring BTC price declines within the range. In another post, he insisted: "The only thing I know for sure is that Bitcoin will reach $95,000."

Daan Crypto Trades also acknowledges that historical precedent favors bulls - in previous BTC price cycles, long periods of consolidation below all-time highs led to bull breakouts. He calculated: "It has now been trading below its previous cycle high for about 11 weeks. It took about 4 weeks in 2017. It took about 13 weeks in 2013. Both led to massive expansions. I don't think BTC will slow down after leaving this price range this time."

However, some still believe a larger correction is the base case, including well-known trader Credible Crypto, who continues to eye the roughly $60,000 area as the next possible target.

Heading into the weekend, Material Indicators added that they are “fully prepared” for a return to $60,000. It concluded: “There is currently not much liquidity-based sentiment to support prices below $60,000, so expect to remain range-bound for an extended period.”

Bitcoin halving ‘not priced in’

For the prominent trader and analyst, Bitcoin’s latest block subsidy halving is “not priced in.” Last week, in a YouTube video, Rekt Capital argued that despite the halving having taken place last month, it is still an extremely important BTC price catalyst. He said that Bitcoin is still in a “re-accumulation phase” after the halving — and that this consolidation has historically lasted up to 160 days. “The longer we consolidate here, the better for Bitcoin,” he said in the video.

Nonetheless, Rekt Capital said that once these phases are complete, an upward continuation is “inevitable.” For the “most parabolic phase” of this cycle, a BTC price target of around $150,000 is appropriate, suggesting that short-term sideways BTC price action may take several weeks to resolve.

PCE data leads macroeconomic week

With US markets closed until May 28, Bitcoin lacked momentum for major external moves during Wall Street trading hours. There were no surprises during the Asian trading session, so the focus shifted to this weekend. That’s when US macro data will be released again, led by the Producer Price Index (PCE) – the Fed’s preferred inflation indicator. Sentiment remains conservative about risk assets benefiting from accommodative Fed policy. Rate cuts are not expected until September or later, and other inflation data remain mixed. Despite this, US stocks continue to hit record highs.

“A short but busy week,” wrote trading resource The Kobeissi Letter in its weekly macro diary entry on X. Commenting on the trends in stocks and Bitcoin, trading firm Mosaic Assets sees mixed conditions that are ultimately favorable for risk sentiment. “Daily momentum indicators such as the S&P 500’s MACD and RSI have stretched out, suggesting a possible mean reversion to the downside,” it wrote in a May 23 edition of its regular newsletter, “Market Mosaic.” “While I would not be surprised by a partial pullback in the stock market, I expect any downside to be just a pause in the bull market,” it wrote in a May 23 edition of its regular newsletter, “Market Mosaic.”

Mosaic also favors a breakout to the upside for BTC/USD.

Risk asset classes are particularly sensitive to easing conditions, which is why I am closely watching the action in Bitcoin and crypto mining stocks for further confirmation that the bull run is still ongoing. And note Bitcoin’s two-month consolidation. The price has been moving along the right side of the base over the past month and may be preparing to break out to new highs. A breakout would be further evidence that investor appetite for speculative assets remains strong.”

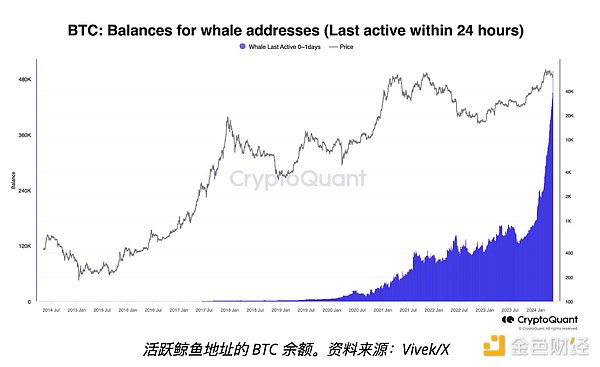

BTC whale continue to be active

When it comes to “buying the dip,” some groups of Bitcoin investors don’t hesitate below $69,000. This week the spotlight is on Bitcoin whale, the largest of them, who have been particularly active as prices have risen and approached all-time highs.

“Bitcoin whale are buying at an unprecedented level,” Vivek Sen, founder of Bitgrow Lab, commented alongside data from on-chain analytics platform CryptoQuant.

Data shows that the balance of active whale addresses in the past 24 hours was close to 500,000 BTC - easily setting an all-time record.