Source: Grayscale, compiled by Baishui, Jinse Finance

Summary

The potential launch of an Ethereum spot ETF will allow more investors to understand the concepts of smart contracts and decentralized applications, and thus understand the potential of blockchain to transform digital commerce.

Ethereum is the largest asset in our smart contract platform cryptocurrency space (by market cap) and the largest blockchain network by number of users and applications. [1] It is pursuing a modular design philosophy to enable scaling, where more activity occurs on the associated Layer 2 network over time. To maintain its dominance in a highly competitive market segment, Ethereum will need to attract more users and increase fee revenue.

Based on international precedents, the Grayscale Research team expects demand for US spot Ethereum ETFs to reach about 25%-30% of spot Bitcoin ETF demand. A large portion of Ethereum supply (such as staked ETH) may not be used for ETFs.

Given the high initial valuation, the scope for further price increases may be more limited compared to the launch of a Bitcoin ETF in January 2024, but Grayscale Research remains optimistic about the prospects for both assets.

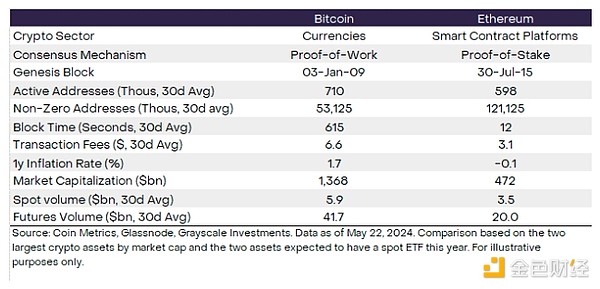

Last week, the U.S. Securities and Exchange Commission (SEC) approved Form 19b-4 filings by several issuers for spot Ethereum exchange-traded funds (ETFs), signaling significant progress toward listing these products on U.S. exchanges. Like the spot Bitcoin ETF that listed in January, these new products could provide exposure to the crypto asset class to a broader range of investors. While both assets are based on the same blockchain technology, Ethereum is a separate network with distinct use cases (Figure 1). While Bitcoin is primarily used today as a store of value and digital alternative to gold, Ethereum is a decentralized computing platform with a rich ecosystem of applications that is often likened to a decentralized app store. New investors interested in exploring this asset may want to consider Ethereum’s unique fundamentals, competitive positioning, and its potential role in the growth of blockchain-based digital commerce.

Figure 1: Ethereum is a smart contract platform

The basics of smart contracts

Ethereum expanded on Bitcoin’s original vision by adding smart contracts. A smart contract is a piece of computer code that is pre-programmed and self-executing. When a user engages a smart contract, it performs a predefined action without any additional input. A classic real-world analogy is a vending machine: the user inserts coins and the vending machine delivers the item. [2] With a smart contract, the user typically “inserts” digital tokens and the software performs some type of action. These actions can include anything from exchanging tokens to issuing a loan to verifying a user’s digital identity.

Smart contracts operate through the mechanisms of the Ethereum blockchain. In addition to recording ownership of assets, the blockchain's block-by-block updates can also record any arbitrary changes to "state" - a computer science term for the state of data in a database. In this way, by adding smart contracts, public blockchains can operate like computers (software computers rather than hardware computers). With these basic elements, Ethereum and other smart contract platform blockchains can host almost any type of application and serve as neutral core infrastructure for the emerging digital economy.

Asset Returns and Fundamentals

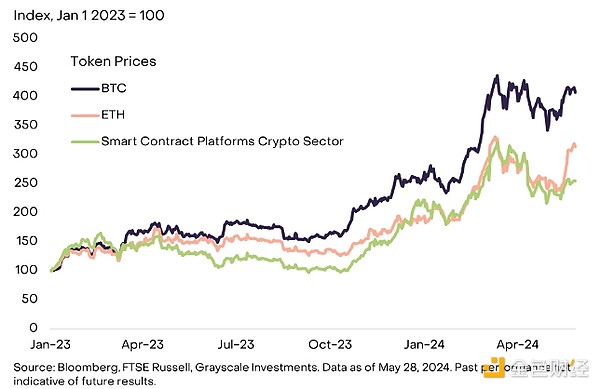

Ethereum (ETH), the Ethereum network’s ether, is the largest component of our smart contract platform cryptocurrency sector by market cap. [3] From the beginning of 2023 until recently, ETH has performed broadly in line with this segment (Exhibit 2). However, it has underperformed Bitcoin (the largest crypto asset overall by market cap) and Solana (the second-largest asset in the smart contract platform cryptocurrency sector by market cap) . Like Bitcoin, Ethereum has outperformed certain traditional asset classes both in absolute terms and on a risk-adjusted basis since the beginning of 2023. [4] Over longer periods of time, both Bitcoin and Ethereum have achieved risk-adjusted returns comparable to traditional asset classes, albeit with significantly higher volatility .

Figure 2: Until recently, ETH has performed in line with the cryptocurrency sector

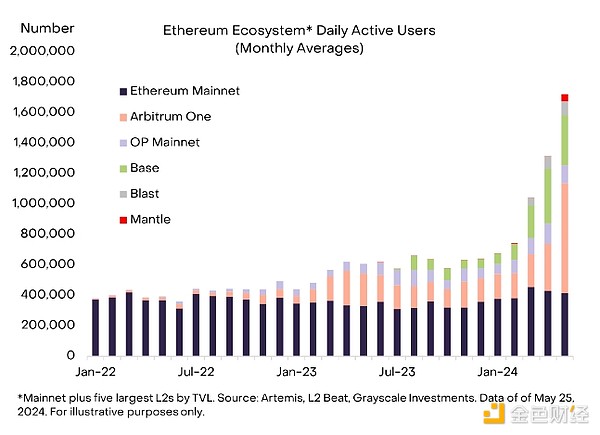

With Ethereum's modular design, different types of blockchain infrastructure are designed to work together to provide an end-user experience. In particular, over time, more activity is expected to occur on Ethereum's Layer 2 network (additional software that provides blockchain functionality and connects to the Layer 1 Ethereum mainnet) to allow the ecosystem to expand. Layer 2 regularly settles and publishes its transaction records to Layer 1, benefiting from its network security and decentralization. This approach is in stark contrast to blockchains with a monolithic design philosophy (such as Solana), where all key operations (execution, settlement, consensus, and data availability) take place on a single Layer 1 network.

In March 2024, Ethereum underwent a major upgrade that is expected to facilitate its transition to a modular network architecture (for more information, see our report “ Ethereum’s Maturity: ‘Dencun’ and ETH 2.0” ). In terms of blockchain activity, the upgrade was a success: the number of active addresses on the Layer 2 network increased significantly and now accounts for about two-thirds of the total activity in the Ethereum ecosystem (Exhibit 3).

Figure 3: Ethereum Layer 2 activity has grown significantly

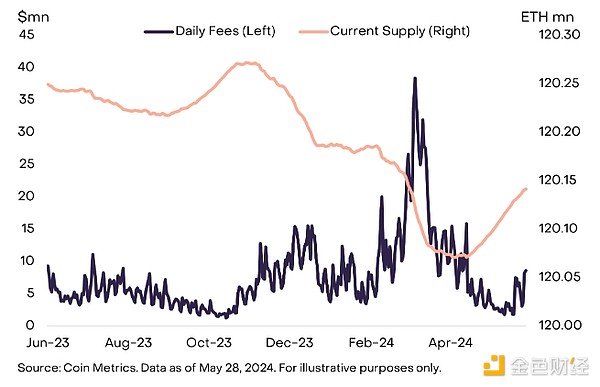

At the same time, the shift in activity to Layer 2 networks has also affected Ether’s token economics, at least in the short term. Smart contract platform blockchains accrue value primarily through transaction fees, which are typically paid to validators or used to reduce the token supply. In Ethereum’s ecosystem, base transaction fees are burned (destroyed and removed from circulation), while priority fees (“tips”) are paid to validators. When Ethereum’s transaction revenue is relatively high, the number of tokens destroyed often exceeds the rate of new issuance, and the total supply of ETH tends to decline. However, as network activity shifts to Layer 2, fee revenue on the Ethereum mainnet has declined, and the ETH supply has begun to increase again (Figure 4). Layer 2 networks also pay fees to publish their data to Layer 1 (so-called “blob fees,” as well as other transaction fees), but the amounts tend to be relatively low.

Figure 4: ETH supply has increased recently due to lower mainnet fees

In order for the value of Ethereum to increase over time, the Ethereum mainnet will likely need to see an increase in fee revenue. [5] This could happen through either i) modest growth in Layer 1 activity, paying higher transaction costs, or ii) significant growth in Layer 2 activity, paying lower transaction costs. Grayscale Research expects this to be a combination of increased Layer 1 and Layer 2 activity and fee revenue.

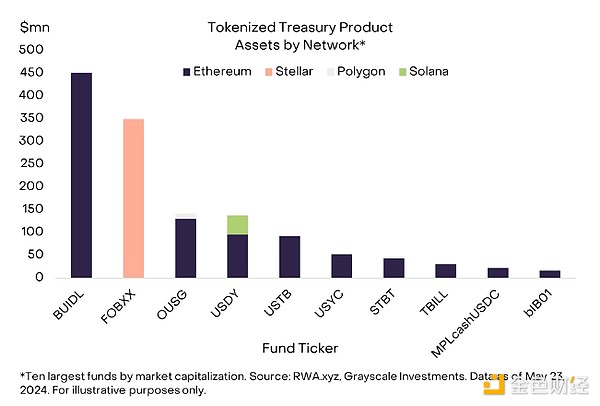

We believe that growth in Layer 1 activity is most likely to come from low-frequency and high-value transactions, and anything that requires a high degree of decentralization (at least until Layer 2 networks are sufficiently decentralized). This could include many types of tokenized projects where transaction costs may be relatively low compared to the dollar value of the transaction. Currently, about 70% of tokenized U.S. Treasuries are on the Ethereum blockchain (Figure 5). We believe that relatively high-value non-fungible tokens (NFTs) are also likely to remain on the Ethereum mainnet, as they benefit from Ethereum's high security and decentralization and change hands relatively infrequently (for similar reasons, we expect Bitcoin NFTs to continue to grow).

Figure 5: Ethereum hosts the majority of tokenized Treasury securities

In contrast, relatively high frequency and/or low value transactions occur more naturally on Ethereum’s various Layer 2 networks. A good example of this is social media applications, which we have seen various recent success stories hosted on Ethereum Layer 2, including friend.tech (Base), Farcaster (OP Mainnet), and Fantasy Top (Blast). We believe that gaming and retail payments may also require very low transaction costs and are more likely to migrate to Layer 2 networks. Importantly, however, given the low transaction costs, these applications will need to attract a large number of users to significantly increase fee revenue on the Ethereum mainnet.

Potential Impact of US Spot Ethereum ETF

In the long term, Ethereum's market capitalization should reflect its fee income and other fundamentals. But in the short term, the token's market price may be affected by changes in supply and demand. While we have seen progress towards full regulatory approval for a US spot Ethereum ETF, issuers still need their registration statements to be reviewed and declared effective by the SEC's Division of Corporation Finance. Full approval and trading launches for these products could bring new demand as the assets become available to a wider range of investors. Given simple supply and demand dynamics, Grayscale Research expects that an increase in the number of people accessing Ethereum and the Ethereum protocol through ETF wrappers will help drive demand and, therefore, the token's price.

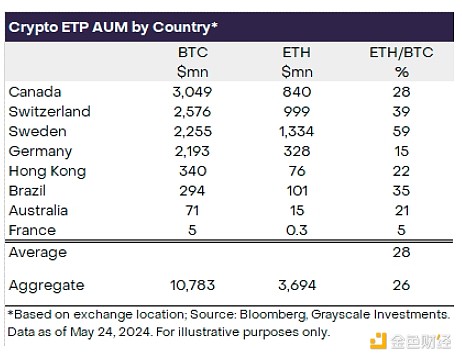

Outside the United States, both Bitcoin and Ethereum exchange-traded products (ETPs) are listed, with assets in the Ethereum ETP accounting for approximately 25%-30% of Bitcoin ETP assets (Exhibit 6). Based on this, Grayscale Research assumes that net inflows into U.S.-listed spot Ethereum ETFs will be 25%-30% of net inflows into spot Bitcoin ETFs to date, or $3.5-4 billion in the first four months or so (25%-30% of the $13.7 billion in net inflows into spot Bitcoin ETFs since January). [6] Ethereum’s market cap is approximately one-third (33%) of Bitcoin’s, so our assumption implies that Ethereum net inflows as a percentage of market cap could be slightly smaller. While we believe this is a reasonable assumption, the estimate is uncertain and there are risks of higher and lower net inflows into U.S.-listed spot Ethereum ETFs. In the U.S. market, ETH futures ETFs only account for approximately 5% of BTC futures ETF assets, although we believe this is not representative of relative demand for spot ETH ETFs. [7]

Figure 6: Outside the United States, Ethereum ETP AUM accounts for 25%-30% of Bitcoin ETP AUM

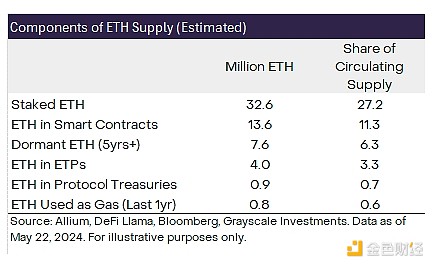

In terms of ETH supply, Grayscale Research believes that about 17% of ETH can be classified as idle or relatively illiquid. According to data from data analysis platform Allium, this includes about 6% of the ETH supply that has not been moved for more than five years, and about 11% of the ETH supply is "locked" in various smart contracts (such as bridges, wrapped ETH, and various other applications). In addition, 27% of the ETH supply is staked. Recently, issuers of spot Ethereum ETF applications, including Grayscale, have removed pledges from public documents, indicating that the U.S. Securities and Exchange Commission may allow these products to be traded in the United States without pledges. Therefore, this part of the supply is unlikely to be purchased by ETFs.

Outside of these categories, $2.8 billion of ETH is spent on gas for network transactions each year. At current ETH prices, this represents an additional 0.6% of supply. [8] There are also a number of protocols that hold large amounts of ETH in their treasuries, including the Ethereum Foundation ($1.2 billion worth of ETH), Mantle (~$879 million of ETH), and Golem ($995 million of ETH). Overall, ETH in protocol treasuries represents approximately 0.7% of supply. [9] Finally, approximately 4 million ETH, or 3% of total supply, is held in ETH ETPs. [10]

Collectively, these groups represent nearly 50% of ETH supply, although the categories partially overlap (e.g., ETH in protocol treasuries may be staked) (Exhibit 7). For any potential new U.S.-listed spot Ethereum ETF, we believe it is more likely that net purchases of ETH will come from the remaining circulating supply. If existing usage limits the available supply for a new spot ETF product, any incremental growth in demand could have a larger impact on price.

Figure 7: A large portion of ETH supply is unable to enter new spot ETFs

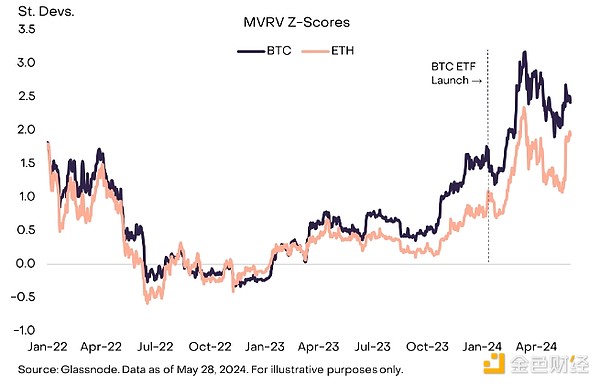

From a valuation perspective, Ethereum is arguably more valuable than Bitcoin was when the spot Bitcoin ETF launched in January. For example, one popular valuation metric is the MVRV z-score. This metric is based on the ratio of a token’s total market capitalization to its “realized value”: its market capitalization based on the price at which the token last moved on-chain (as opposed to the price at which it trades on an exchange). When the spot Bitcoin ETF launched in January, its MVRV z-score was relatively low, suggesting that valuations were modest and that there could be more room for price upside. Since then, the cryptocurrency market has been appreciating, with both Bitcoin and Ethereum’s MVRV ratios increasing (Chart 8). This could indicate that there is less room for price upside following the approval of the spot ETH ETF compared to when the US spot Bitcoin ETF was approved in January.

Figure 8: ETH is worth more than BTC when the spot Bitcoin ETF is launched

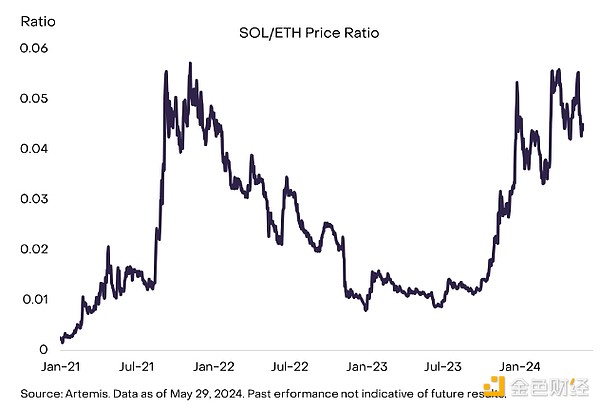

Finally, crypto-native investors may be concerned about the impact of a spot Ethereum ETF on competition in the smart contract platform crypto space, specifically the SOL/ETH price ratio. Solana is the second-largest asset in this segment (by market cap), and Grayscale Research believes that it is currently best positioned to take market share from market leader Ethereum in the long run. Solana has significantly outperformed Ethereum over the past year, with the SOL/ETH price ratio now near the peak of the last crypto bull run (Chart 9). [11] This may be due in part to the network’s user and developer community continuing to grow the ecosystem despite the involvement of failed crypto exchange FTX (in terms of token ownership and development activity). More importantly, Solana has also been able to drive increased trading activity and fee revenue through a compelling user experience. In the short term, we expect the SOL/ETH price ratio to stabilize as inflows from the new spot Ethereum ETF support the price of ETH. However, in the long run, the SOL/ETH price ratio will likely be determined by the relative growth of fee revenue between the two chains.

Figure 9: SOL/ETH price ratio is close to the previous cycle high

Looking ahead

While the launch of a spot ETH ETF in the U.S. market could have an immediate impact on valuations, regulatory approval has important implications beyond price. Ethereum provides an alternative framework for digital commerce based on decentralized networks. Blockchains have the potential to offer even more possibilities, including near-instant cross-border payments, true digital ownership, and interoperable applications. While there are other smart contract platforms that offer this utility, the Ethereum ecosystem has the most users, the most decentralized applications, and the deepest pool of capital. [12] Grayscale Research expects that the new spot ETF could introduce this transformative technology to a wider audience of investors and other observers and help accelerate blockchain adoption.

References:

[1] Source: Artemis, Dapp Radar. Data as of May 27, 2024.

[2] This metaphor comes from computer scientist Nick Szabo’s 1997 memo “The Idea of Smart Contracts”.

[3] Source: Artemis. Data as of May 27, 2024.

[4] For example, from December 31, 2022 to May 23, 2024, Bitcoin and Ethereum’s price returns and returns divided by annualized volatility exceeded those of global equity markets (represented by the MSCI All Country World Index), global bond markets (represented by the Bloomberg-Barclays Global Aggregate Index), and commodities markets (represented by the S&P/GSCI). Source: Bloomberg, Grayscale Investments. Data as of May 23, 2024.

[5] While Grayscale Research considers fee income to be the primary driver of smart contract platform valuations, other factors may include maximum extractable value (MEV), possibly a “monetary premium” (willingness to hold an asset as a store of value and/or as a medium of exchange), and other factors.

[6] Source: Bloomberg, Grayscale Investments. Data as of May 24, 2024.

[7] Source: Bloomberg, Grayscale Investments. Data as of May 28, 2024.

[8] Source: Artemis, Grayscale Investments. Data as of May 24, 2024.

[9] Source: DeFi Llama.

[10] Source: Bloomberg, Grayscale Investments. Data as of May 24, 2024.

[11] In terms of market capitalization, Solana’s increase is greater due to its relatively high supply growth.

[12] Source: Artemis, Dapp Radar, Defi Llama. Data as of May 27, 2024.