As Bitcoin spot exchange-traded funds (ETFs) see inflows for 19 consecutive days, hedge funds are increasing their Bitcoin short positions on the Chicago Mercantile Exchange (CME).

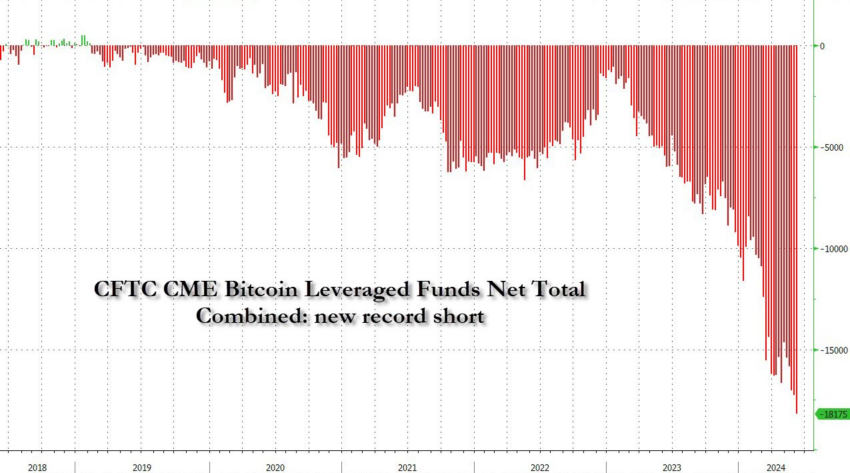

According to ZeroHedge, the Commodity Futures Trading Commission's (CFTC) Commitment of Traders (COT) report shows that Bitcoin hedge fund net short positions have increased significantly, reaching an all-time high.

Are hedge funds bearish on Bitcoin?

Hedge funds have increased their net short positions in the CME standard Bitcoin futures contract, data shows. These positions reached an all-time high of 18,175 contracts. These contracts, each worth 5 BTC, are part of a trading strategy in which traders sell futures contracts to profit from the expected price decline of the underlying asset.

Read more: Shorting Bitcoin: How it works and where you can short it in 2024

Sina Ji, co-founder of Bitcoin-focused 21st Capital, said these record short positions suggest hedge funds are interested in carry trade strategies . Carry traders typically buy spot and sell futures at the same time to take advantage of price differences between the spot and futures markets.

“This is a more speculative position and could represent a carry trade, where a hedge fund buys Bitcoin from somewhere else. But asset managers take the opposite position. These positions are less speculative and long-term,” Sinazi said .

Interestingly, these record short positions coincide with 19 consecutive days of inflows into Bitcoin ETFs . Over the past three weeks , ETFs have seen inflows of over $2 billion . However, despite these large inflows, the Bitcoin price failed to reach its all-time high of $73,835 in March. Instead, it has recorded a slight increase of 2% over the past seven days.

This decline in Bitcoin prices has caught many investors off guard. However, market experts explained that this was because major financial institutions were buying Bitcoin ETFs and selling futures at the same time to take advantage of the price difference. As a result, there was a large influx of ETF funds with minimal impact on the Bitcoin spot price.

Read more: What is a Bitcoin ETF ?

Nevertheless, JAN3 CEO Sampson Mow is confident that “all Bitcoin short sales will eventually be liquidated, voluntarily or otherwise.”

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.