A. Market View

1. Macro liquidity

1. Macro liquidity

Monetary liquidity improved. The US economic growth slowed down, with 152,000 new jobs in May, the lowest level in three months. The CME Fed Watch tool shows that the probability of a 25 basis point rate cut in September is close to 60%. The Bank of Canada became the first G7 country to cut interest rates, and the European Central Bank may start its first rate cut since March 2016 in the near future. The market expects that there will not be much difference in monetary policy between the United States and other countries. The US dollar index broke down on a weekly basis, and US stocks continued to rise to a record high. The crypto market followed the US stock market and fluctuated upward.

2. Market conditions

2. Market conditions

The top 100 companies with the highest market capitalization:

BTC fluctuated upward this week. Market liquidity improved, and new coins, games, and inscriptions, which had fallen sharply in the previous period, rose in turn.

1. BNB: BNB, the platform coin, hit a record high. Its founder CZ will be released from prison in the United States in early October. 2. KAS: Kaspa, the POW public chain, will launch krc20, which is similar to the erc20 standard. Many memes will be released in the future. You need to download the wallet Kaspium Wallet in advance. 3. BENJI: BENJI is the dog meme on the Base chain. Coinbase launched a new wallet this week, which will greatly improve the user experience on the chain and facilitate the addition of new users to the Base chain.

3. BTC market

3. BTC market

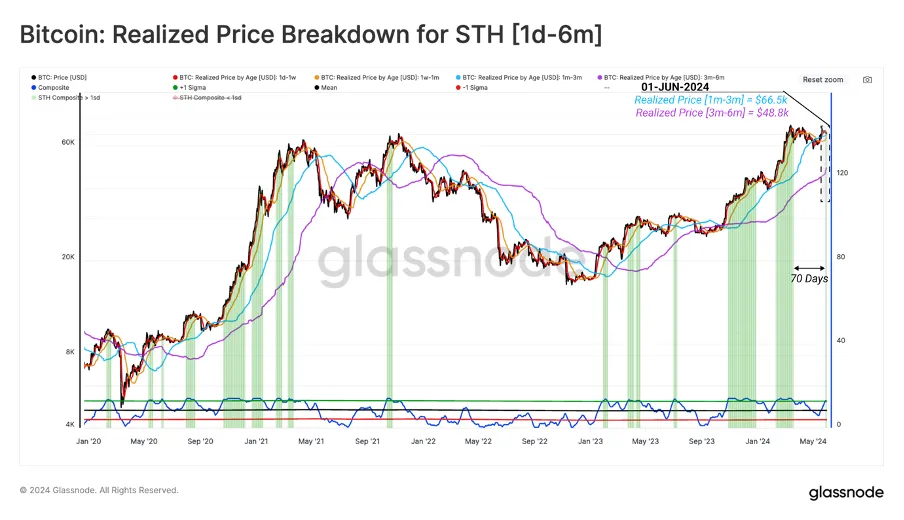

1) On-chain data

BTC's stack structure is healthy and the shock is coming to an end. Most BTC investors are holding unrealized profits, and speculative enthusiasm has returned to the market after two months of sideways trading. The short-term holder group has borne the vast majority of market losses, which usually occurs when a bull market pulls back from a new high.

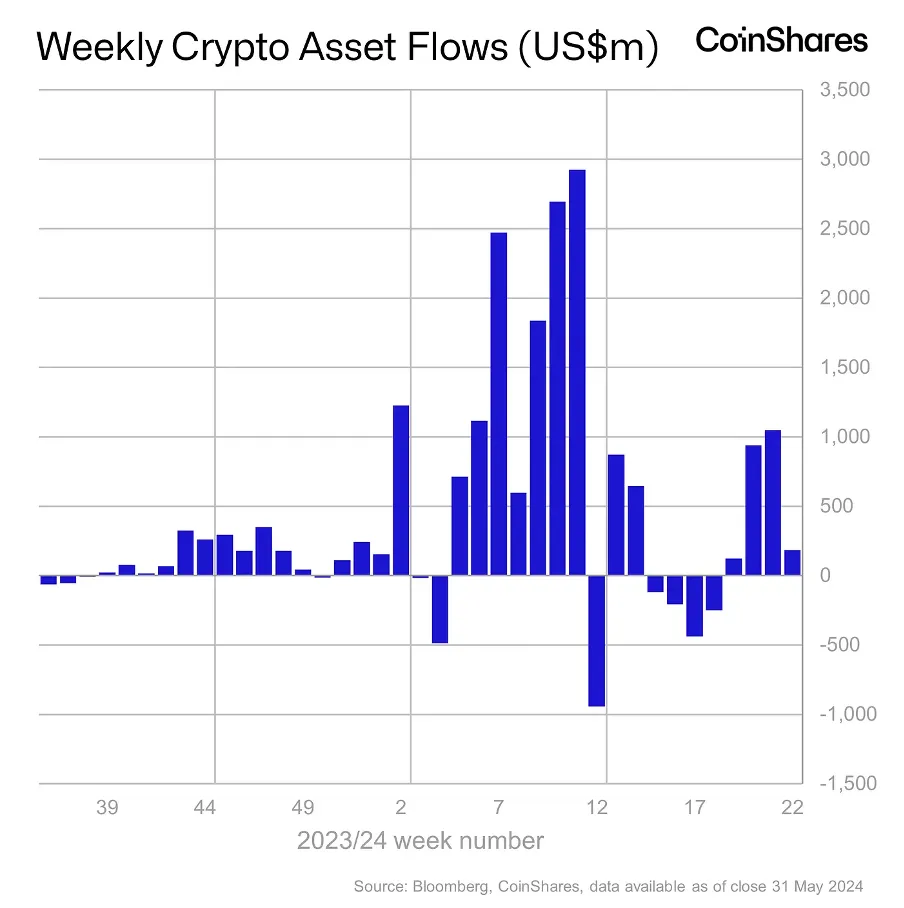

The market value of stablecoins increased by 1%, and the overall trend of capital inflows was positive.

Institutional funds have seen net inflows for four consecutive weeks, with inflows exceeding US$15 billion year-to-date.

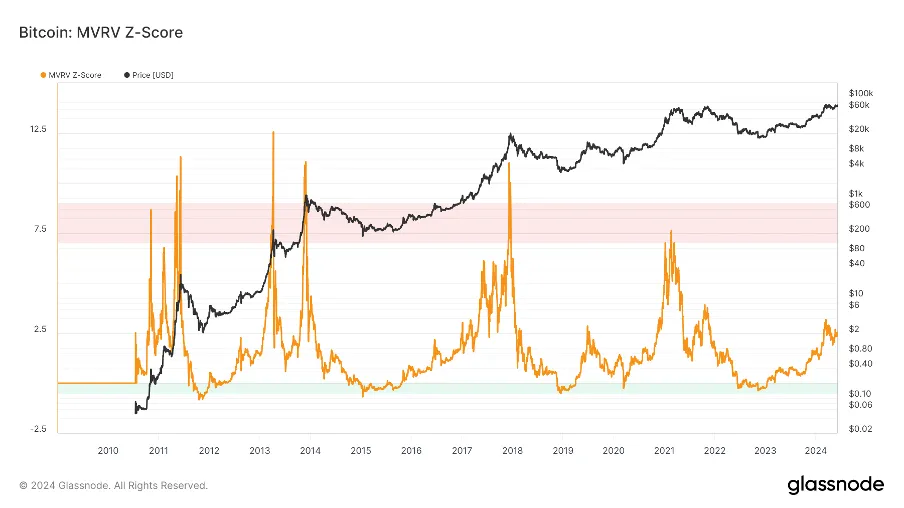

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV falls below the key level, and the holders are generally in a loss state. The current indicator is 2.4, entering the middle stage.

2) Futures market

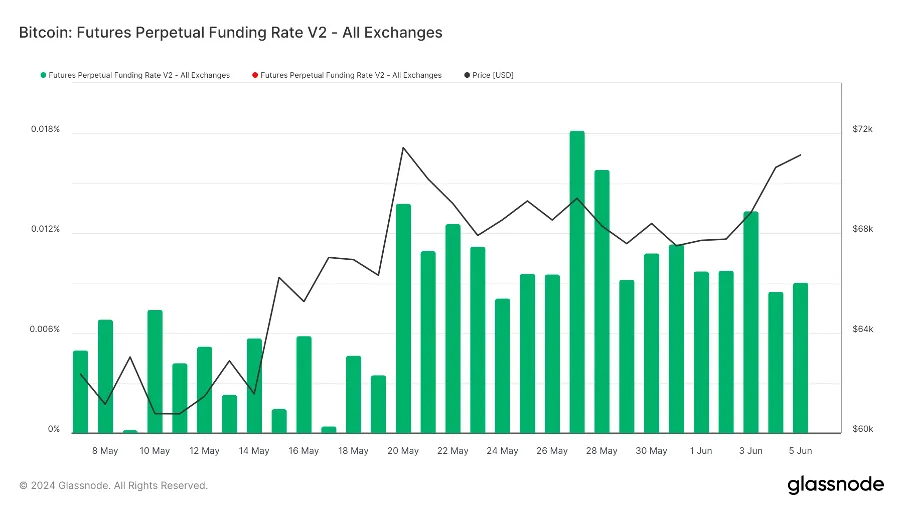

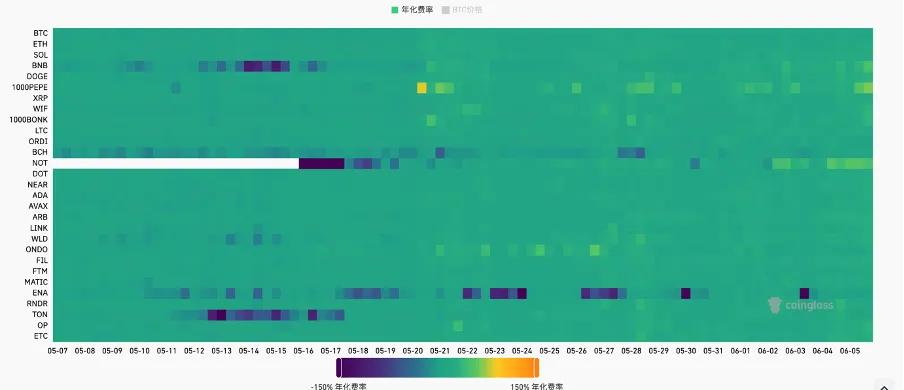

Futures funding rate: The rate dropped slightly this week. The rate is 0.05-0.1%, with more long leverage, which is the short-term top of the market; the rate is -0.1-0%, with more short leverage, which is the short-term bottom of the market.

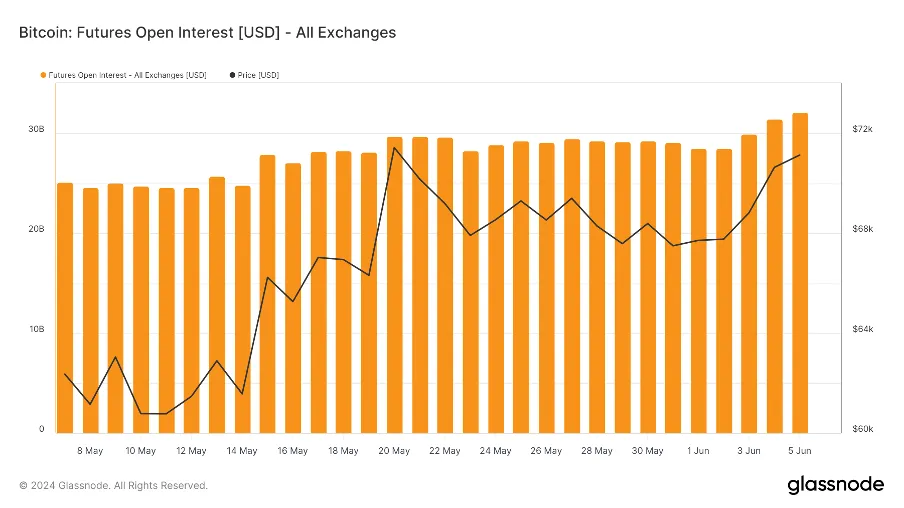

Futures open interest: BTC open interest increased significantly this week, with major market players entering the market.

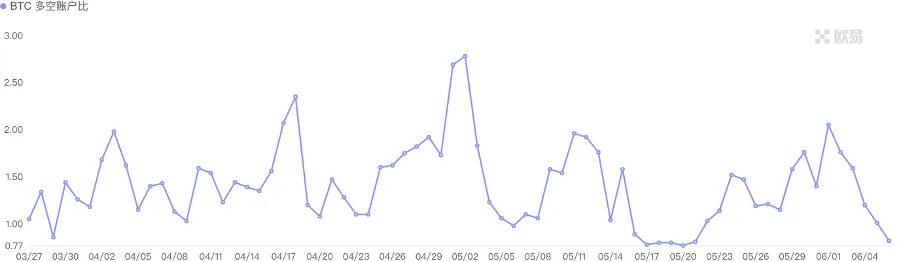

Futures long-short ratio: 0.9, market sentiment is bearish. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more panic, above 2.0 is more greedy. The long-short ratio data fluctuates greatly, and its reference value is weakened.

3) Spot market

BTC fluctuated upward, approaching its previous high. Spot ETFs have seen net inflows for 15 consecutive days, with daily increases approaching a three-month high. BTC long-term investors with more than 6 months of holdings have increased their holdings for the first time in six months. The probability of the Federal Reserve cutting interest rates in September has greatly increased, and the peripheral US stock market has repeatedly hit new highs, with market liquidity spilling over.

B. Market Data

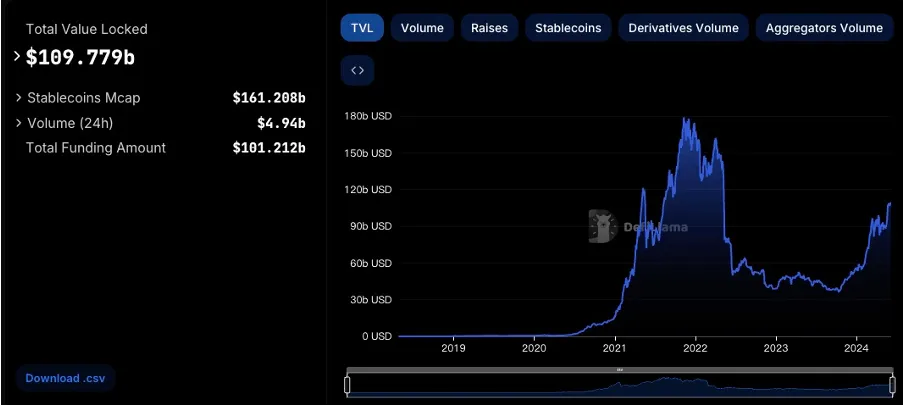

1. Total locked-up amount of public chains

1. Total locked-up amount of public chains

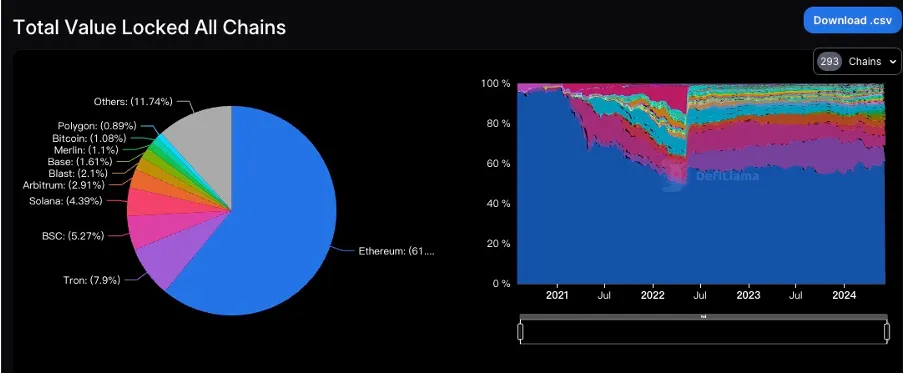

2. TVL Proportion of Each Public Chain

2. TVL Proportion of Each Public Chain

This week's TVL is $109.8 billion, up $3 billion, or 2.8%. This week, the TVL of mainstream public chains all rose, and the market continued to be very good. The ETH chain rose by 3%, the TRON chain rose by 4%, the BSC chain rose by 8%, and the ARB chain, BLAST chain, BASE chain, MERLIN and POLYGON chain all rose by about 3%. The rising star BLAST chain has exceeded $2.3 billion in TVL, up more than 40% in the past month, and has firmly stood in the sixth position.

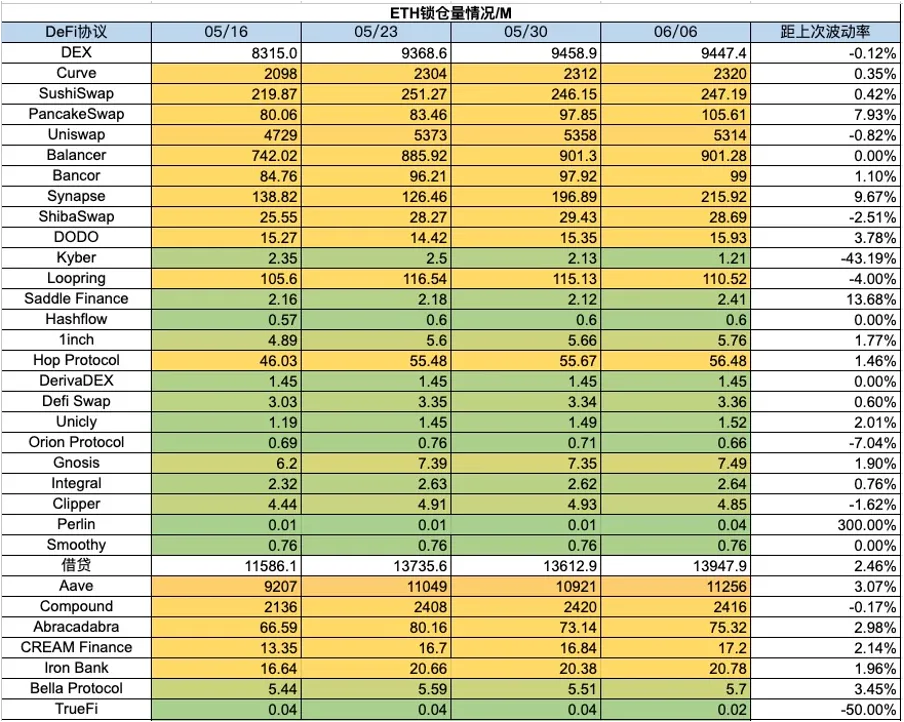

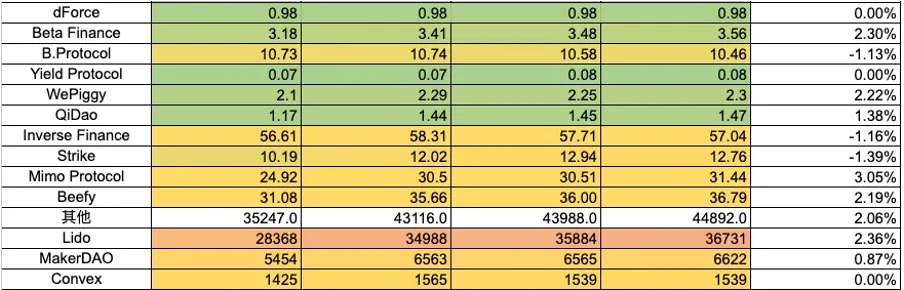

3. Locked Amount of Each Chain Protocol

3. Locked Amount of Each Chain Protocol

1) ETH locked amount

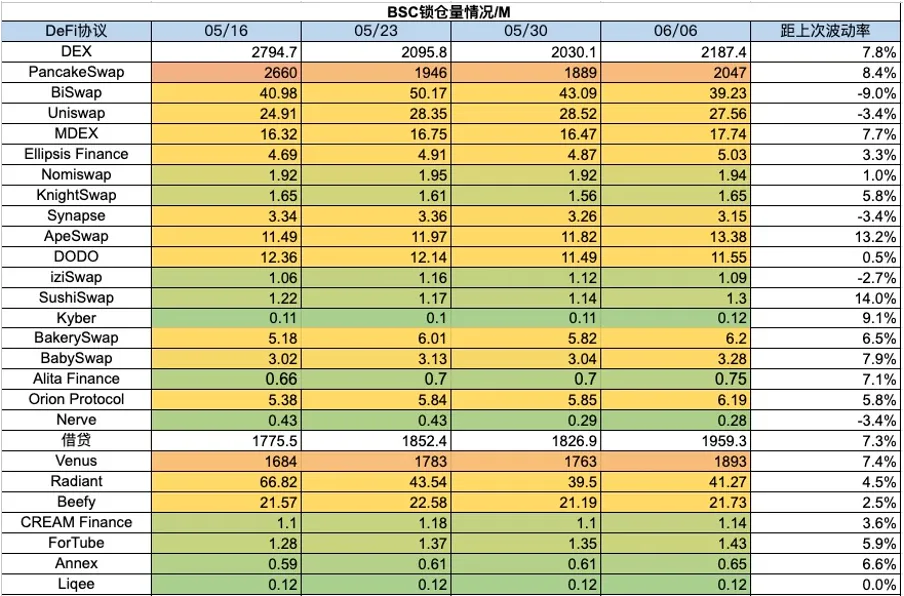

2) BSC locked amount

3) Polygon locked-up amount

4) Arbitrum locked amount

5) Optimism locked amount

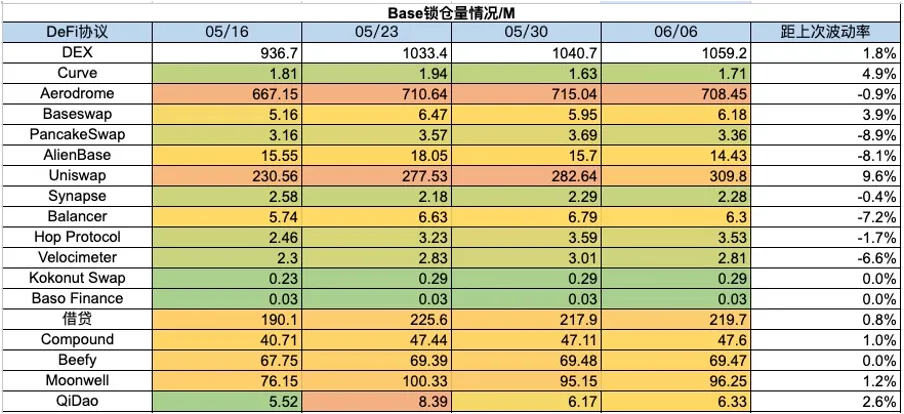

6) Base lock-up amount

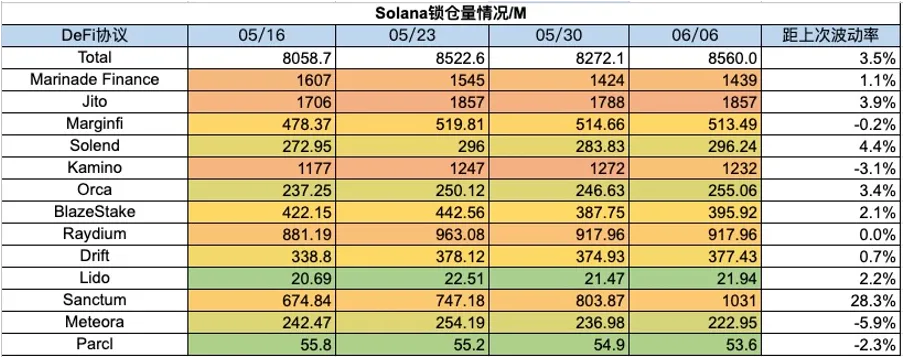

7) Solana locked amount

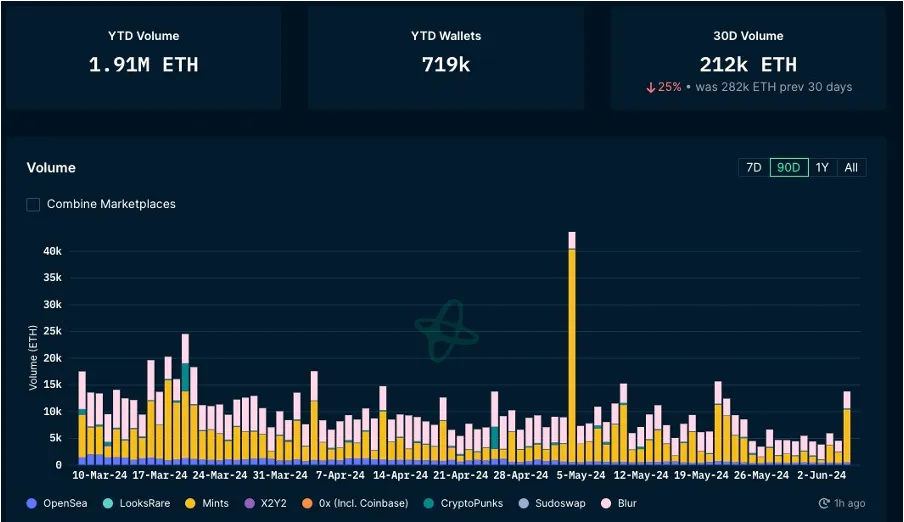

4. Changes in NFT Market Data

4. Changes in NFT Market Data

1) NFT-500 Index

2) NFT market situation

3) NFT trading market share

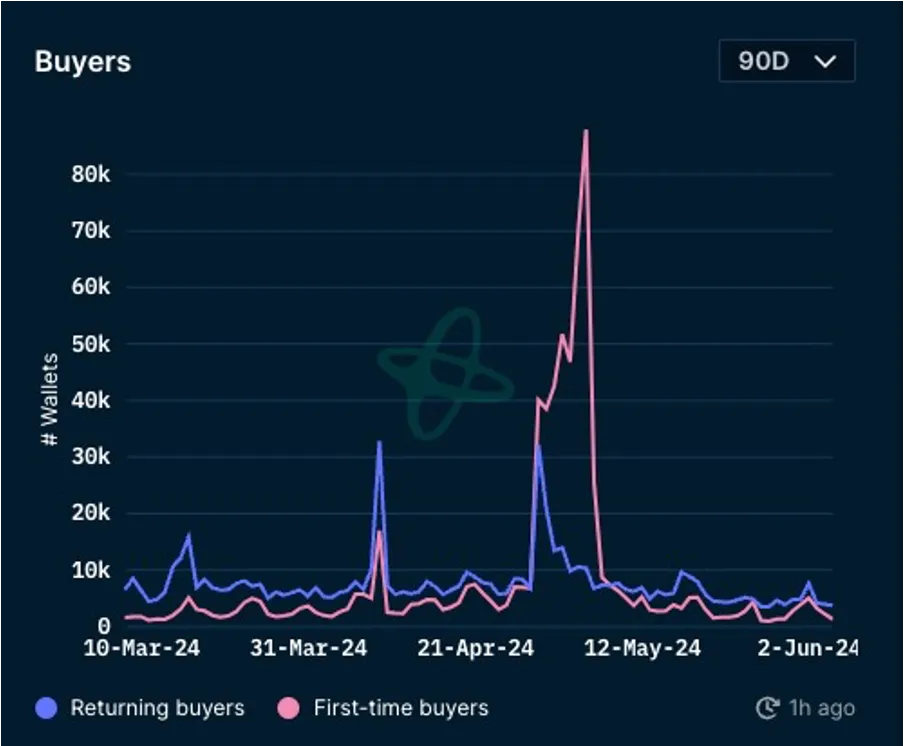

4) NFT Buyer Analysis

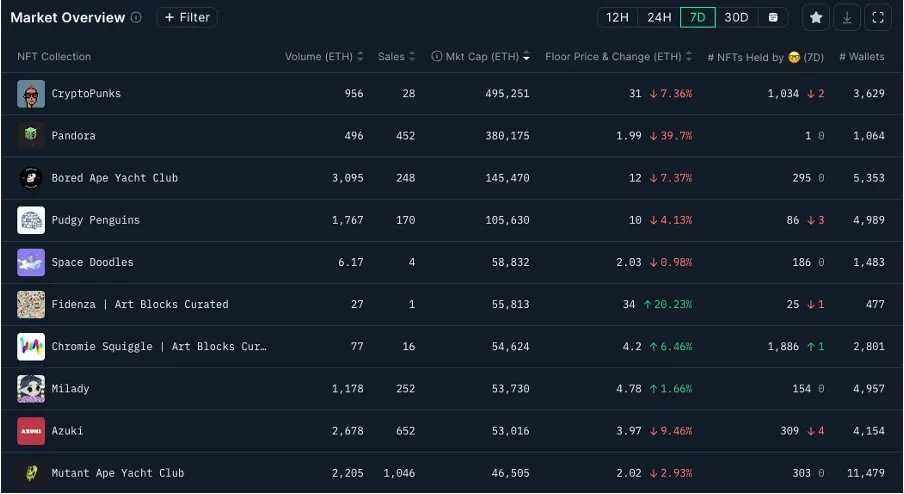

This week, the blue chip floor price of the NFT market is mainly falling, and the market is still in a downward trend. This week, CryptoPunks fell 7%, Pandora plummeted 49%, BAYC fell 7%, MAYC fell 3%, Azuki fell 9%, Pudgy Penguins fell 4%, LilPudgys fell 5%, Milady rose 2%, and CloneX rose 22%. This week, the overall transaction volume of the NFT market has rebounded significantly, but the number of first-time and repeat buyers has not increased due to the rebound in transaction volume. The NFT market continues to be sluggish, and the switch to reverse market sentiment has not yet been discovered and turned on.

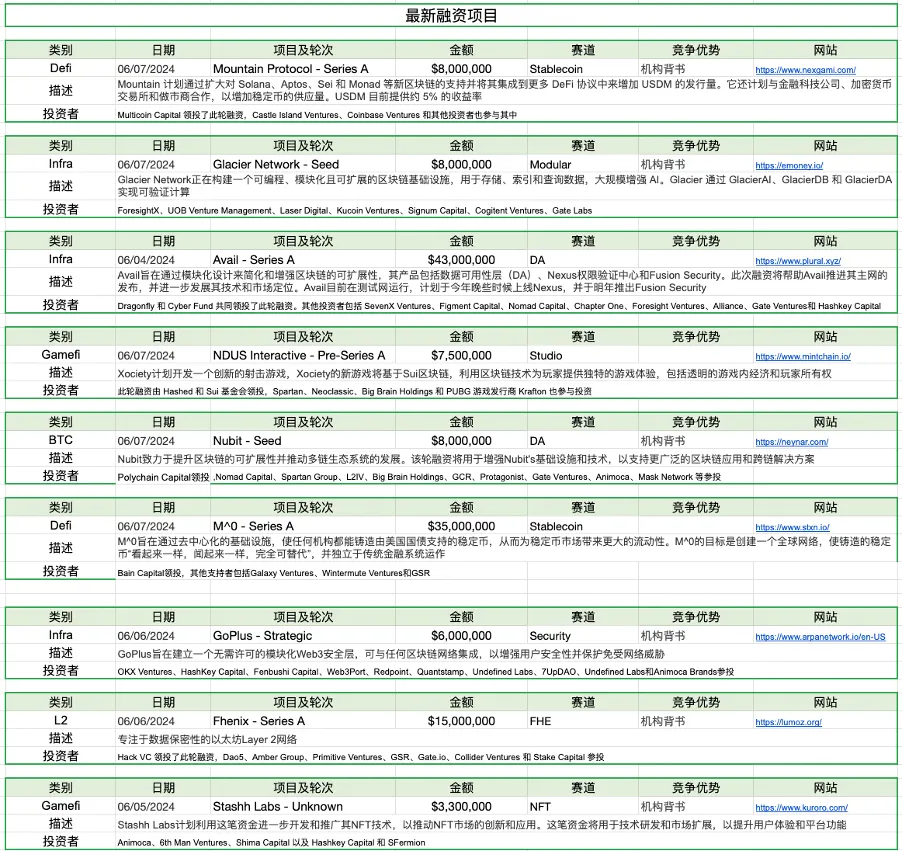

V. Latest project financing situation

6. Post-investment dynamics

1) IO.NET — AI

Binance Launchpool will be launched on io.net (IO), and users can mine IO by staking BNB and FDUSD. The mining time is 4 days, starting at 8:00 on June 7th, Beijing time. In addition, Binance will launch IO at 20:00 on June 11th, and open IO/BTC, IO/USDT, IO/BNB, IO/FDUSD and IO/TRY trading pairs. The maximum supply of IO tokens is 800 million, the initial supply is 500 million, the Launchpool reward is 20 million (accounting for 4% of the initial supply), and the initial circulation supply is 95 million (accounting for 19% of the initial total supply). Among them, the BNB mining pool can mine 17 million tokens, and the FDUSD mining pool can mine 3 million tokens. The hourly mining hard cap for individuals: 17708.33 tokens for the BNB mining pool and 3125 tokens for the FDUSD mining pool.

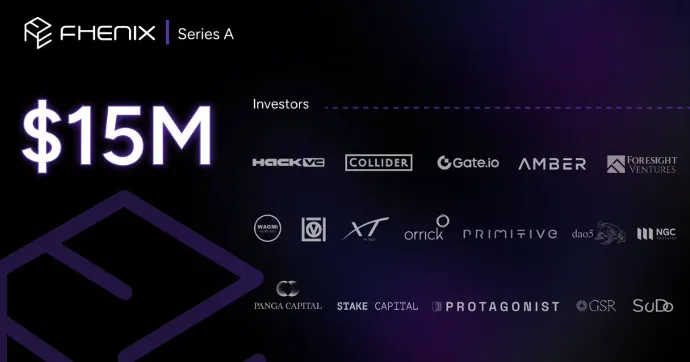

2) Fhenix — L2

Fhenix, an Ethereum Layer2 focused on confidentiality, has completed a $15 million Series A financing round led by Hack VC, with participation from Amber Group, Foresight Ventures, Primitive Ventures, GSR, Dao5, Collider Ventures and Stake Capital.

In addition, Fhenix launched the open testnet Helium (originally planned to be named Renaissance), where developers can deploy "confidential" smart contracts on the Fhenix second-layer network. Fhenix uses the fully homomorphic encryption (FHE) technology of the cryptographic company Zama to help ensure the confidentiality of its network. The Mainnet is expected to be launched in the first quarter of next year.

In order to attract developers to join its testnet, Fhenix has set up a grant program, the size of which has not yet been finalized. This Series A financing brings Fhenix's total financing to $22 million. In September last year, Fhenix raised $7 million in a seed round from Multicoin Capital and other companies.

3) Avail — Infrastructure

Polygon's modular blockchain project Avail announced the completion of a $27 million seed round of financing, led by Founders Fund and Dragonfly, with participation from SevenX Ventures, Figment, Nomad Capital, and others. Angel investors include former Coinbase CTO Balaji Srinivasan, Osmosis co-founder Sunny Aggarwal, Polygon CISO Mudit Gupta, AltLayer COO Amrit Kumar, and others.

Avail was spun out of Polygon in March 2023 and is led by Polygon co-founder Anurag Arjun. The funding will be used to develop three core products: its data availability solution (DA), Nexus and Fusion.