Cryptocurrency markets are seeing significant volatility this week as the U.S. Federal Reserve prepares to release its updated economic outlook.

Market experts and investors expect interest rate cuts to decrease despite slowing growth.

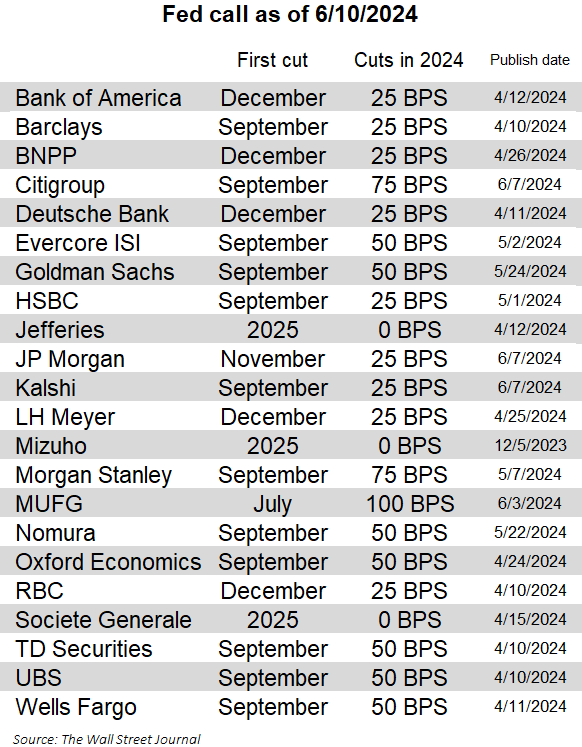

JP Morgan and Citi abandon interest rate cut forecast in July

Federal Reserve Chairman Jerome Powell warned that actual results may vary. Unexpected economic developments have challenged the Federal Reserve's recent projections.

While key inflation measures remain stable following aggressive rate hikes in 2022 and 2023, economic risks are now more nuanced and data is often contradictory. For example, U.S. companies added 272,000 jobs in May, and wages rose at a 4.1% annual rate. But unemployment soared to 4%.

Read more: How to Use Cryptocurrency to Protect Yourself from Inflation

“There has been a lack of further progress toward the Committee’s 2% inflation target in recent months,” the Fedwrote after its last meeting on May 1.

Therefore, the Fed is cautious about cutting interest rates until inflation improves significantly . Policymakers are questioning whether inflation can reach the 2% target without tighter monetary policy. The Fed's rate-cutting approach stands in contrast to some global central banks, such as the European Central Bank (ECB) and Bank of Canada (BoC) , which have recently cut interest rates . According to Wall Street Journal reporter Nick Timiraos, JPMorgan and Citigroup abandoned their expectations of a July rate cut after last Friday's jobs report .

He added , “Most sell-side economists and other professional Fed watchers expect one or two rate cuts in September or December of this year.”

In addition to JP Morgan and Citigroup, various financial institutions are expecting a Federal Reserve interest rate cut in 2024. Most forecasters expect the first rate cut as early as September, with some predicting a cut in December.

Mateo Greco, research analyst at Finekia, shared his perspective on the current situation in an interview with BeInCrypto. He explainedthat less restrictive monetary policies are generallybeneficial for risky assets such as stocks and cryptocurrencies. This is especially true when interest rate cuts do not signal an imminent recession.

“In this case, the central bank's decision to cut interest rates despite higher-than-target inflation signals its optimism to manage inflation through more expansionary monetary policy and keep it close to the desired level,” he noted.

At the time of writing, Bitcoin (BTC) is trading at $67,482, down 2.8% in the last 24 hours. Meanwhile, major altcoins such as Ethereum (ETH) and Solana (SOL) fell 3.9% and 3.4% over the same period. The overall cryptocurrency market capitalization is now $2.59 trillion, down 2.7% over the same period.

Read more: 7 ways to cope with retirement as inflation rises

In fact, this situation is very important for cryptocurrency traders and investors. The Fed's interest rate decisions have a direct impact on market liquidity, borrowing costs, and overall economic conditions, which all affect cryptocurrency market dynamics.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.