Medium demand for Bitcoin (BTC) among retail investors has dropped to a five-month low, last seen in January – which was capped off by a 75% rally in two months. the next month.

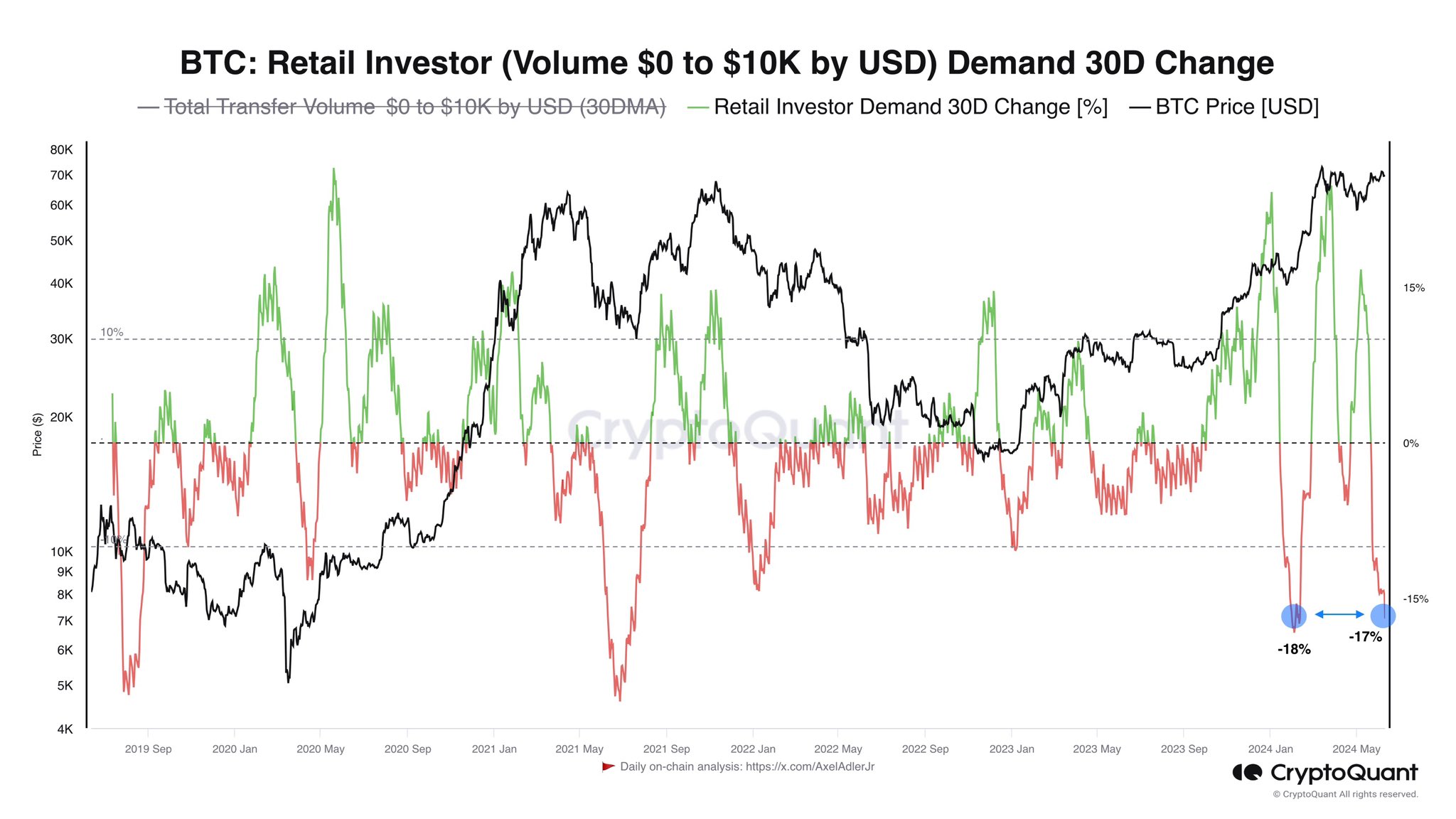

The Medium monthly change in Bitcoin demand among retail investors – those with transfer volumes up to $10,000 – has dropped to negative 17% over the past 30 days, according to data Chia on X on June 10 by CryptoQuant author AXEL Adler.

Adler added that “a similar drop to -18%” in January saw Bitcoin rise from $40,000 to $70,000 – when it spiked after Bitcoin spot exchange-traded funds (ETFs) were approved in United States, pushing Bitcoin to an All-Time-High of $73,679 in mid-March.

“I also found that this group responds quickly to any market changes,” Adler said.

Source: Adler

Last month, Adler used the same measure to show that demand fell 31% in the 17 days before May 24, falling to -14.5%. He pointed to increased interest in GameStop (GME) and Ether (ETH), possibly due to the initial approval of spot Ether ETFs.

Analysts have previously suggested that the change in Bitcoin demand is due to multiple factors, including the US Consumer Price Index (CPI ) which tracks inflation.

As CPI falls, it could make assets considered riskier like Bitcoin more attractive to investors as traditional savings and term deposits offer less return when interest rates decrease.

10x Research head of research, Markus Thielen, said in May that the CPI should fall to 3.3% by June 12 – the day the Bureau of Labor Statistics (BLS) will release the data (at 7:30 p.m. Vietnam time) – for Bitcoin to reach a new all-time high.

Bitcoin fell below $67,000 on June 11 – the asset's All-Time-High in November 2021 – a level closely watched by traders. At the time of writing, Bitcoin is trading at $67,350, down 3.2% over the past 24 hours.

This sudden decline wiped out $52.87 million worth of Bitcoin Longing positions over the past day. Open Interest (OI) remains above the closely watched $35 billion level, according to CoinGlass data.

Although traders hoped Bitcoin would quickly recover above $70,000 after dipping below it on June 8, it is not there yet.

Futures traders do not appear to be predicting its recovery in the short term, despite the expected CPI results on June 12, with $2.14 billion in Short positions at stake if it recovers.

Join Bitcoin Magazine's Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Thach Sanh

According to Cointelegraph