Bitcoin (BTC) cash exchange-traded funds (ETFs) are seeing daily outflows of over $200 million as uncertainty over US inflation data dominates the market.

Investors are reassessing their positions in risky assets, including Bitcoin ETFs, as inflation concerns grow. This situation demonstrates the complex relationship between macroeconomic indicators and cryptocurrency markets.

Bitcoin ETF sell-off due to market expectations

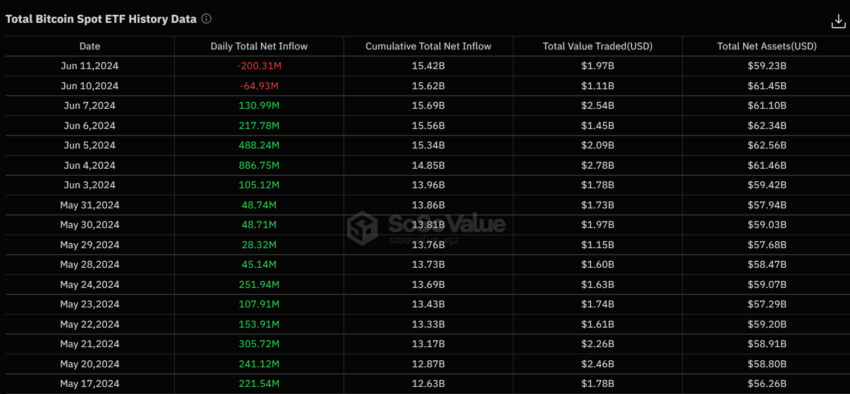

As of June 11 , daily net outflows from U.S. spot Bitcoin ETFs were $231 million, according to SoSo Value data. Grayscale Bitcoin Trust (GBTC) and Ark 21Shares Bitcoin ETF (ARKB) were hit the hardest, with outflows of $121 million and $56 million, respectively. On the other hand, BlackRock's iShares Bitcoin Trust (IBIT) saw no inflows during the same period.

Read more: How to Use Cryptocurrency to Protect Yourself from Inflation

This change is notable, as the ETF has been experiencing positive inflows since May 13th. However, outflows began to occur on June 10 as market participants anticipated the US May Consumer Price Index (CPI) data to be released today.

Jesse Cohen, global market analyst at Investing.com, highlighted increased market volatility surrounding the upcoming CPI report. He said the ongoing market rally could be extended if a lower-than-expected CPI report is released. This could reassure investors about the likelihood of a Federal Reserve interest rate cut in the coming months.

“However, unexpectedly high inflation numbers could delay expectations of interest rate cuts and raise concerns about inflationary pressures, which could trigger market volatility,” he added .

Research company Kobeish Letter also weighed in on this. The report noted that expectations regarding CPI data were mixed. The company noted that while major banks expect CPI inflation to be 3.4%, prediction markets give a 17% chance of inflation exceeding 3.4% and a 41% chance of it falling below 3.4%.

“If CPI inflation is above 3.4% [today], it means inflation has been rising in three of the last four months,” the Kobeish letter wrote .

Mixed economic signals further complicate the outlook for inflation and market performance. For example, U.S. companies added 272,000 jobs in May and wages rose 4.1% annually, while the unemployment rate soared to 4%. The paradox of unemployment rising at the same time as employment and wages rise adds to uncertainty in the economy.

Matthew Dixon, CEO of cryptocurrency valuation platform Ebay, emphasized the importance of the upcoming CPI and Federal Reserve meetings. He acknowledged that higher inflation could be positive for the dollar but negative for risk assets, including Bitcoin.

“It is also possible that the CPI will fall and a dovish Federal Reserve will push risk assets up,” he said .

However , historically, Bitcoin prices tend to bounce after FOMC announcements, despite initial volatility. Anonymous cryptocurrency researcher Gumshaw mentioned this in a recent analysis.

“There will be four FOMC [meetings] in 2024. […] ] In the 48 hours before all meetings took place, BTC fell 10%. On the day of the FOMC, the full movement was restored. “The market always prices in overly bearish statements and then reverses,” Gumshoe explained.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Spot Bitcoin ETF outflows show cautious sentiment among investors as markets brace for imminent inflation data. The outcome of the US CPI report and the Federal Reserve's follow-up actions are likely to set the tone for market movements in the near term.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.