Meme coins are gaining attention due to their potential to generate significant profits through word of mouth. Trading volumes for these coins have recently hit record highs, attracting the attention of skeptics and enthusiasts alike.

However, meme coin trading requires thorough research, strategic execution, and constant market monitoring.

Meme coin trading strategies shared by cryptocurrency traders

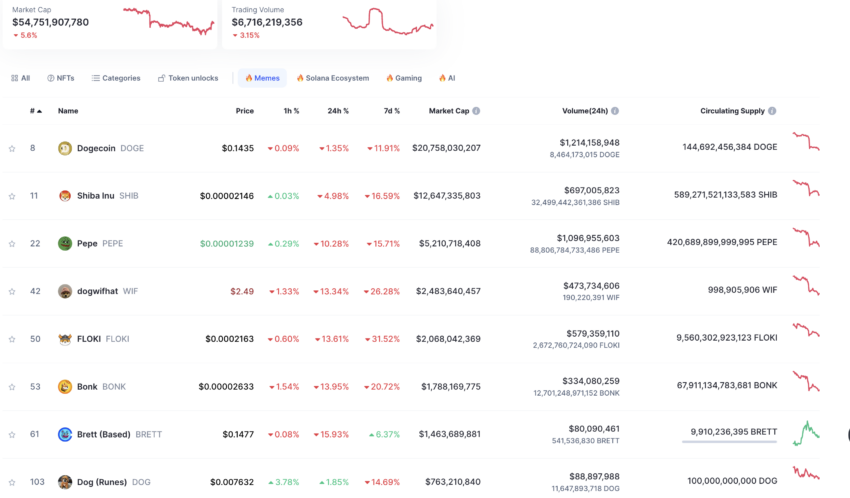

Experts such as Mike Novogratz of Galaxy, a leading digital asset company, highlight the importance of meme coins, which currently boast a market capitalization of more than $54 billion.

“Meme coins have become a cornerstone of the cryptocurrency economy, whether you’re a fan or not… In today’s market, meme coins are one of the most powerful stories,” says Novogratz.

Read more: 7 Popular Memes Coins and Altcoins Trending in 2024

Meme coins attract investors with the opportunity for quick profits. Crypto analyst Atlas explains that knowledgeable traders can earn up to 100x returns from meme coins.

“Once you understand the basics of trading, you can start analyzing and purchasing tokens. You can become a millionaire in just a few clicks, all you have to do is invest a little time,” he emphasizes .

Atlas shares some essential strategies for those interested in exploring this market. First of all, he advises evaluating the project's footprint on social media, especially X (Twitter), which is very important for studying sentiment. Not having an X account is often a sign of a project's lack of credibility.

Atlas also recommends tools such as DEX Screener or DEXTools to evaluate the distribution of token holders. They warn that a high percentage of tokens held by creators could lead to a crash risk. This analysis is very important as it helps eliminate potential fraud.

Token sniping, purchasing tokens as soon as liquidity becomes available, has been discussed as another strategy.

“Sniping is buying tokens the moment liquidity is added, and you can easily make 100x your profits in a short period of time,” Atlas explained .

Popular Telegram bots such as Bonkbot, Salt Tradingbot, and Unibot can facilitate meme coin sniping. Meme Coin Snipers act quickly when a new token pool appears. They copy contracts, analyze them, and quickly buy tokens through the aforementioned bots.

Read more: Unibot: A comprehensive guide to Telegram bots

But the atlas emphasizes the importance of caution. He demonstrates the unpredictable nature of trading, where no one can achieve a 100% success rate.

Additionally, the atlas suggests that traders should not be distracted by a large number of emerging projects and instead focus on existing market leaders. Because the meme coin sector is very sensitive to broader cryptocurrency trends, particularly movements in Bitcoin, it is important to remain alert to overall market conditions.

KingWilliam, another cryptocurrency trader, offers additional advice. He recommends monitoring new pairs on a dexscreener and imitating the strategies of top traders. Tools like AlphaTrace provide insight into successful strategies.

“Wallets should have a win rate of at least 60-70% and a P&L of at least $500-600,000,” KingWilliam suggested .

Lastly, there is always the potential for fraud in the meme coin space. Tools like LugCheck can help determine the likelihood of a ‘ rugpull ’, a scam in which a developer abandons a project and walks away with investors’ money.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.