Decentralized finance (DeFi) analyst Stacey Moore warns that the surge in popularity of meme coins could signal the end of the current cryptocurrency bull market.

Muir argues that investors should consider securing returns, according to Mesiri's meme coin investment study.

Why Stacey Moore Is Guessing the Market Top

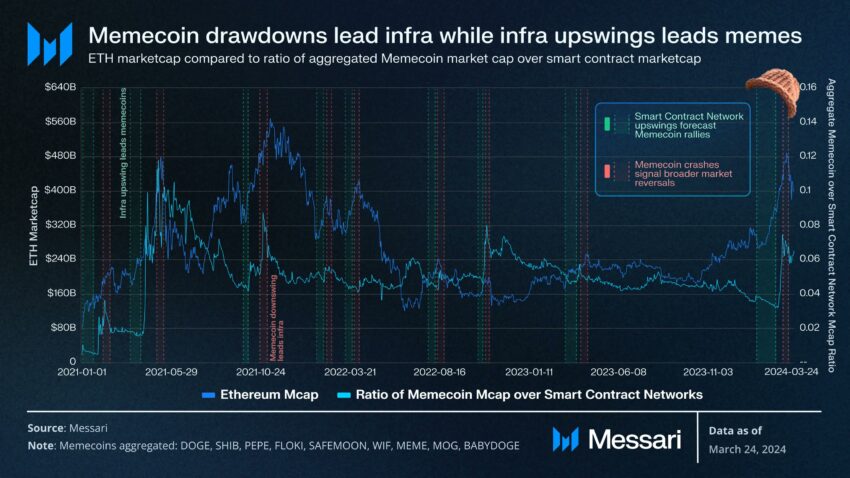

Mesiri's analysis reveals patterns in the cryptocurrency market, which typically begin with large investments in cryptocurrency infrastructure projects.

“This is quite logical: cryptocurrency bull markets usually start in BTC or smart contract platforms due to factors such as liquidity, risk-reward profile, and technological innovation. These assets “send a signal that cryptocurrencies are not dead” and drive speculation and development, Muir explains .

The investment trend then shifts to more volatile assets known for potential surges, such as meme coins. However, Muir warns that meme coins are usually the first to fall, signaling the end of a speculative wave across cryptocurrencies.

Read more: 7 Popular Meme Coins and Altcoins That Will Be Trending in 2024

Currently, Muir notes that as meme coin activity declines, platforms such as pump.fun that support the creation and trading of these assets are seeing a drop in trading volume.

“Based on these patterns in our research, Messari proposes the following investment framework: Buy memes when traditional DeFi/cryptocurrencies start to rise. Then, if the meme coin falls above a threshold, we cash out the entire portfolio and freeze transactions,” Muur details .

Muir's claims sparked debate among his followers. In her X (formerly Twitter) thread, some critics argue that current cycles are different from past ones.

“The framing of this entire paper is wrong. Unlike in the past, memes were the first to fuel this cycle. Now we are moving into a cycle of higher liquidity with lower interest rates. We are not even close to the peak yet,” said one X user.

Other analysts are also skeptical. This month, BeInCrypto reported insights from one analyst who pointed out three of the market's top signals :

- Celebrity endorsements for meme coins.

- The surge in new meme coins,

- Flood of PnL screenshots on social media.

The growing celebrity involvement in meme coins, with celebrities like Caitlyn Jenner , Iggy Azalea , and Andrew Tate launching tokens, mirrors past market peaks in 2017 and 2021.

Learn more: Cryptocurrency Scam Project : How to Identify Fake Tokens

Additionally, over 1 million new meme coins were created in April alone , indicating that market speculation has reached its peak. This situation, along with the widespread sharing of PnL screenshots, suggests that the market is approaching a tipping point.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.