Source: Ethena Labs; Translated by: Tao Zhu, Jinse Finance

Today marks an important step in aligning the growth and use of USDe more closely with $ENA. Ethena will begin to gradually introduce more utility features for $ENA in the Ethena ecosystem, starting with the launch of universal staking functionality for $ENA.

Table of contents

i) Current use cases of $ENA in the Ethena ecosystem;

ii) Introducing universal re-staking of $ENA and $USDe;

iii) Potential rewards from the Symbiotic re-staking pool $ENA;

iv) Starting from Season 1, lock-up requirements for users who have not vested ENA will be implemented, immediately reducing future $ENA inflation.

i) Current use cases of $ENA:

Currently, $ENA is used as follows:

i) Locked in Ethena to increase potential future returns. This is intended to incentivize the transfer of value from more employed capital pools to users more aligned with the long-term growth of Ethena. The size of this reallocation scales linearly with the amount of USDe held by users. Therefore, as the supply of USDe grows, the potential implicit $ENA holding requirements imposed on long-term aligned ecosystem members will also scale with this growth. Currently, the locked ENA pool holds approximately 290 million ENA.

ii) Locked in Pendle Finance PT-ENA, users can earn a fixed APY of currently around 75% in the form of PT-ENA, YT-ENA purchasers can earn point allocations, and are able to meet the minimum ENA holding relative to their USDe holdings by holding only 1 YT = 1 ENA. Currently, the PT-ENA pool holds approximately 160 million ENA.

iii) The next phase of incorporating $ENA into the Ethena system and increasing its utility will be leveraging a universal re-staking pool to stake $ENA. The first use case is to provide economic security for cross-chain transfers of USDe relying on a LayerZero DVN-based messaging system. This is the first of many layers of infrastructure related to the upcoming Ethena Chain and financial applications built on top of it that will leverage and benefit from the re-staking $ENA module.

For more details on the chain, see the Ethena 2024 roadmap post detailed here .

The staked $ENA and $sUSDe will be the first batch of new assets deposited in Symbiotic in the upcoming era, and the initial LST cap was fully filled in under an hour.

Dune dashboard for lock$ENA has been created here :

ii) Details of the $ENA re-staking module:

Ethena will initially pilot a universal re-staking framework with Symbiotic and LayerZero, seeking to secure cross-chain transfers of Ethena-based assets, including $USDe and $sUSDe. These transfers are validated via the LayerZero DVN network, which is secured by $ENA staked within Symbiotic.

This module will also include building a general framework to launch re-collateralized DVNs for LayerZero ecosystem partners that use a consistent token to provide economic security and DVN operator selection.

For more details on LayerZero DVN, see the documentation here .

While cross-chain transfers based on Ethena will be secured by staked $ENA, Ethena will provide a unique value proposition for general re-staking use cases through $USDe and $sUSDe for use as a base asset by other systems and protocols.

$USDe/$sUSDe offer two different asset qualities that unlock unique potential use cases compared to utilizing $ETH as the underlying re-collateralized asset:

i) Uncorrelated: Relatively stable assets “pegged” to the USD are generally uncorrelated with volatile crypto assets, and during periods when slashing needs to occur, USD stability relative to ETH is an important quality in moments of stress - when you need the security of re-staking the most.

ii) Sustainable Real Returns: It is unclear how AVS can provide a true non-inflationary yield on billions of dollars of re-staked capital without having excessive token rewards be the majority of the yield. Using $sUSDe, which has structurally higher real yields than any USD-based asset since inception, uniquely solves this problem by reducing the need for inflationary rewards to bridge the capital cost gap between re-stakers and the system that consumes security.

iii) $ENA Symbiotic staking rewards details:

After the ETH LST cap is filled in a few days, $ENA and $sUSDe will become the next eligible assets to be staked in the next era.

The following rewards will be given to those who stake $ENA in Symbiotic:

Highest Ethena multiplier, 30x per ENA per day;

Symbiotic Points;

Mellow points;

Potential future LayerZero RFP allocations (if allocated to Ethena);

The $ENA pool will go live on Wednesday, June 26th.

$ENA re-staked in Ethena Chain:

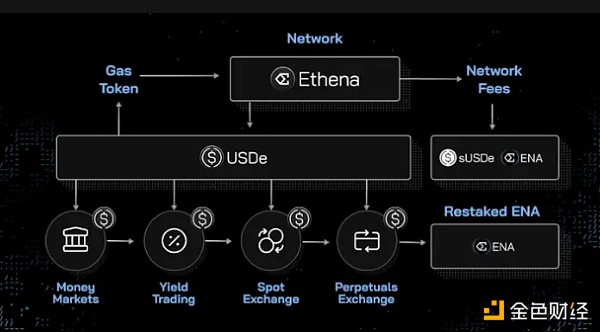

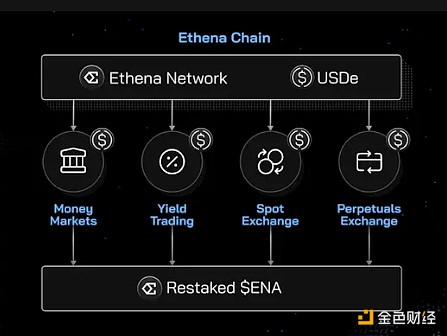

As stated in the 2024 roadmap, Ethena Chain will focus on building financial applications and infrastructure on $USDe as the gas token and fulcrum asset within the system.

Our view is that crypto-native currencies are the holy grail and the killer app, while the U.S. dollar is the lifeblood of every financial application.

The re-staked $ENA will provide general security for these use cases for the following applications:

Spot AMM;

Permanent DEX;

revenue trading;

currency market;

Low collateral loans;

On-chain prime brokers;

Options and structured products.

And on-chain infrastructure solutions, such as:

Cross-chain transfers;

Oracle providers;

Shared sequencer;

Data Availability Solutions

In return, they may be eligible to benefit from potential future airdrops on these protocols at a later date at their discretion.

As the ecosystem and use cases around the USDe asset grow, $ENA’s utility will grow as an asset that helps secure the ecosystem.

iv) $ENA Lock and vesting updates:

As of June 17th, any user who received $ENA via an airdrop (e.g. the portion received from the Shard Campaign airdrop subject to vesting conditions) will need to lock up at least 50% of their claimable $ENA $ENA from one of the three options outlined in the first section.

Failure to do so will result in all of a user’s unvested $ENA (attributed to the associated wallet) being redistributed to other users who will lock $ENA in i) Ethena staking, ii) PT-ENA on Pendle (any chain), or iii) Symbiotic Restaking. As more $ENA use cases emerge in the ecosystem, the options for locking $ENA for this purpose may also expand.

To be clear: the purpose of the above is to incentivize $ENA holders to realign from hired capital to long-term consistent users.

The above instructions will be made clear when users claim their next weekly ENA vesting on June 23. From that point on, at least 50% of the newly vested ENA needs to be locked in the above options, otherwise users will lose unvested ENA.

$ENA that is confiscated due to not meeting the above conditions will not be retained by the foundation, team or investors - it is only used to benefit users who are aligned with the ecosystem.