Binance Coin (BNB) rose to an all-time high of $720.67 on June 6. As selling pressure intensified, the price of the coin fell and has since shown a downward triangle trend.

As of this writing, BNB is trading at $592.71, down 18% since June 6th .

Binance Coin Loses Bull Market Support

After rising to a yearly high on June 6, the price of BNB fell, forming a descending triangle.

This pattern is a bearish signal. It forms when the price of an asset makes lower highs and bounces off horizontal support.

For BNB, support was found at $593.90, the level at which it is currently trading. Typically, if bulls fail to defend support in a descending triangle, it signals a bearish breakout and continuation of the downtrend.

This means that sellers have outpaced buyers and asset prices will continue to fall. Due to the surge in BNB selling, the coin price is currently trading below the 20-day exponential moving average (EMA).

Read more: How to Buy BNB and Everything You Need to Know

An asset's 20-day EMA tracks its average price over the past 20 days. If the price falls below this key moving average, it is a sign that buying pressure is decreasing and coin circulation is increasing.

BNB Price Prediction: Long Traders Maintain Bullish Outlook

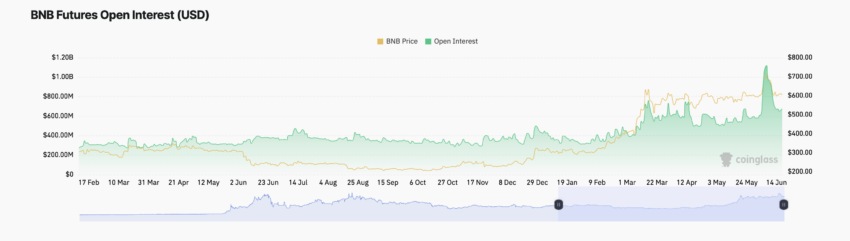

The decline in the price of BNB over the past two weeks has led to a decrease in futures open interest. On-chain data shows that altcoin futures open contracts soared to a yearly high of $1.12 billion on June 8, before falling later.

At press time, BNB futures open contracts stood at $674 million, down 33% since June 8.

BNB's Futures Open Contracts tracks the total number of open futures contracts or positions that have not been liquidated or settled. A decline in this number indicates an increase in the number of traders exiting the market rather than opening new positions.

However, despite BNB’s price decline over the past month, funding rates across cryptocurrency exchanges have largely remained positive. At press time, BNB’s funding rate is 0.0021%.

The funding rate is a mechanism used in perpetual futures contracts to ensure that the contract price remains close to the spot price.

When an asset's funding ratio is positive, more traders hold long positions. This means that there are more traders who expect asset prices to rise than those who expect prices to fall . If selling activity decreases, the BNB price could rise above $600, trading at $615.10.

However, if market sentiment continues to be weak, the BNB price could fall to $555.90.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.