While Bitcoin fell from $70,000 to $64,000, Avalanche (AVAX) fell 28% since June 7, reaching the critical support level of $25.

In this analysis, we will cover both the technical and on-chain aspects of Avalanche (AVAX) and provide a detailed price prediction.

AVAX Price Prediction and Forecast

After Bitcoin's price fell from $70,000 to $64,000, AVAX experienced a whopping 28% decline from June 7 to date. This large decline caused AVAX to test the critical support level of $25.

Additionally , the RSI on the daily chart has reached 28, indicating an oversold environment .

In a previous BeInCrypto analysis, we predicted that AVAX could fall to $25 in a bearish scenario if Bitcoin price continues to fall. To reduce risk exposure, we have advised waiting until the price falls below $30 before buying. We suggest that the ideal buy range for an optimal entry position is around $25-$27.

Read more: How to Buy Avalanche (AVAX) and Everything You Need to Know

Prices followed Avalanche forecasts and reached a local low of $25 today, a level not seen since December 2023. It then rebounded 6% to $26.50. This confirms our predictions and highlights the importance of the $25 price level mentioned in our previous analysis.

The price is currently trading below all major technical analysis indicators on the daily time frame, showing a bearish scenario. The Ichimoku Cloud, its baseline, and the exponential moving average are all below, which are all strong bearish signals.

Analyzing the total number of addresses holding AVAX and their profitability

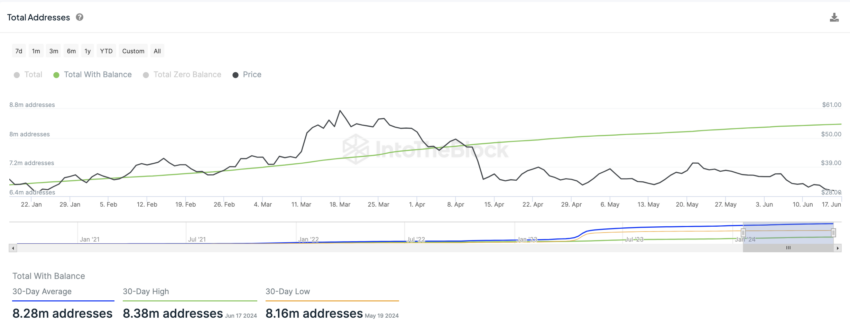

Total number of addresses holding AVAX

Total addresses with balance measures the number of unique addresses on the blockchain that hold some AVAX. Each address represents a user or entity that can send, receive, and hold cryptocurrency, as well as interact with decentralized applications (dApps) on the network.

The number of addresses increased by 41,316.85 from June 3 to June 10 and by 22,060.86 from June 10 to June 17. This data shows a steady increase in new addresses, with a larger increase in the first week compared to the second week.

Read More: Avalanche (AVAX) Price Prediction 2024/2025/2030

These trends indicate that user adoption and network expansion will increase, but growth will slow in the second half of the year. Therefore, you should keep an eye on potential changes in user engagement or market sentiment.

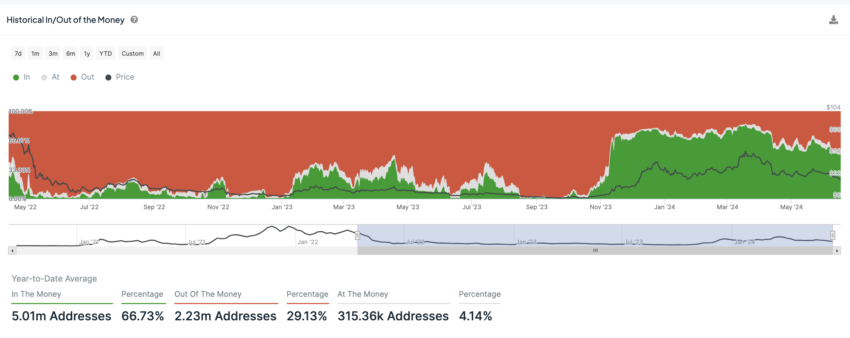

Historical profitability of addresses holding AVAX

By analyzing the past profitability of addresses holding AVAX , we can see changes in the economic sentiment of participants . The loss area (red) in the chart indicates the percentage of AVAX addresses that experienced loss. The break-even area (gray) indicates the percentage of AVAX addresses that have reached the break-even point. Revenue areas (green) indicate addresses that are earning revenue.

As of May 31, 2024, 36.69% of active addresses were unprofitable. This ratio increased to 49.94% on June 17, 2024, reflecting the increasing number of participants holding unrealized losses. The rate for At the Money addresses started at 5.89% and decreased to 0.78% on June 17, 2024.

This decrease in break-even addresses means that fewer participants reach their cost threshold. Because more people are experiencing loss. Initially, 57.42% of addresses were In the Money, but this decreased to 49.28% by the end of the period.

Additionally, the rise in the loss (loss) category from 36.69% to 49.94% shows growing bearish sentiment among holders. The continued decline in At The Money addresses suggests that price fluctuations have pushed most participants off their cost basis and into loss territory.

Read More: 11 Best Avalanche (AVAX) Wallets to Consider in 2024

This situation is bearish because it can trigger selling pressure on participants to try to cut their losses. This could push prices down further and increase market oversupply.

If the Avalanche (AVAX) price falls below $25, it is likely to fall quickly to the strong support level of $20. This $20 level will act as an important and solid support level.

For long-term holders, buying AVAX at this price is a good opportunity. AVAX price is stabilizing around $26, up 7% from its low of $25, signaling a potential local bottom.

In fact, this scenario could be invalidated if Bitcoin falls below $65,000. Conversely, if Bitcoin rises back to $68,000-69,000 in the medium term, AVAX will likely rise above $30.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.