A glaring problem is becoming apparent in the cryptocurrency market. The surge in over 2.52 million altcoins has pushed the industry to the point of suffocation.

While this unprecedented increase in new tokens was initially a sign of a booming market, it is now causing serious problems.

2.52 million new tokens created

In 2020, the cryptocurrency market experienced a crucible of enthusiasm. Liquidity has surged as individual investors and venture capitalists (VCs) pour money into the industry. In particular, VCs have contributed to the development of numerous projects through huge investments.

Will Clemente, co-founder of Reflexivity Research, recalls that the strategy at the time was simple. All investors had to do was allocate capital to high-beta altcoins and enjoy a bull run that outperformed Bitcoin.

“In 2020, if you invest in altcoins with higher betas compared to Bitcoin, all altcoins will rise,” Clemente explained.

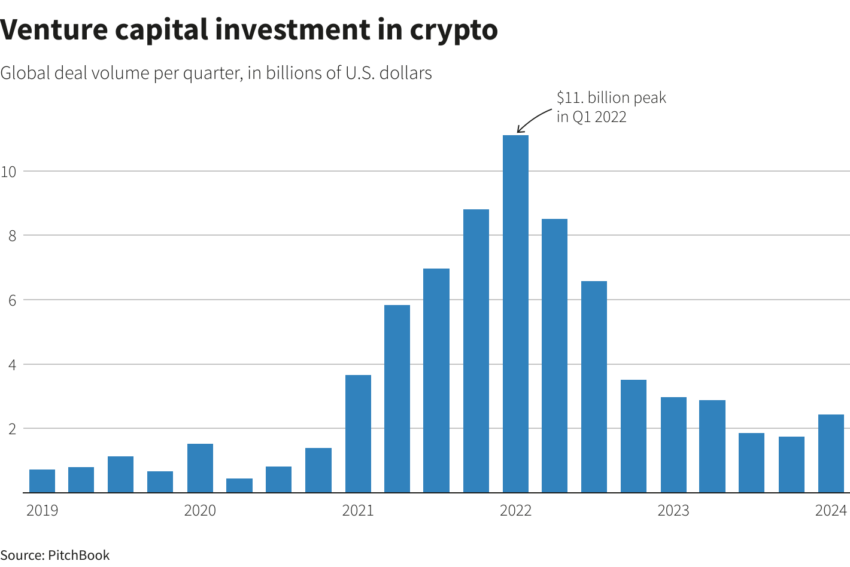

This trend will continue in 2022, with VC funding reaching $11.1 billion in the first quarter alone. However, this flood of new capital has led to an unsustainable rise in altcoins.

The number of tokens tripled between 2020 and 2022, but the subsequent bear market took its toll. High-profile failures, such as the collapse of LUNA and FTX, have caused widespread market turmoil. Projects that have raised significant funding have decided to delay their launch while waiting for more favorable market conditions.

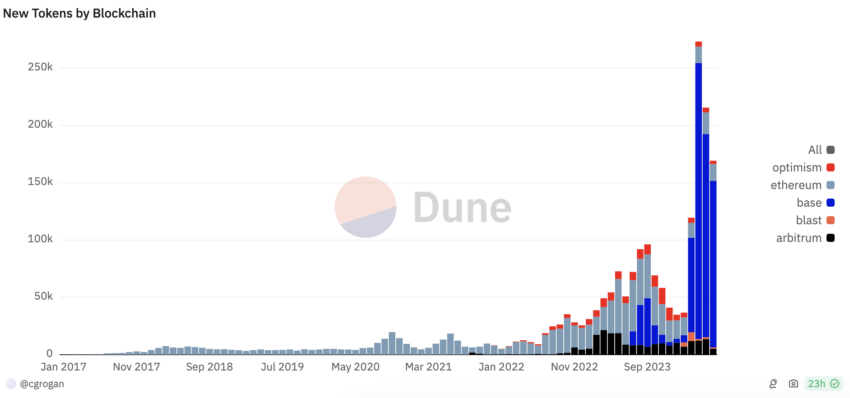

Toward the end of 2023, new altcoin launches began to surge as market sentiment improved. This upward trend will continue into 2024, with over 1 million new tokens launched since April. As a result, a total of 2.52 million altcoins were released across multiple blockchains.

“Nearly 1 million new cryptocurrency tokens were created in the past month, which is double the total number of tokens created on Ethereum from 2015 to 2023,” said Coinbase Director Connor Grogan.

Read more: 7 Popular Meme Coins and Altcoins That Will Be Trending in 2024

These numbers may be inflated due to the ease of making meme coins, but the amount of new tokens is staggering.

Impact of altcoins on cryptocurrency

This flood of new tokens is problematic. The more altcoins pour into the market, the greater the cumulative supply pressure.

Estimates suggest that between $150 million and $200 million worth of additional new supply is entering the market every day. This continued selling pressure drives prices down, similar to inflation in a traditional economy. As more altcoins are created, their value relative to other currencies decreases.

“You can think of token dilution as inflation. When the government prints U.S. dollars, the dollar's purchasing power relative to the cost of goods and services decreases. The same goes for cryptocurrencies,” explains cryptocurrency analyst Myles Deutscher.

Many of these new tokens have low fully diluted value (FDV) and high liquidity, exacerbating supply pressure and diversification. This environment may be manageable if new liquidity flows into the market.

However, if there is not enough new capital, the market will be forced to absorb the constant influx of new tokens , which will lead to price suppression.

Read more: What are the best altcoins to invest in June 2024?

This may be one of the reasons why individual investors feel at a disadvantage compared to VCs and are reluctant to participate.

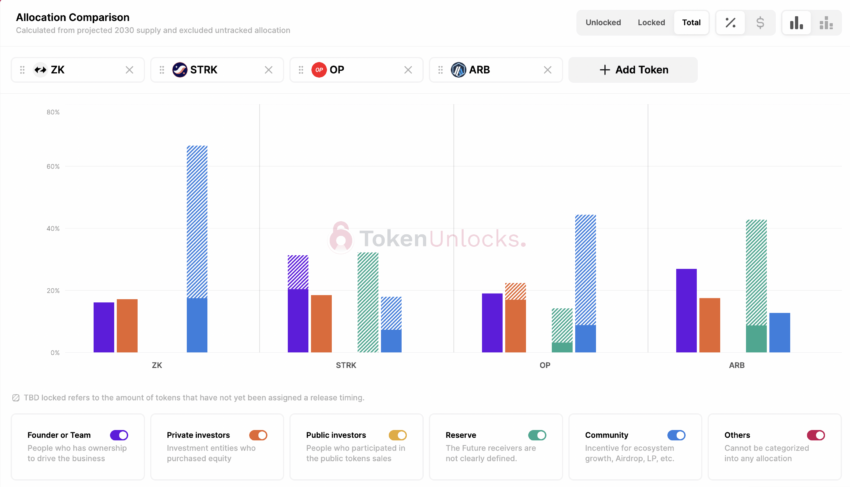

In previous cycles, individual investors were able to reap significant returns. However, now tokens are launched at high valuations, leaving little room for growth, and losses are often incurred as the unlock schedule begins.

“One of the biggest problems in the cryptocurrency market, especially compared to other markets such as stocks or real estate, is the concentration towards private markets. This bias is problematic because retail feels like it can’t win,” Deutscher concluded .

Solving this problem requires a joint effort from multiple stakeholders. Exchanges can implement stricter token distribution rules, and project teams can prioritize community allocation. Additionally, mechanisms to prevent dumping will ensure that a larger proportion of tokens are unlocked at launch.

Read more: 10 Best Altcoin Exchanges in 2024

The current state of the market reflects the need for greater pragmatism. Exchanges should consider delisting defunct projects to free up liquidity. The goal should be to create a more retail-friendly environment that benefits everyone, including VCs and exchanges.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.