Dogecoin (DOGE), a leading meme coin, has witnessed double-digit price declines over the past week.

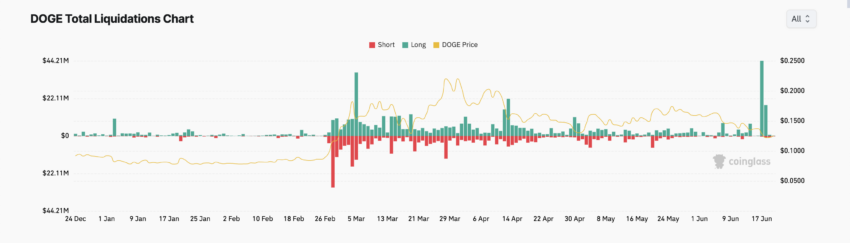

The decline deepened on June 17, when it fell to a three-month low and triggered the largest liquidation of purchases this year .

Dogecoin short trader pays funding fee

On June 17, the price of Dogecoin plummeted to a three-month low of $0.12. This led to an increase in buy liquidations, reaching $44.21 million on the day. This is the highest figure so far this year.

Liquidation in the derivatives market of an asset occurs when a trader runs out of funds to maintain the position and is forced to liquidate the position.

Long liquidation occurs when traders with long positions are forced to sell their contracts if the value of the asset falls unexpectedly.

By comparison, the short position liquidated on June 17 was worth less than $400,000.

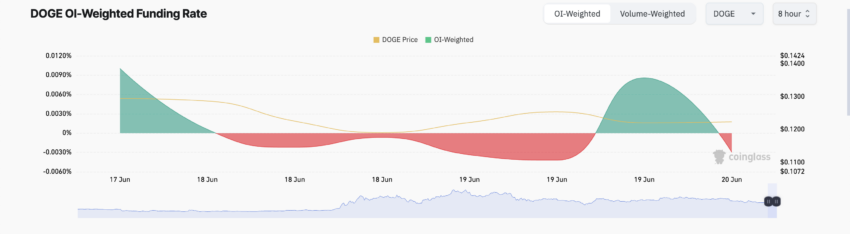

After this incident, DOGE's funding rate across cryptocurrency exchanges was mostly negative. As of this writing, the weighted funding rate for Meme Coin is -0.003%.

Read more: Dogecoin (DOGE) vs Shibainu (SHIB ): What's the difference?

The funding rate refers to the amount periodically paid between traders to ensure that the market price of a futures contract remains close to the spot price of the underlying asset.

If the futures price of an asset is higher than the spot price, the funding rate becomes positive and traders with long positions pay fees to traders with short positions. This means that there is more demand for long positions than short positions.

Conversely, if the perpetual futures price of an asset is lower than the spot price, the funding ratio will be negative. In this case, the short trader pays a funding fee to the trader holding the long position.

When this happens, it means that there are more traders buying an asset expecting its price to fall than there are buying it expecting its price to rise .

DOJI Price Prediction: Long Traders Face a Difficult Road Ahead

DOGE's decline in value pushed its price below its 20-day exponential moving average (EMA) and 50-day small moving average (SMA) on June 7.

An asset's 20-day EMA measures its average price over the past 20 trading days, while its 50-day SMA tracks its average closing price over the past 50 trading days.

When an asset's price falls below these key moving averages, it is a sign of mounting selling pressure. This confirms a bearish bias for the asset, which many traders interpret as a signal to close long positions.

The negative value of DOGE’s Elder-Ray Index confirms the bearish sentiment towards the meme coin. As shown above, the Elder-Ray index returned only negative values as the price of the coin fell below its main moving average.

This indicator measures the relationship between the power of buyers and sellers in the market. A negative value means that selling pressure is dominating the market. As of this writing, the value of ADA's Elder-Ray Index is -0.023.

If the doji bears continue to dominate the market and sell momentum gains, the value of the meme coin could plummet to $0.11.

Read more: How to Buy Dogecoin (DOGE) eToro: The Complete Guide

However, if the bias towards Dogecoin turns bullish and buying pressure surges , the coin could rise to $0.13 .

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.