Author: Hanzo

Compiled by: TechFlow

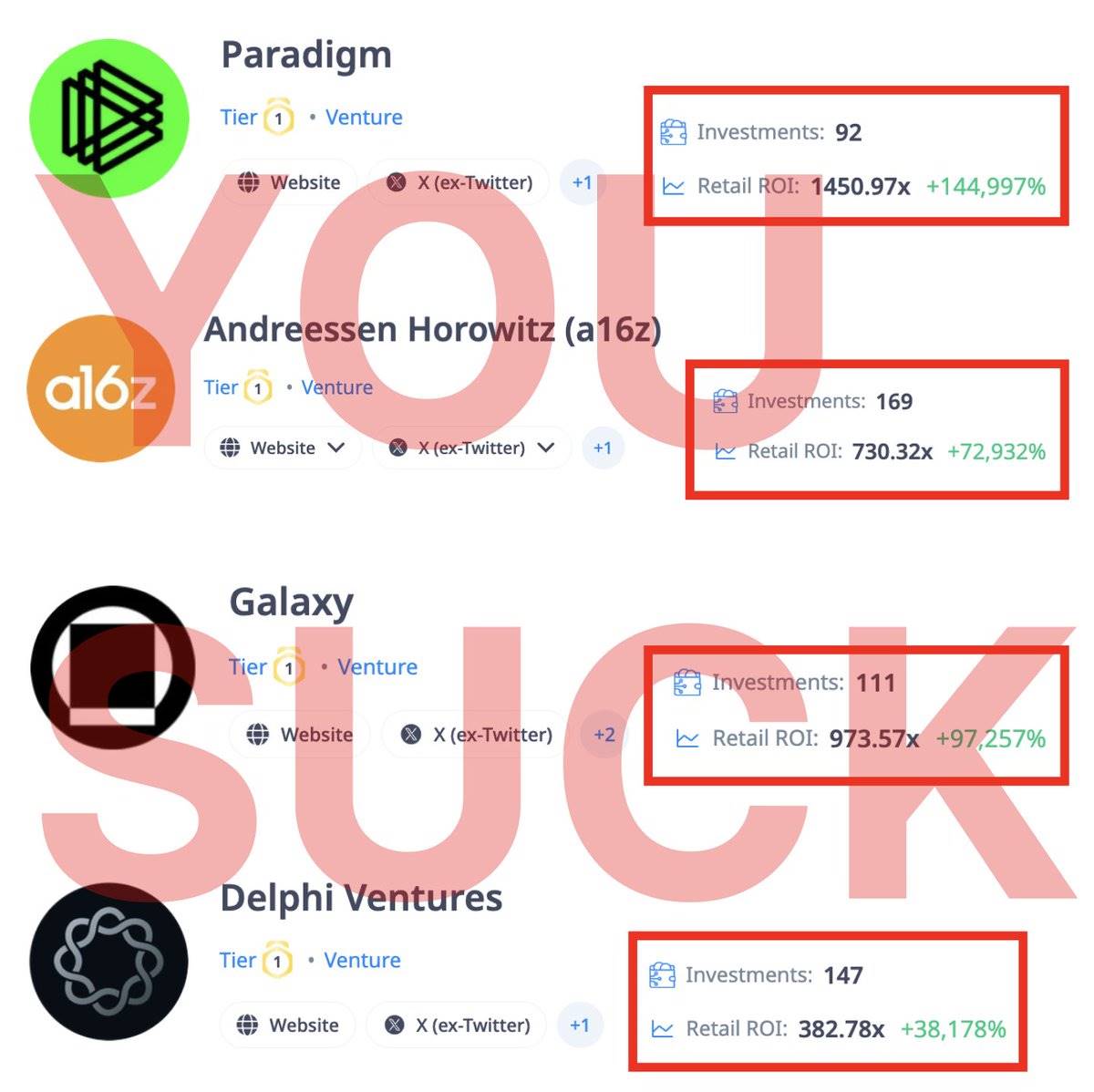

You were deceived by venture capital. Every limit down you bought was the venture capital cashing out to make huge profits.

If I hadn't figured out their tricks, I would have lost nearly $300,000 in June!

Everyone only looks at the price of a token when evaluating it, forgetting about the market cap and token unlocking.

This is a mistake.

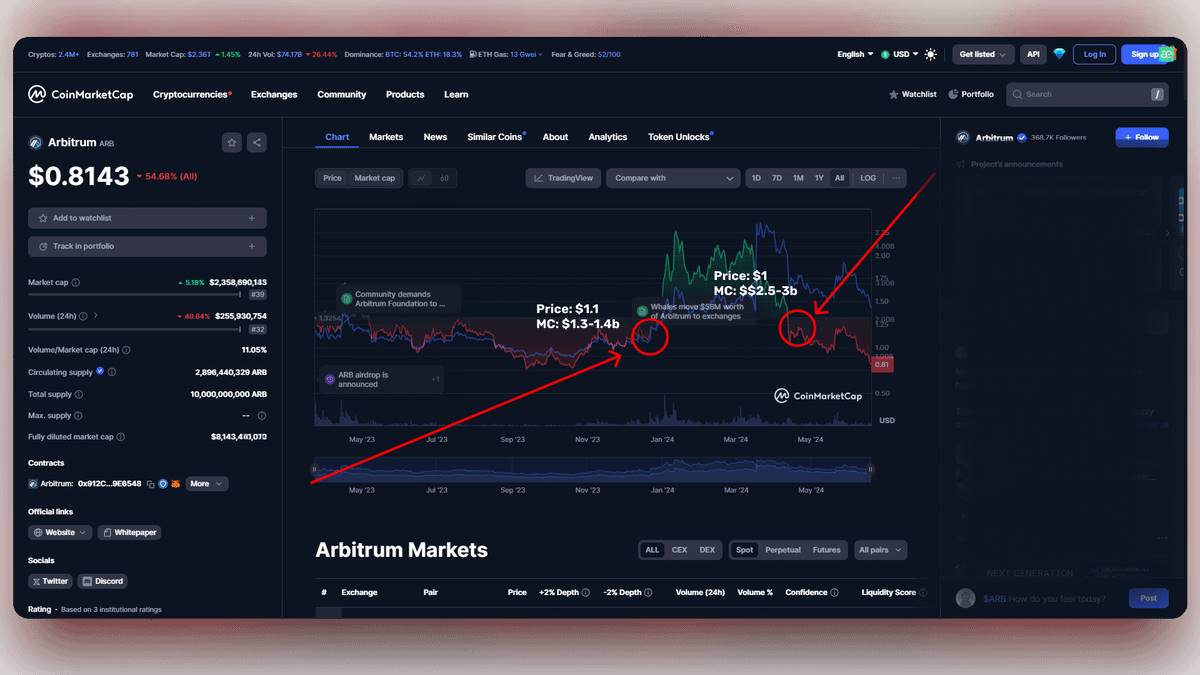

There are many examples, Arbitrum, Starknet, Zksync, etc.

In mid-December, the price of $ARB was about $1.1, with a market cap of $1.3-1.4 billion, and then the price rose to over $2, with a corresponding increase in market cap. By April-May, the price dropped to $1, but Arbitrum's market cap remained at $2.5-3 billion, the same as in December!

How did this happen?

As VC unlocks, the price increases from $1 to $2.

Venture capital firms began selling, causing prices to fall, but people saw every dip as a good buying opportunity.

This causes the price to go up, more tokens unlocked, VCs sell, and retail investors buy. That’s how it works.

Feeding a bunch of people is a complex task. That’s why projects allocate airdrops themselves, manipulate prices, and play with unlocks. Starknet is a good example, where the price is gradually decreasing as the unlocks are going on.

What conclusions can we draw from this?

Before buying any tokens, please review the unlocks and token economics.

Check the Market Cap Ratio (MCap) and its history.

Analyze and logically evaluate whether it is worth buying a specific token.

In today’s market, it is quite risky and difficult to make a decent and consistent profit on regular Altcoin. Currently, memes are performing much better than regular coins.