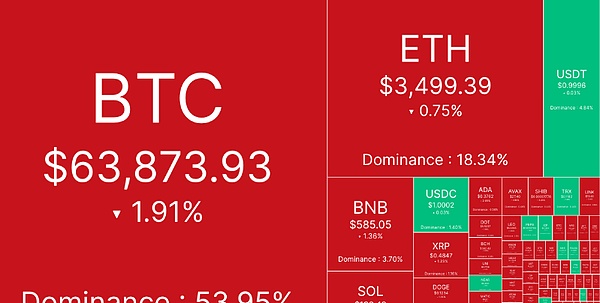

Crypto markets were slightly negative on Friday, with Bitcoin falling below key support at $64,000.

During the overnight trading session, BTC fluctuated in a narrow range between $64,300 and $65,017, and then fell below $64,000 and hit an intraday low of $63,353.50 during the midday trading session of the U.S. stock market. As of press time, it has recovered slightly and the latest trading price is $64,500, a 24-hour drop of nearly 2%.

Altcoin followed BTC in sideways trading, and the top 200 tokens by market value fell more than they rose. The current overall market value of cryptocurrencies is 2.34 trillion US dollars, and Bitcoin's market share is 53.95%.

As for U.S. stocks, as of the close of the day, the Dow Jones Industrial Average initially closed up 0.04%, the S&P 500 fell 0.16%, and the Nasdaq fell 0.18%. Nvidia (NVDA.O) continued to fall 3.22%, and its market value fell back to US$3.1 trillion, lower than Microsoft and Apple.

For more information, please visit Weibo Tuantuan Finance here .

Sentiment “extremely negative”, short-term bearish target is $60,000

Pay attention to the relationship between technology stocks and BTC.

Bitcoin has recently deviated from the Nasdaq’s upward momentum, mainly affected by long-term holders and miners liquidating their positions. In addition, growing concerns about the stagnant nature of ETF inflows have also led to this decoupling. The German government transferred $425 million worth of BTC (probably for sale), which further pressured the market.

Outflows from U.S.-listed spot bitcoin exchange-traded funds (ETFs) have reached their highest level since late April, with $900 million flowing out of these products so far this week, approaching the total net outflow of $1.2 billion in the April 24-May 2 trading sessions.

The lackluster price action has dampened market sentiment. BTC’s sentiment has now entered the “extremely negative” zone for the fourth consecutive week.

Market weakness, coupled with whale accumulation, usually leads to a rebound, which is beneficial to those who are patient.

The US dollar has seen a new round of strength, and the demand for risky assets is gradually decreasing, causing Bitcoin to fall continuously from its intraday high. Continuous low tests such as the 50-day moving average have brought opportunities for bears, and the next target may be $60,000.

Continue to fall or breakout?

If this is indeed our bottom, we should see a breakout in a day or two at most.

If we break out from here, we will find ourselves in the 'dream long' zone, and if we manage to reach that zone, that is when a full reversal is most likely to occur.

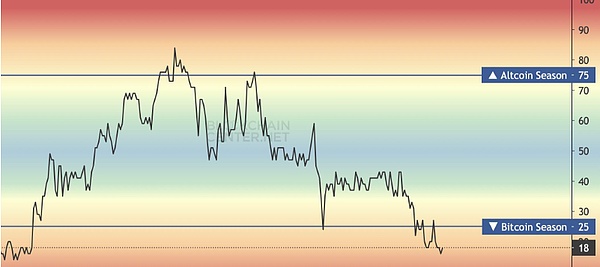

The current trend is very similar to the trend in 2017, which shows that large fluctuations in Bitcoin and Altcoin season are inevitable, but patience is key. Bitcoin season seems to be very close to bottoming out and Altcoin season is about to begin.

Yesterday, the lower resistance level was strongly rejected, leading to further declines today. Bitcoin is not ready to end the downtrend in June. But once Bitcoin is ready to reverse upward, this is still a descending trendline to watch for if it is broken.

It is worth noting that the current BTC price has only retreated less than 15% from the all-time high of $73,000 set in March. In the eyes of BTC bulls, this small pullback and consolidation period is expected and healthy before aiming at the $100,000 mark. Depending on how the situation breaks out, this may be a major turning point for Bitcoin.

Crypto options market data shows that traders maintain a long-term bullish outlook. Call options expiring in June have strike prices of $65,000, $68,000 and $70,000, call options expiring in July have a strike price of $110,000, and call options expiring in December have a strike price of $95,000.

Therefore, the future is still bright. In the recent market, try to reduce the frequency of short-term trading. If you really enter the short-term market, you should sell it first when you have profit. Don't be in a difficult market at present. If you make money today and don't sell it, you may be trapped tomorrow. Although the spot will always be untied, the utilization rate of funds will be greatly reduced. You must always keep bullets in your hand, so that once the market reverses, you will be able to arrange it with ease.

Later, I will bring you analysis of leading projects in other tracks. If you are interested, you can click to follow. I will also organize some cutting-edge consulting and project reviews from time to time. Welcome all like-minded people in the crypto to explore together. If you have any questions, you can comment or private TTZS6308. All information platforms are Tuanzi Finance .

I plan to accept five more one-on-one classes at the end, but I won’t accept any more. To be honest, I can’t handle too many. After all, my energy is limited.

Currently, there are basically no good opportunities for retail investors to get on board BTC. The focus is to lay out high-quality copycats in the later stage and strive to achieve an overall return of no less than 10 times this year.