Ethereum (ETH) price is likely to face the impact of not only selling by whales, but also dumping by all investors.

The resulting price impact could push the second-generation cryptocurrency to multi-week lows.

Skeptical Ethereum Investors

Ethereum price recently lost a key support line due to widespread market signals and widespread pessimism among Ethereum holders. The biggest sign can be seen in the whales' behavior.

Whales tend to have the greatest influence on assets because they have the largest wallets. However, in the case of Ethereum, whales do not seem to have high expectations for profits. Addresses holding between 100,000 and 1 million ETH have sold close to 700 million ETH over the past two weeks.

Selling $2.322 billion worth of volume reduced their total holdings to 20.26 million ETH. Whales are well known in bear markets, so their sudden selling raises concerns.

Read more: How to invest in Ethereum ETF?

Second, sales volume by individual investors also appears to have surged.

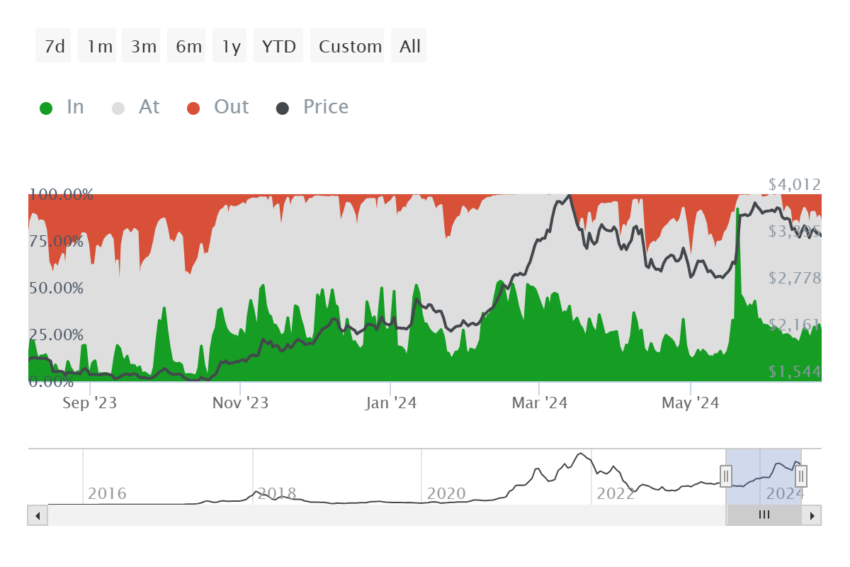

If we observe active addresses by profitability, we can see that approximately 25% of users are profitable. The most likely reason they transact on the network is to reserve profits.

If this indicator is below 25%, the probability of Ethereum hodlers selling is rather low . However, if the indicator crosses a threshold, investors may try to capture all possible profits before the price falls further.

Therefore, Ethereum may face a sell-off from these investors.

Ethereum Price Prediction: Prepare for a Rebound

The price of Ethereum is moving within a descending wedge, a technical pattern known as a bullish reversal signal. This puts the altcoin's potential target well above $4,000. But even in a bull market, this won't happen.

However, the bullish signal could counter the aforementioned bearish signal and suggest a period of time when Ethereum is bottoming. A sideways move could limit the altcoin below $3,500 as well as prevent a decline.

Read more: Ethereum (ETH) price prediction 2024/2025/2030

However, if the price of Ethereum fails to follow a bullish pattern , it could fall below $3,000. This could nullify the potential of a rally and magnify investors' losses.