Bitcoin (BTC) spot exchange-traded funds (ETFs) have seen significant outflows of $1.13 billion over the past seven trading days.

This situation has led to growing concerns among investors and traders about Bitcoin's stability and future prospects.

Background to Spot Bitcoin ETF Outflow: Changes in Market Sentiment and Dynamics

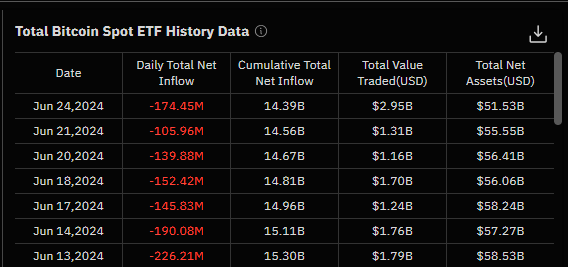

According to SoSo Value data, there wereoutflows from Bitcoin spot ETFs from June 13 to June 24. Grayscale Bitcoin Trust (GBTC) and Fidelity Wise Origin Bitcoin Fund (FBTC) were the biggest contributors to these large outflows, with $90 million and $35 million outflows, respectively, as of June 24.

Read more: What is a Bitcoin ETF ?

Cryptocurrency research firm 10x Research notes that the current ETF selling stands in sharp contrast to the bullish buying driven by institutional Bitcoin adoption in February and March. Currently, the market is reflecting bearish sentiment with ETF selling having a significant impact on market confidence and trading behavior as institutions potentially exit the market.

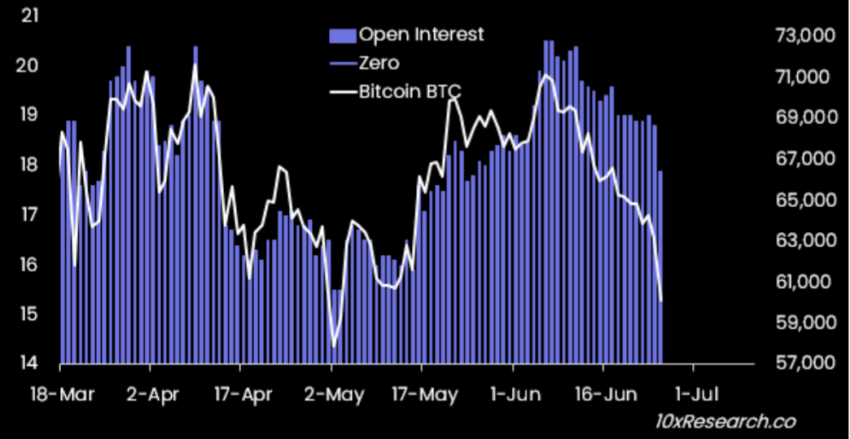

This change is evident in the behavior of many multi-strategy hedge funds . These funds, which previously bought Bitcoin ETFs and sold Bitcoin futures on the Chicago Mercantile Exchange (CME), are now unloading their positions. This decision, as annual funding yields have fallen below 10%, is reflected in a decline in open interest in Bitcoin CME futures that matches the scale of selling in Bitcoin spot ETFs.

Additionally, institutional futures speculative trading activity through ETFs has expanded funding rates. Institutions have adopted a delta-neutral strategy, buying ETFs and selling futures to lock in returns.

Arbitrage funds, which account for 30-40% of the $14.2 billion in Bitcoin ETF inflows, have traditionally utilized a delta-neutral strategy of buying Bitcoin spot and selling futures. Current market conditions have prompted a re-evaluation of this strategy, reflecting broader changes in institutional behavior and market sentiment.

Bitcoin ETF buyers remain flat due to market price decline

10x Research also noted concerns about excessive bullish sentiment toward the Ethereum spot ETF, especially amid weak Bitcoin ETF inflows. These concerns are further amplified by the fact that the average entry price for Bitcoin ETF buyers remains flat at $60,000 to $61,000.

The continued outflows from these ETFs are consistent with Bitcoin's current price action. On June 24, the price of Bitcoin plummeted from $64,076 to $59,495, a decline of approximately 7%. According to 10x Research, several factors influenced this sell-off, including Mt. Gox , the German government's sell-off , Bitcoin miners, ETFs, and OG wallets.

“Hypothetically, that’s $16 to $18 billion, which is similar to the annual Bitcoin ETF inflows,” says Markus Thielen of 10x Research.

10x Research has also identified several sell signals for Bitcoin. These signals include price range indicators that predict significant volatility and decline. These factors suggest that a deeper decline could occur before a rebound from lower levels.

However, 10x Research points out that Bitcoin is currently severely oversold. Additionally, the greed and fear indices are at one of their lowest levels, which often indicates a market bottom. This situation creates a bullish sentiment among cryptocurrency influencers and recommends buying in declining markets.

Read more: Bitcoin (BTC) price prediction for 2024/2025/2030

Despite significant outflows from Bitcoin spot ETFs and the current BTC price situation, several institutional investors remain bullish on the cryptocurrency. Earlier this week, companies such as MicroStrategy and Japanese company Metaplanet announced significant Bitcoin purchases. Additionally, Hong Kong's Bitcoin spot ETF saw its Bitcoin volume increase from 3,842 BTC on June 21st to 3,911 BTC on June 24th.