As July approaches, the spot Ethereum ETF, which received partial approval from the U.S. Securities and Exchange Commission (SEC) on May 23, is set to officially launch. Many investors wonder whether the price of Ethereum (ETH) will follow Bitcoin (BTC)'s reaction to related financial products in January.

But the answer lies in the future, which could begin in just a few days. While we wait, on-chain analytics provides actionable insights that can predict whether altcoins are following expected patterns.

Rising expectations among altcoin investors

Modifications to registration documents are one of the factors that have delayed live trading of the Ethereum spot ETF. But in a recent interview , SEC Chairman Gary Gensler confirmed that things are going smoothly.

Additionally, the product is expected to be launched on July 4, according to anonymous sources in the regulator .

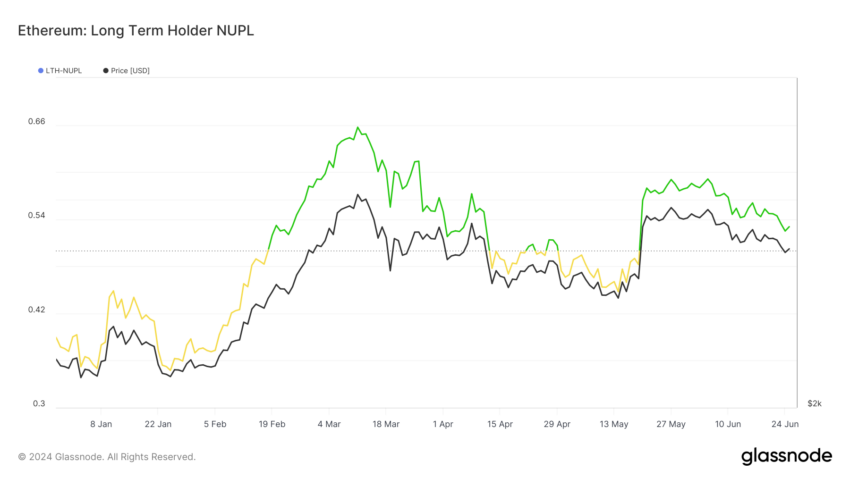

Since development, BeInCrypto has monitored holder behavior on Ethereum. According to survey results, Ethereum holders have strong trust in the cryptocurrency. We discovered this after investigating LTH-NUPL provided by the analytics platform Glassnode.

This indicator stands for Long Term Holder Net Unrealized Profit/Loss. It measures the behavior of holders who have owned a cryptocurrency for more than 155 days. As you can see in the chart below, different colors exist for different emotions.

Read more: Ethereum ETF explained: What it is and how it works

Red represents surrender and orange represents fear. Yellow represents optimism and blue represents greed. Currently, Ethereum’s LTH-NUPL is in the belief (green) zone. In this case, long-term investors are confident about future price increases.

However, Ethereum has fallen 12.75% over the past 30 days and is trading at $3,365. In situations like these, overall sentiment is expected to be weak. So the much-anticipated development appears to be the cause as perceptions tilt towards confidence. If this sentiment continues until the launch date, it could boost demand for Ethereum.

Ethereum is taking Bitcoin’s place

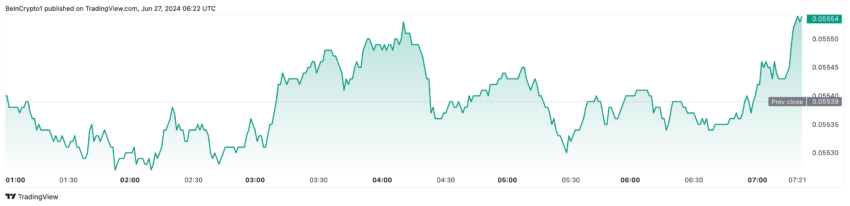

Meanwhile, awareness alone cannot drive prices up. Therefore, we evaluate another indicator that can influence the price of altcoins: the ETH/BTC ratio. This ratio tells us whether Bitcoin is superior to Ethereum or vice versa. Specifically, a high ETH/BTC ratio means that Ethereum is performing better than Bitcoin.

However, a lower ratio means that BTC is performing better than Ethereum. As of this writing, this rate stands at 2.33%, up 0.055 over the past seven days. This means that currently you can purchase 0.055 BTC with 1 Ethereum.

If this rate continues to rise, Bitcoin's market dominance will decline. Therefore, the price of Ethereum could rise even further. Considering Bitcoin's performance, its price rose 56.95% in less than two months after approval.

If Ethereum makes a similar move, it would be worth $5,308 by the end of the third quarter (Q3). Now let’s look at the short-term potential of altcoins.

Ethereum Price Prediction: The Price Is Not Set

On the daily chart, the 20 (blue) and 50 (yellow) EMAs are located above the Ethereum price. EMA stands for exponential moving average. This is an indicator that measures the direction of a trend over a specific period of time.

If the EMA is below the price, it indicates that bulls are defending the price. However, if this indicator is higher than the price, it gives credence to the decline. If conditions remain the same, Ethereum could fall to $3,278. This position also shows that Ethereum has not yet been priced in.

Simply put, this means that the economic impact of upcoming developments is not yet reflected in current market prices. Therefore, we can assume that there is still potential for the value to rise.

However, both EMAs are close to reaching the same point. If this happens , the price of Ethereum will move sideways and is likely to bottom out between $3,355 and $3,610. However, if the 20 EMA overturns the 50 EMA (bullish crossover), the altcoin could enter the $3,866 resistance level.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

In a very bullish scenario, Ethereum could replicate its performance between February and March and reach $4,059 before the end of July.

Additionally, one of the main concerns for investors is the value of the funds coming in. Many analysts are unsure whether the Ethereum ETF will be able to attract the same trading volume as Bitcoin, comments online said.

However, previous forecasts had projected monthly inflows of $569 million . If Ethereum matches this volume, a rally could occur that surpasses the altcoin's all-time highs in the short term.

However, if the reaction to news of the development is “all talk and no action,” the price of Ethereum could plummet, falling as much as 10%.