Compiled by: TechFlow

Major fundamental flaws in crypto are showing up and this is the primary reason for Altcoin’ underperformance in this cycle. There seems to be no solution at the moment and I dug into all the data and what I found is shocking.

The purpose of this post is to provide you with more insight into the biggest question in crypto. It will explain exactly how we got here, why prices behave the way they do, and the path forward.

Let me take you back to 2021 , when the market was in a frenzy. New liquidity was pouring into the market rapidly, mainly driven by new retail investors. The bull market seemed unstoppable, and risk appetite was at its highest point.

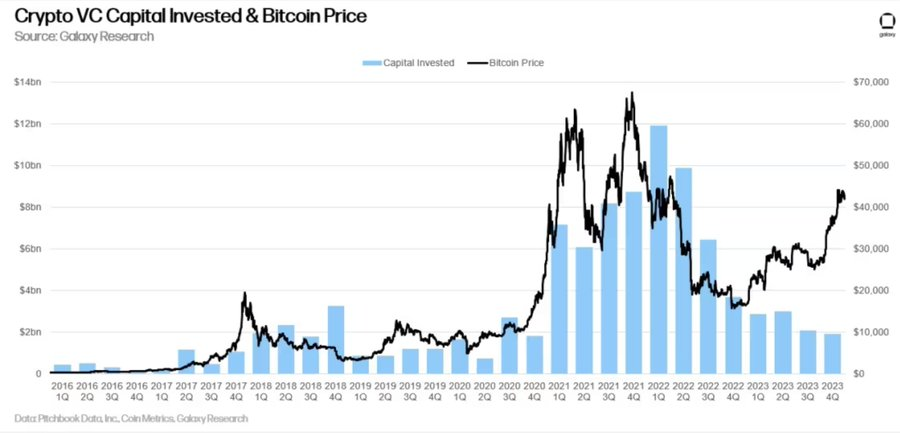

During this time, venture capital firms began pouring unprecedented amounts of money into the sector.

Founders and VCs are opportunists just like retail investors.

Increased investment is a natural capitalist response to market conditions.

For those who don’t know about the private market, in simple terms, VCs invest money into projects at an early stage (usually 6 months to 2 years before launch), usually at a low valuation (with vesting). This investment helps to fund the project to develop, and the VCs often provide other services/connections to help the project get off the ground.

Interestingly, Q1 2022 was the highest quarter ever for VC funding ($12 billion). This marked the beginning of the “bear market” (yes, VCs got their timing right).

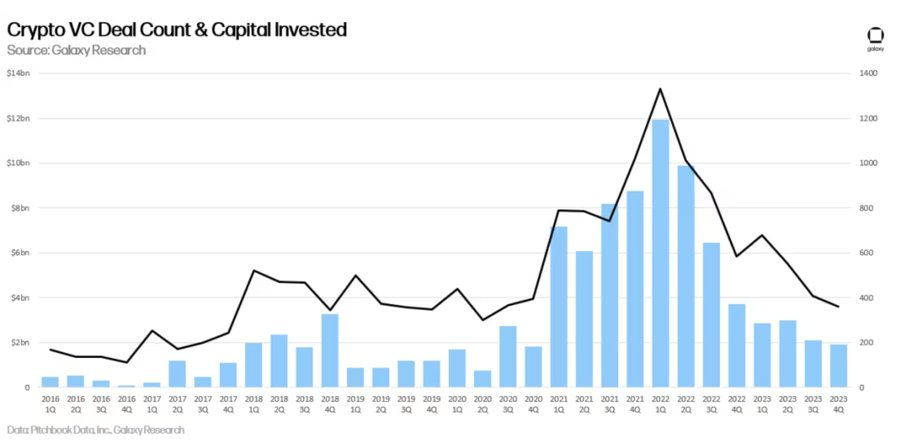

But remember, VCs are just investors, and the increase in the number of deals comes from an increase in the number of projects being created.

The low barrier to entry, coupled with the high upside potential presented by cryptocurrencies in a bull market, makes Web3 a hotbed for new startups. New tokens are emerging one after another, causing the total number of cryptocurrency tokens to triple between 2021 and 2022.

But soon after, the party stopped. A chain of contagion, starting with LUNA and ending with FTX, completely destroyed the market. So what did these projects that raised all this money earlier this year do?

They delayed, and delayed again and again. Launching a project in a bear market was a death sentence, and low liquidity + bad sentiment + lack of interest meant that many new bear market launches were dead on arrival. So the founders decided to wait for a reversal. It took a while, but finally — in Q4 2023, they did. (Remember, the biggest peak in venture funding was in Q1 2022, 18 months earlier).

After months of delays, they could finally launch their tokens under better conditions, and they did, one after another.

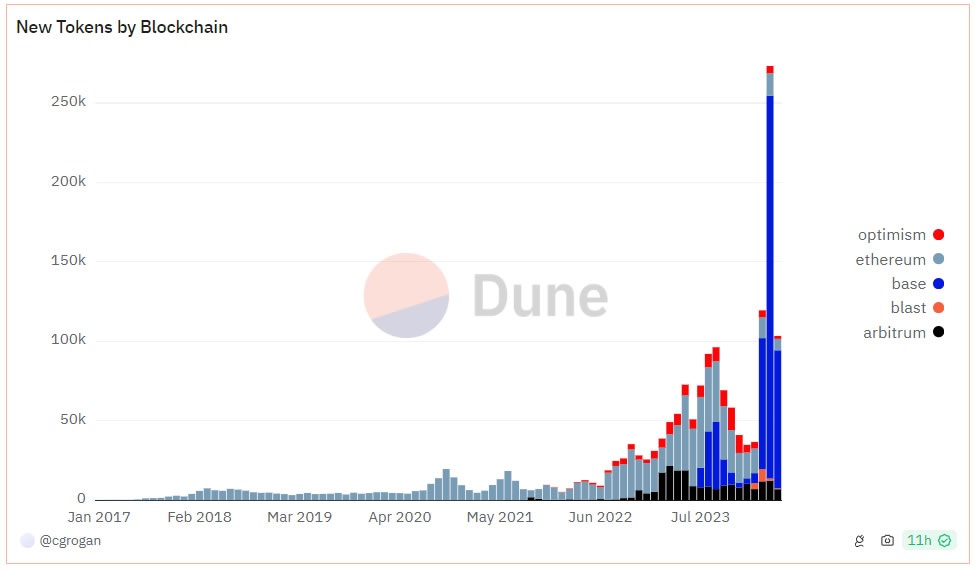

It’s not just old projects that are deciding to launch. Many new players are also seeing the new bull market conditions as an opportunity to launch projects and make a quick buck. As a result, the number of new launches in 2024 is at an all-time high.

Here are some incredible statistics. Since April, over 1 million new cryptocurrency tokens have been issued. (Half of these are meme coins created on the Solana network).

You could say these numbers are inflated by the ease of deploying meme coins on-chain. That’s true, but it’s still a crazy number.

For more accurate numbers, see the chart below from Coingecko, which excludes many smaller meme coins.

We now have 5.7 times as many cryptocurrency tokens as we did at the peak of the 2021 bull run.

This is a big problem and one of the main reasons why cryptocurrencies have been struggling this year despite $BTC setting new all-time highs.

Why?

Because the more tokens are released, the greater the cumulative supply pressure on the market, and this supply pressure is "cumulative".

Many 2021 projects are still being unlocked, and supply pressure continues to accumulate in each subsequent year (2022, 2023, 2024).

Current estimates suggest that there is approximately $150-200 million of new supply pressure per day. This continued selling pressure has had a huge impact on the market.

Think of token dilution like inflation . If the government prints dollars, this will correspondingly reduce the purchasing power of the dollar relative to the cost of goods and services.

The same is true in cryptocurrencies. If you print more tokens, this will correspondingly reduce the purchasing power of the cryptocurrency relative to other currencies, such as the US dollar.

Altcoin decentralization is basically the cryptocurrency version of inflation . It’s not just the number of tokens issued, the low FDV/high circulation mechanism of many new launches is also a big problem.

Because this leads to a) high levels of fragmentation, and b) continued supply pressure.

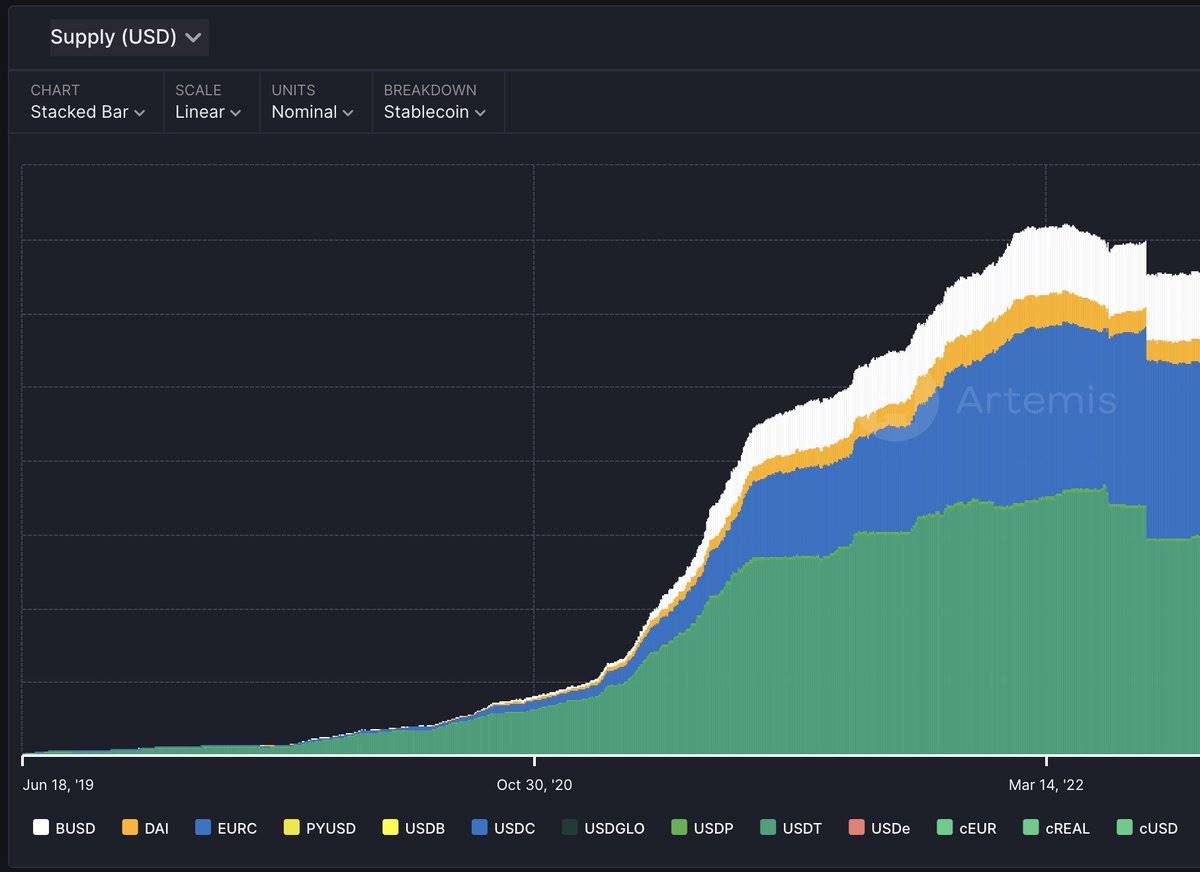

All this new launch and supply would be acceptable if there was new liquidity entering the market. In 2021, there were hundreds of new launches every day, and everything was going up. However, that is not the case now. So we find ourselves in the following situation:

A) There is not enough new liquidity entering the market;

B) Huge dilution/selling pressure from unlocking.

Now that you know what the problem is, let's discuss the issue at hand.

So how can things get better? First, I must emphasize the need for more liquidity in cryptocurrencies.

There are too many VCs, relatively speaking. The imbalance in the private market is one of the biggest (and most damaging) problems in crypto, especially compared to other markets like stocks and real estate. This imbalance becomes a problem because retail investors feel like they can’t win. If they don’t feel like they can win, they won’t play the game.

Why do you think meme coins have dominated this year? This is the only way retail investors feel like they have a fighting chance.

Since price discovery for many high FDV tokens happens in the private markets, retail investors don’t have the opportunity to earn a 10x, 20x, or 50x return like VCs do.

In 2021, you can buy a launchpad token and get a 100x return. This round, tokens are launched at market caps of 5 billion, 10 billion, 20 billion plus, and there is no room for price discovery on the open market.

Then they start unlocking and the price keeps going down. I don't have an answer to this problem. It's a complex problem with a lot of players who can make a difference.

However, I have some ideas here.

Exchanges can implement better token distribution

Teams can prioritize community allocations and provide a larger pool for real users

A higher percentage could be unlocked at launch (perhaps with measures like tiered sell-off taxes implemented to prevent sell-offs).

Even if insiders don’t force change, eventually the market will. Markets always adjust and correct themselves, and the weakening of the effectiveness of current meta data and public reaction may change the situation in the future.

At the end of the day, a friendlier retail market is good for everyone. Good for projects, good for VCs, good for exchanges, and good for more users.

Most of the current problems are symptoms of short-sightedness (and the fact that the industry is still in its infancy). Also, on the exchange side, I would also like to see exchanges be more pragmatic. One way to offset the massive new listings/dilution is to be equally ruthless with delistings. Let’s clear out the 10k dead projects that are still sucking up precious liquidity.

The market needs to give retail investors a reason to come back, which would solve at least half of the problem. Whether it's a $BTC rally, $ETH ETF, changes in the macro environment, or killer apps that people actually want to use. There are still many potential catalysts.

Hopefully I was able to shed some light on what has been going on for those who are confused by the recent price action. Fragmentation is not the only issue, but it is certainly a major one and something that needs to be discussed.

Welcome to TechFlow TechFlow official community

Telegram subscription group:

Official Twitter account:

Twitter English account: