In the cryptocurrency industry, interest in exchange-traded funds (ETFs) continues to grow. GSR, a leading cryptocurrency market research firm, says Cardano (ADA) and Ripple's XRP may not receive ETF approval anytime soon, but Solana (SOL) is on the verge of a major breakthrough.

GSR’s comprehensive analysis assumes a cryptocurrency-friendly regulatory approach in the United States. In this case, ETF approval largely depends on two factors: decentralization and market demand. GSR also said it has a long position in Solana.

How Solana Beats Other Altcoins in ETF Approval Potential

According to GSR, Solana excels in both criteria, putting it far ahead of other altcoins. The blockchain platform demonstrates a gradual move towards decentralization with the upcoming Firelancer client. It is also capturing significant market demand, as evidenced by its positive decentralization and demand scores.

Solana’s decentralization plan is noteworthy. The introduction of Firelancer to diversify the network client base is an important step toward reducing central control and strengthening network resilience. This strategic move reflects the spirit of decentralization that regulators find attractive.

Read more: How to Buy Solana (SOL) and Everything You Need to Know

Market demand for Solana is equally attractive. The asset has consistently demonstrated strong market performance, high trading volume, indicators of investor confidence, and sustained demand potential. Solana could therefore be a strong candidate for an ETF, especially when potential inflows play a pivotal role in asset selection.

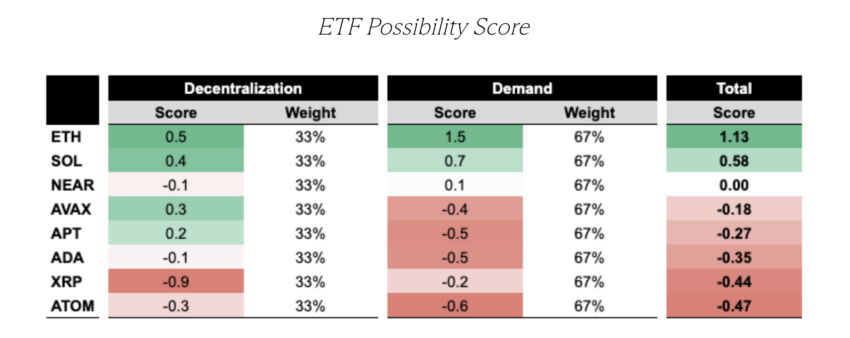

Taking into account the decentralization score and demand score, GSR calculated an indicator called the ETF Likelihood Score. Ethereum (ETH) had the highest ETF likelihood score, followed by Solana and Near Protocol (NE AR).

The remaining altcoins, including Avalanche (AVAX ), Aptos (APT ), ADA, XRP, and Cosmos (ATOM), recorded negative ETF likelihood scores.

“All in, the results clearly suggest that Solana will be next if additional digital asset spot ETFs are permitted in the U.S.,” GSR wrote .

GSR's analysis also takes a closer look at the potential impact of ETF approval on Solana's price. Similar to Bitcoin's ETF journey that triggered a price surge, Solana could experience a similar rise. GSR presents several scenarios, ranging from a conservative estimate of a 1.4x price increase to an optimistic 8.9x increase under favorable conditions.

“We can adjust our relative flow estimates for the relative size of Solana and the 2.3x increase in Bitcoin from spot ETFs under various scenarios. This could increase Solana by 1.4x in the bearish flow scenario, 3.4x in the baseline scenario, and 8.9x in the lightning scenario,” predicted GSR analysts.

The recent application by asset manager VanEck for a Solana spot ETF further supports Solana's ETF prospects. This pioneering step demonstrates the asset’s growing attractiveness to institutional investors.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

Matthew Siegel, head of research at VanEck, emphasized that Solana matches the characteristics of existing digital products.

“Solana’s decentralized nature, high usability, and economic feasibility are consistent with those of other existing digital products, making SOL a valuable product with use cases for investors, builders, and entrepreneurs looking for an alternative to monopoly app stores. It reinforces our belief that it can be done,” Siegel said .