The USD/JPY exchange rate is the most important macroeconomic indicator. I wrote in my previous article, The Easy Button, that something must be done to make the yen more resilient. The solution I proposed was that the Fed could swap unlimited amounts of newly printed dollars with the Bank of Japan for yen. The Bank of Japan would then be able to provide the Ministry of Finance of Japan with unlimited dollar firepower, allowing them to buy yen on the global foreign exchange market.

While I still believe in the validity of this solution, the central bank crooks responsible for the “Group of Fools” (aka the G7) seem to have chosen to convince the market that the interest rate differential between the Yen and the USD, EUR, GBP and CAD will narrow over time. If the market believes this future state, it will buy the Yen and sell all other currencies. Mission accomplished!

For this magic to work, the G7 central banks, whose policy rates are “on the high side”, must lower their rates.

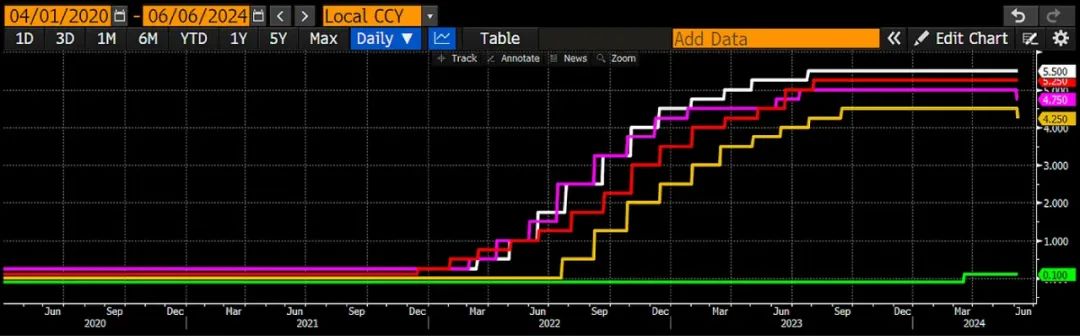

It is worth noting that the Bank of Japan’s policy rate (green) is 0.1%, while other countries have policy rates of 4-5%. The interest rate differential between the domestic currency and foreign currencies fundamentally drives the exchange rate. From March 2020 to early 2022, countries played the same game. As long as you stay at home with a cold and inject mRNA heroin, all of you can get free dollars. When inflation manifested itself in such a huge way that the elites could no longer ignore the pain and suffering of the common people, the G7 central banks all actively raised interest rates.

The Bank of Japan cannot raise interest rates because it owns more than 50% of the Japanese government bond market. As interest rates fall, JGB prices rise, making the Bank of Japan appear solvent. However, if the Bank of Japan allows interest rates to rise, causing its JGB holdings to fall, the highly leveraged central bank will suffer catastrophic losses. I did the scary math for you in The Easy Button.

That is why if Yellen, the “bad woman” calling the shots in the G7, decides to close the spread, the only option is to lower the central bank’s “high” policy rate. In orthodox central bank thinking, lowering interest rates is a good thing if inflation is below target. What is the target?

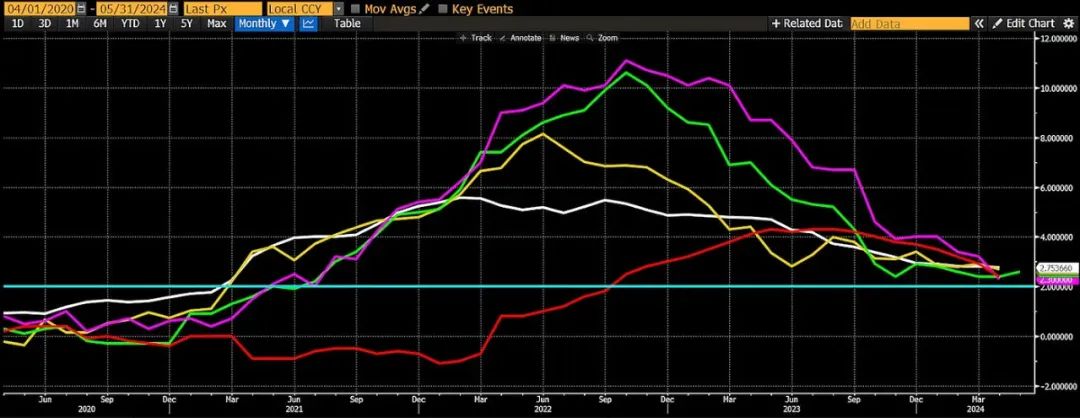

For some reason, and I don't know why, the G7 central banks all target 2% inflation, regardless of differences in culture, growth, debt, demographics, etc. Is inflation currently on track to break 2%?

Each colored line represents a different G7 central bank's inflation target. The horizontal line is 2%. No G7 government has ever published manipulated and dishonest inflation statistics below target. It looks to me like G7 inflation is forming a local bottom in the 2-3% range before exploding higher.

Given this chart, orthodox central bankers would not cut rates from current levels. Yet this week, the Bank of England and the European Central Bank cut rates even as inflation was above target. This is odd. Is it financial turmoil that is causing the need for cheaper money? No.

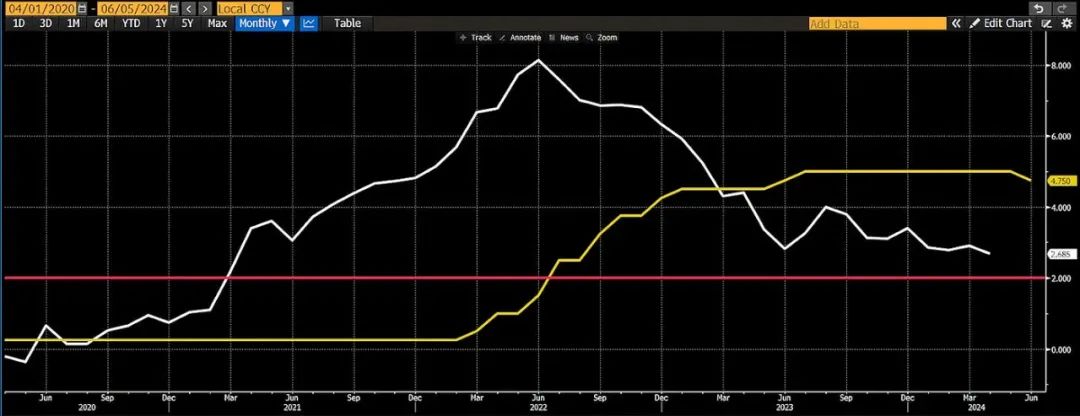

The People's Bank of China cut its policy rate (yellow), while inflation (white) was above target (red).

The ECB cuts its policy rate (yellow) while inflation (white) is above target (red).

The problem is the weak yen. I believe that "bad woman" Yellen has stopped the rate hike show. Now is the time to start preserving the US-led global financial system. If the yen does not strengthen, the Chinese will unleash the dragon of RMB devaluation to match the super cheap yen of Japan, their main export competitor. In the process, US Treasuries will be sold off, and if this happens, Pax Americana will become a child's play.

Next step

The G7 will meet in a week. The communique released after the meeting will be of great interest. Will they announce some kind of coordinated currency or bond market manipulation to strengthen the yen? Or will they remain silent but agree that everyone except the Bank of Japan should start cutting rates? Stay tuned!

The big question is whether the Fed will start cutting rates so close to the U.S. presidential election in November. Typically, the Fed does not change course so close to an election. However, typically, the favored presidential candidate does not face potential jail time, so I am prepared to be flexible in my thinking.

If the Fed cuts rates at their upcoming June meeting and their preferred doctored inflation measure is above target, USD/JPY will be much lower, which means a stronger yen. I don't think the Fed is ready to cut rates just yet, as a slow-burning Biden is being questioned in the polls over rising prices. Understandably, the average American cares more about whether their vegetables are more expensive than the cognitive abilities of the vegetables running for reelection. To be fair, Trump is also a vegetable, as he likes to watch Shark Week while munching on McDonald's fries. I still think a rate cut would be political suicide. My base case is for the Fed to stay on the sidelines.

As these second-rate bastards sit down to their taxpayer-paid dinner on June 13, the Fed and the Bank of Japan will have held their June policy meetings. As I have said before, I do not expect the Fed and the Bank of Japan to change monetary policy. The Bank of England will meet shortly after the G7 meeting, and while the consensus is that they will keep their policy rate steady, I think they will surprise the market with a cut, given the rate cuts by the BoE and the ECB. The BoE has nothing to lose. The Conservatives will be thumped in the next election, so there is no reason to defy the orders of their former colonial rulers to curb inflation.

Exit the depression zone

The June central bank fireworks, which kicked off this week with rate cuts from the Bank of England and the European Central Bank, will push cryptocurrencies out of the northern hemisphere summer doldrums. This is not the base case I expected. I thought the fireworks would start in August, around the time the Fed holds its Jackson Hole symposium. That is usually the venue for sudden policy changes as the fall season begins.

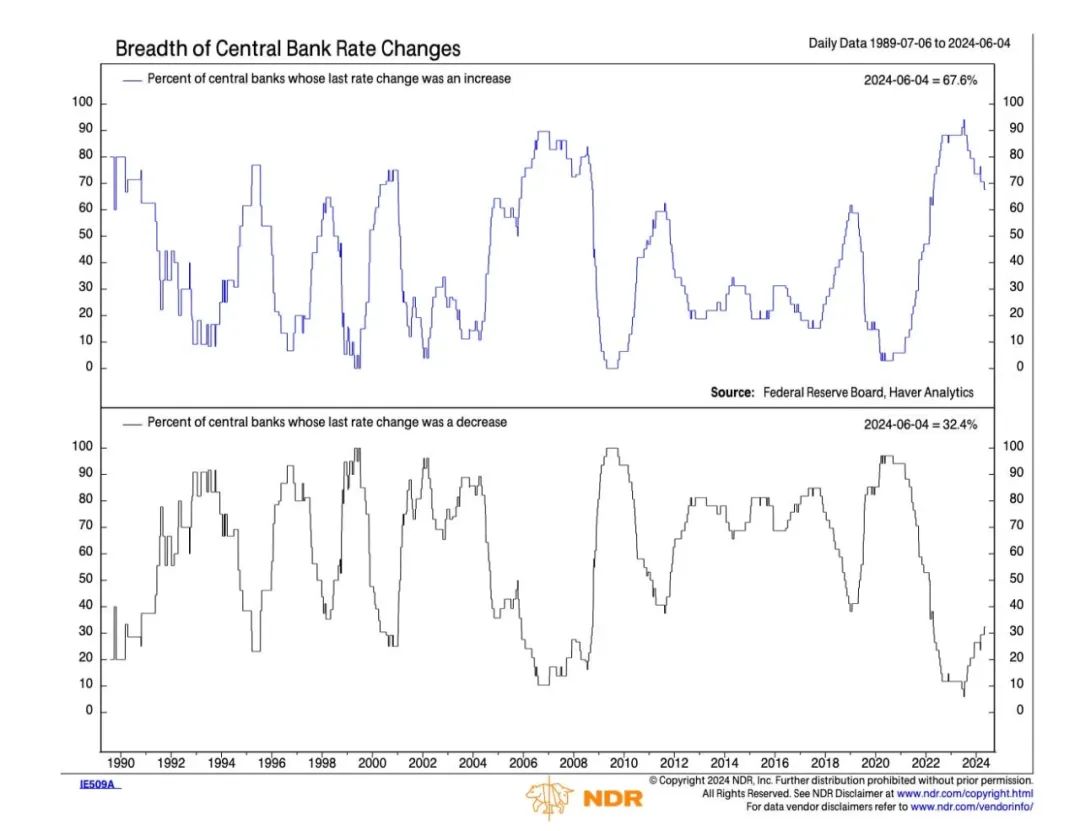

The trend is clear. Central banks on the brink are starting an easing cycle.

We know how to play this game. We’ve been playing this damn game since 2009 when our savior Satoshi Nakamoto gifted us the weapons to defeat the demons of TradFi.

LongBitcoin , then Shitcoin.

The macro picture has changed compared to my baseline. So my strategy should change accordingly. For the Maelstrom portfolio project, they asked me if I would launch their token now or later. I said, let’s just fucking do it!

It is earning a nice APY on my excess liquidity crypto synthetic USD cash, aka Ethena's USD (USDe). Of course, I'll tell you what these are after I buy them. But suffice it to say, the crypto bull market is waking up and about to skin the profligate central bankers.