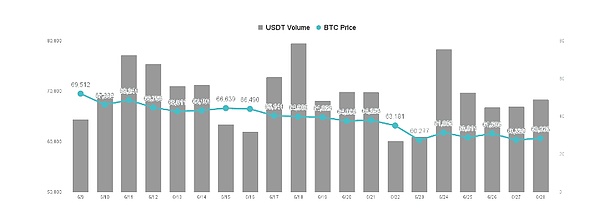

The crypto market was not good last week. Bitcoin rebounded from $60,000 to $62,000 but failed to counterattack and then fell below the key support level of $60,000. The weekly decline widened to 5.7%. Under the strong selling pressure of the market, even though Ethereum had the theme of spot ETF to enhance its attractiveness, its price still did not break through $3,500. The weekly decline narrowed to about 3.5% compared with Bitcoin, and the overall buying sentiment of the market was low.

For more information, please visit Weibo Tuantuan Finance here .

The low buying sentiment can be attributed to three reasons, the largest of which is the selling by long-term investors. The transfer of funds on the chain has been quite frequent in the past week, and most of them are net transfers to crypto exchage. Investors are looking at the Mt. Gox crypto exchage, which is about to start repaying Bitcoin debts. Since its impact on the market is still unknown, many long-term investors are realizing profits over the years, and the current market selling pressure is therefore quite heavy.

The second is that miners are upgrading their equipment. The second quarter of this year is the delivery wave of mining equipment. Bitcoin Mainland's latest Antminer has been favored by many mining farms, and they have purchased mining machines from it to upgrade their computing power. In response to the sharp drop in revenue after the Bitcoin halving, the future will be a computing power war between mining farms. Since mining machines are delivered on a futures and cash basis, miners must sell their Bitcoin inventory to raise cash. It is expected that this wave of deliveries will continue until the middle of next year.

Finally, the least affected is the net outflow of funds from Bitcoin ETFs. There has been no significant net outflow of funds from Bitcoin ETFs in the past week. According to Farside data, it is currently just flat. There is no particularly strong buying or large-scale selling. We would say that the main reason for the recent market weakness is not Bitcoin ETF, but historical burdens and the industry's own funding needs.

According to the current situation, it is a difficult challenge for Bitcoin to rebound strongly to above $70,000 in the short term. Facing the Mt. Gox debt repayment in July, many people are realizing profits and waiting for subsequent pullbacks to enter the market. However, July is also the month when the Ethereum spot ETF will be listed and traded, which makes the overall market outlook more difficult to judge. We believe that Mt. Gox is more of an emotional influence, and the issuance and listing of the Ethereum spot ETF deserves more attention from investors.

Ethereum would be a better choice for layout

Although the current buying momentum in the crypto market is generally lacking and the buying power is not strong, as mentioned above, mining farms, long-term investors and Bitcoin ETFs are all experiencing short-term selling pressure, but the pullback is also a good opportunity for long-term investors to reduce their average holding costs. However, compared to buying Bitcoin, Ethereum may be a better choice. The purpose behind this is to use the funds that fund companies must raise to issue Ethereum spot ETFs to buy and thereby obtain additional gains.

Currently, many financial companies have completed the seed fund stage. The real buying will have to wait until the ETF starts trading in July. After the net inflow of funds into the Ethereum ETF, the fund companies will buy more ETH on the crypto exchage. At this time, Ethereum will have the opportunity to achieve a higher increase than Bitcoin. In addition, Ethereum has completely gotten rid of the doubts about being sold as a security with this ETF and officially obtained the "digital commodity" identity certification from the US regulator, which will be very helpful for the promotion of various Layer-2 applications in the future.

The market also started to rise this morning. Bitcoin reached a high of 63,800, close to 6.4, and Ethereum even broke through 3,500. I wonder if there was a news leak?

In the past, the crypto industry always had compliance concerns about promoting applications on Ethereum, which was considered securities sales, but this time the SEC has given the green light. In the future, companies' concerns about violating laws when launching products and services using Ethereum applications will be greatly reduced. Lowering the compliance threshold will help the entire Ethereum ecosystem to flourish. For example, applications such as Layer-2 payments and NFT creation will have greater development potential.

However, things will not go so smoothly in the short term. Currently, all US funds have gone to AI. Even if the legal compliance barriers of Ethereum are removed, the crypto market will hardly flourish like it did in 2021. But funds will move, and long-term funds will always return to platforms that are more suitable for innovation of small and medium-sized enterprises. Fintech has been silent for a very long time. We believe that Ethereum is an important key to promoting the development of the entire industry as a compliant crypto platform.

In the future, as long as there are innovative applications or airdrops that are successful on Ethereum, they are expected to drive the next wave of Ethereum price increases, just like successful airdrop projects like BNB or Solana can drive the price of native currencies. Assuming that future innovations are concentrated on Ethereum, ETH demand will continue to rise. We are optimistic about the continued development of Ethereum in the medium and long term. For the crypto market to return to a bull market in the near future, we can only wait for the Ethereum ETF to be listed in July and the Fed’s interest rate cut policy in September this year. Long-term investors can increase their holdings during market corrections.

Later, I will bring you analysis of leading projects in other tracks. If you are interested, you can click to follow. I will also organize some cutting-edge consulting and project reviews from time to time. Welcome all like-minded people in the crypto to explore together. If you have any questions, you can comment or private TTZS6308. All information platforms are Tuanzi Finance .

I plan to accept five more one-on-one classes at the end, but I won’t accept any more. To be honest, I can’t handle too many. After all, my energy is limited.

Currently, there are basically no good opportunities for retail investors to get on board BTC. The focus is to lay out high-quality copycats in the later stage and strive to achieve an overall return of no less than 10 times this year.