Bitcoin (BTC) has started the new month strong after a price drop that fell short of expectations for the second quarter of 2024 (Q2). It is trading at $63,255, up 3.11% over the last 24 hours.

Investors will be interested to see whether the coin continues its upward trend or does better. This analysis confirms the possibility of higher prices by the end of July, unless something unexpected happens.

Bitcoin Miners Decrease High Sales Activity

Miners have been one of the factors driving the decline in Bitcoin prices over the past few months. Last April, the rewards for Bitcoin miners who verify transactions on the network were halved.

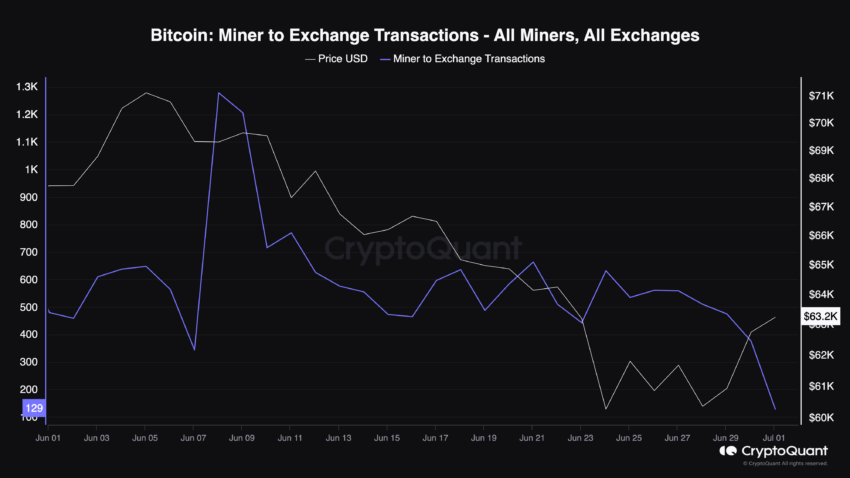

After that, profits declined as operating costs became difficult to cover. As a result, they sold some of their Bitcoin holdings. According to CryptoQuant, there was a surge in miner-to-exchange transactions through June 8.

The miner-to-exchange transaction indicator measures the number of Bitcoin coins transferred from miners’ reserves to exchanges. When this indicator increases, the price of Bitcoin falls. However, a noticeable drop provides stability to the Bitcoin price, with the price either rising or moving sideways.

Read more: 5 Platforms to Buy Bitcoin Mining Stocks After Halving in 2024

There was widespread speculation that this indicator would surge again, but that did not happen as miners appear to have finished distributing . As seen above, only 129 Bitcoins were sent to miners and exchanges.

This is very low compared to June 8 when it was 1,279 BTC. If the value of Bitcoin continues to fall, it could remain above $60,000 until July. In a very bullish scenario, we could see a retest of $65,000-$67,000.

Looking at past trends raises eyebrows

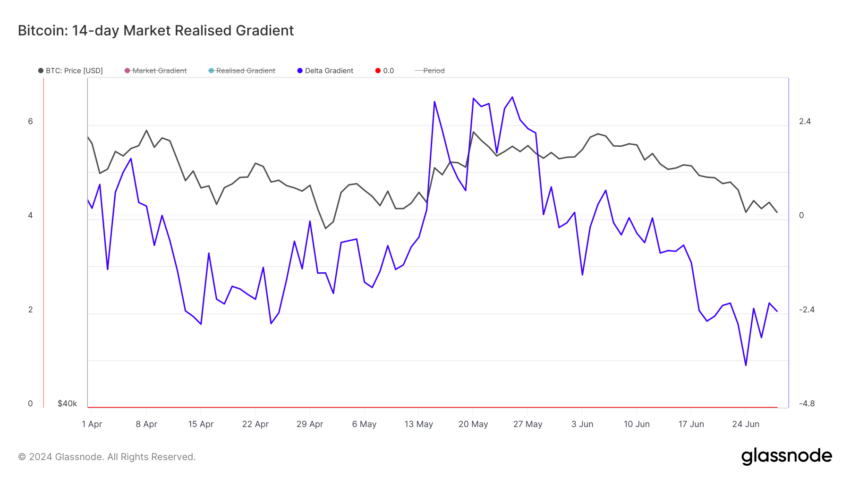

Another indicator supporting the price rise is Bitcoin’s delta gradient. The delta gradient model evaluates the rate of price change relative to the capital flowing into Bitcoin.

It also takes into account the slope of the spot Bitcoin value and realized price. The difference between these two values gives the delta gradient.

If this indicator is positive, it means investors should expect an upward trend within a certain period of time. On the other hand, a negative slope means that returns can be negative.

At press time, the 28-day Bitcoin delta gradient is -1.62, according to data from Glassnode. In general, this is expected to lead to a downward trend for BTC. However, this may not be the case as this is an improvement over the figure of -2.90 a few days ago.

If the above indicators continue to rise, Bitcoin will also rise. Additionally, you can see an increase in the price of Bitcoin when it jumps into the positive area.

Meanwhile, analysts shared their views on this month's performance on social media. For example, Ali Martinez wrote in X that BTC could rebound strongly in July.

Referring to Bitcoin's previous seven-month performance, he explained :

“Historically, if Bitcoin has a negative June, it tends to bounce back strongly in July. In fact, Bitcoin recorded an average return of 7.98% and a median of 9.60% this month.”

BTC Price Prediction: $67,000 or Nothing?

According to the daily BTC/USD chart, the coin has formed a cup and handle pattern. This pattern appears when the price forms a rounded bottom (cup) and later tests a new low, forming a handle.

The cup and handle patterns act as bullish signals and indicate that a bullish breakout may have the strength to continue moving north. Looking at Fibonacci retracements as spot support and resistance levels, if the uptrend continues, BTC could reach $64,966.

From a more optimistic perspective, the Bitcoin price could reach $67,241 before the end of the month. Additionally, the relative strength index (RSI) has also started to rise. A rise in RSI means that Bitcoin is exiting a bear market.

However, to validate the price prediction, the RSI reading must be above the neutral zone of 50.00. In this case, Bitcoin will continue its upward trend and is likely to surpass $64,000 within a few days.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Failure to solidify upward momentum will invalidate the prediction. Traders should also keep an eye on the movements of institutions holding Bitcoin.

Recently, Spot on Chain revealed that the US and German governments are selling Bitcoin again . If this situation continues, the Bitcoin price may not be able to maintain $60,000 and may fall to $59,795. In a very bearish case, the price may plummet to $56,599.