Crypto whales have a huge impact on market trends by dumping significant amounts of Bitcoin (BTC) and Ethereum (ETH). Recent data shows this pattern of large-scale selling continues, with a total of more than $148 million worth of cryptocurrency moving to multiple exchanges and possibly being liquidated.

Since last week, Bitcoin has been trying to recover after falling to $58,500. There was a clear attempt at a rebound on Monday, with Bitcoin nearing $64,000. However, as selling pressure increased, the price fell below $63,000.

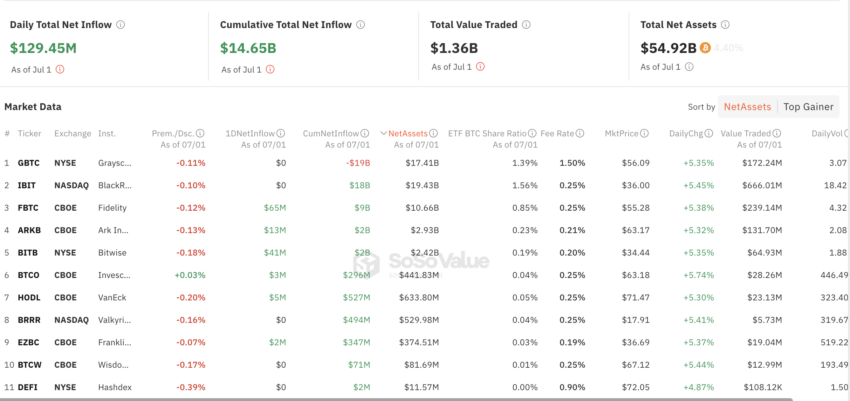

While cryptocurrency whales were selling, the Bitcoin ETF saw inflows of $129 million.

On Monday, a famous cryptocurrency whale linked to wallet address 3G98j transferred 1,800 BTC, equivalent to $114 million , to Binance for approximately $63,333. This move typically signals an intention to cash out, reflecting a strategy commonly used by cryptocurrency whales when market volatility is high.

“Bitcoin price started to fall after whales unloaded BTC,” Spot on Chain said.

Further analysis reveals significant changes in trading behavior. From June 19 to 21, cryptocurrency whales withdrew 6,725 BTC, equivalent to $437 million, from Binance and OKX at an average price of $65,008.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

This is the first large accumulation of BTC by a cryptocurrency whale in 1.5 years. However, with the price dropping more than 4.11%, the cryptocurrency whale showed bearish sentiment , sending 3,481 BTC back to Binance over the past five days.

Historically, this cryptocurrency whale has shown a strategic trading acumen, earning around $1 billion from BTC trading between 2022 and 2024. During the 2022 bear market, he amassed 41,000 BTC at an average price of just $19,000. Later, during the bull market in 2023 and 2024, he took advantage of this by selling 37,000 BTC at approximately $46,800.

There was similar whale activity on Ethereum . Early Monday, cryptocurrency wallet 0xedo, believed to be associated with Abraxas Capital, deposited 42,000 ETH, worth approximately $34.78 million, on Bitfinex. Despite these large transactions, this cryptocurrency whale still has a significant presence in Ethereum, having currently distributed over $112 million across lending and farming platforms such as Spark, Gearbox, and Stargate, securing $4.53 million in revenue. occupies.

Meanwhile, there was a glimmer of hope for Bitcoin investors. Bitcoin spot ETFs saw significant inflows on Monday, with $129 million flowing into the ETF .

This is the highest amount in the last 16 trading days. Fidelity Wise Origin Bitcoin Fund received the most inflows at $65 million. Additionally, BlackRock's iShares Bitcoin Trust and Grayscale Bitcoin Trust recorded inflows of $0 on Monday.

Read more: How to Trade Bitcoin ETF: A Step-by-Step Approach

This contrast between whale selling and significant ETF inflows illustrates the complex and often contradictory forces shaping cryptocurrency markets. These insights are essential to predict market changes, protect investments, and keep stakeholders informed and vigilant.