The price of Ripple (XRP) has been falling steadily since closing at a yearly high of $0.72 on March 11. Over the past month, the token price has fallen 7%.

The recent decline has put the seventh-largest cryptocurrency by market capitalization in a descending triangle, which it is currently trying to break out of.

Ripple heading towards resistance line

At press time, XRP was at $0.48. It was trading close to the upper line of the descending triangle that has formed resistance since May 22nd.

A descending triangle is a bearish pattern that forms when an asset's price makes a series of lower highs while remaining relatively flat at support levels.

If the asset's price attempts to break above the upper trend line of this triangle, which forms a resistance line, it signals a potential upside breakout. If this breakout is accompanied by increased volume, it confirms the possibility of a trend reversal from bearish to bullish.

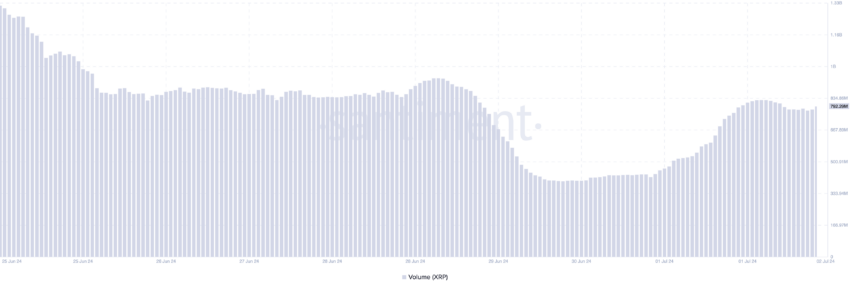

XRP has seen a surge in daily trading volume over the past few days. In the last 24 hours, altcoin trading volume surged more than 30% to a total of $775 million.

Read more: How to Buy Ripple and Everything You Need to Know

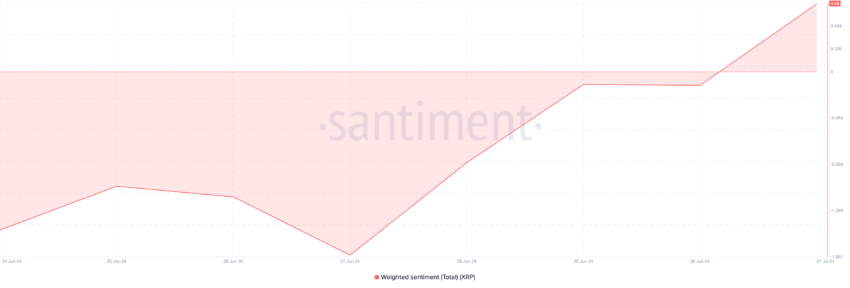

Additionally, aggravated sentiment turned positive for the first time since June 21. This indicator tracks the overall sentiment in the market for an asset. Consider the sentiment around the property and the amount of social media discussion.

A change from negative to positive means that market sentiment has shifted from bearish to bullish. At press time, XRP’s weighted sentiment is 0.68 .

XRP Price Prediction: Battle Between Buyers and Sellers

As XRP begins its rally, readings from the Moving Average Convergence/Divergence (MACD) indicator show that a bullish crossover between the MACD line (blue) and the signal line (orange) occurred on June 30th.

This indicator measures the price trend of an asset and identifies potential buy or sell signals. When the MACD line crosses the signal line in an uptrend, it is bullish. Because an asset's short-term average is rising faster than its long-term average, traders often interpret this as a buy signal.

If XRP's weighted sentiment remains positive and demand for the altcoin continues to grow, the price could rise to $0.49.

However, if it fails to break the resistance line and falls back into the triangle, the above prediction will be invalidated and it will trade at $0.47 .