Cryptocurrency data platform Kaiko recently reported that the introduction of the Solana cash exchange-traded fund (ETF) did not have a significant impact on the market.

Despite initial enthusiasm and a brief price surge, market dynamics for Solana (SOL) quickly reverted to previous levels, reflecting skepticism and regulatory concerns.

Solana's Brief Soar: Investors' Hopes Fading Quickly Despite ETF News

On June 27, Van Eck filed for the first Spot Solana ETF with the U.S. Securities and Exchange Commission (SEC). On June 28, 21Shares also submitted a similar application.

These applications initially generated excitement, sending Solana's price skyrocketing by as much as 6%. However, Kaiko said the impact was temporary and market dynamics soon returned to their previous state.

Read more: Cryptocurrency ETNs and Cryptocurrency ETFs: What's the Difference ?

The report explains, “This report temporarily boosted market sentiment, which had been depressed due to concerns about a large-scale sell-off due to Mt. Gox redemption.”

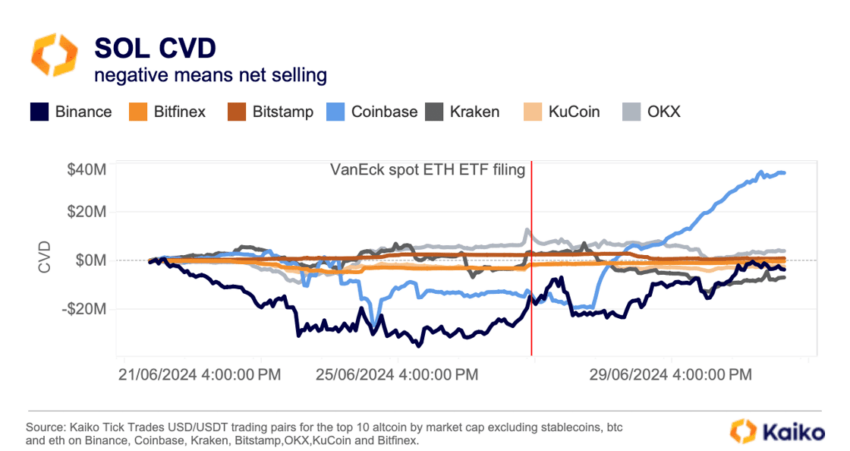

These temporary changes are reflected in Solana's cumulative volume delta (CVD) data, which measures net buying and net selling of cryptocurrencies. According to Kaiko, Solana recorded $29 million in net positive CVD over the past week, primarily driven by increased spot buying on Coinbase.

Additionally, Kaiko’s analysis shows that investor expectations for the Solana spot ETF are not as high compared to other cryptocurrencies such as Ethereum (ETH). Dubbed the ‘Ethereum killer’, Solana has struggled to maintain momentum.

A comparative analysis with Ethereum shows these differences. After the Ethereum spot ETF received partial approval on May 23, it has shown a more sustained upward trend than Solana.

Kaiko also pointed out that the Solana ETF news had limited impact on the derivatives market. On June 27, the volume-weighted funding ratio for SOL tokens briefly spiked, but soon returned to neutral levels. Open interest was little changed and down 20% from early June levels, showing the lack of continued strong demand.

Solana ecosystem continues to expand despite regulatory doubts

One possible explanation for the muted market reaction could be skepticism about the odds of approval for the Solana spot ETF . Unlike Bitcoin or Ethereum, Solana has little data accumulated in the derivatives market, making it difficult to convince regulators of its price stability and resistance to manipulation.

Kaiko cited these regulatory hurdles as a significant factor. Industry experts also share Kaiko's cautious outlook. Solana's securities status could pose a significant obstacle to the approval process, said James Seipart, ETF analyst at Bloomberg Intelligence.

“Solana is classified as a security and faces a very difficult path to ETF approval,” Seypart said.

Despite these challenges, there are positive developments in the Solana ecosystem. According to a report from cryptocurrency exchange Bitget, Solana's decentralized finance (DeFi) ecosystem is growing rapidly, with total deposited volume (TVL) increasing from approximately $1.3 billion in early 2024 to approximately $4.5 billion at the end of June.

The Solana Foundation is also innovating. We recently expanded our ecosystem to include Solana Phones, SDKs, and the newly released Solana Blink .

“These products lay the foundation for Solana’s mass adoption, represent Solana’s adaptation to mobile Internet developments, and play a key role in the continued growth of active addresses on chain,” Ryan Lee, senior analyst at BitGet Research, told BeInCrypto. “I do it,” he explained.

Read more: What is Solana (SOL) ?

Nonetheless, the continued growth and innovation of the Solana ecosystem is laying the groundwork for possible future success. Additionally, Solana's prospects could improve as regulatory conditions change.