Author: Viet Anh

Compiled by: TechFlow

Summary of key points

The bubble-like growth in the number of Altcoin in 2024 and the risks it brings.

The number of users participating in tap-to-earn games surged in 2024.

Nvidia (NVDA) stock is growing in popularity and showing signs of a bubble in 2024.

Between 2023 and 2024, the overall market value of the Crypto market did not show a parabolic rapid growth, and it has not even returned to its historical high in 2021. These growth bubble predictions are not for the crypto market, but for other data and objects that have a significant impact on the crypto market.

The following is a summary and assessment of these growth phenomena.

Growth in the number of Altcoin in 2024 and the risks that come with it

Although the market value has not returned to its peak, the number of Altcoin and new projects has already exceeded the peak and has increased many times compared to the previous cycle. This has led to a situation of "small land and many people" in the market, with too many projects sharing a smaller and smaller market value pie.

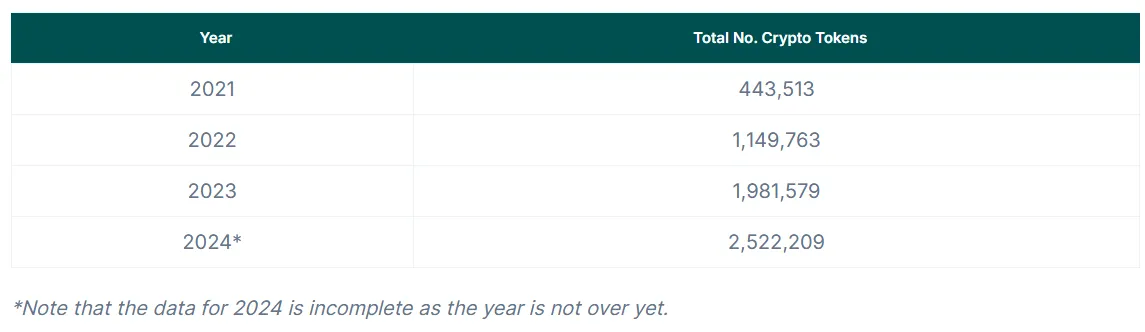

Data from Coingecko Research shows that as of April 2024, the number of tokens on the market has exceeded 2.5 million, compared to 1.98 million in 2023. This means that in less than half a year in 2024, more than 500,000 tokens have been created. Coingecko said that an average of 5,300 new tokens are created every day.

Meanwhile, market trading volume has tapered off, and market capitalization has not returned to its 2021 highs. Recently, Binance took the unprecedented step of launching an early warning feature to alert users which tokens may be delisted. This is because there are too many coins on the market, but poor liquidity.

It is expected that the number of tokens with lack of liquidity and low trading volume will increase in the near future. Many tokens/ Altcoin will be delisted and investors will need to re-examine their portfolios and reallocate funds to truly high-quality tokens.

The number of users participating in tap-to-earn games will surge in 2024

Since the beginning of 2024, various tap-to-earn game apps on Telegram have become popular in the community.

Hamster Kombat announced that as of June, their user base has reached 200 million, making it the most used tap-to-earn app.

Tapswap announced that they have 55 million global players and 18 million daily active users.

Yescoin also announced that in just over a month, they have reached 18 million users, with over 6 million users connecting their wallets.

All of these projects are expected to become the next "Notcoin". But the question is how to provide enough liquidity for hundreds of millions of users? Will user growth continue? At the same time, many experts believe that the crypto market in 2024 lacks capital inflows from retail investors, who were a strong growth driver in previous cycles.

It is expected that the popularity of these Mini-app users on Telegram will cool down or reach saturation in the second half of 2024, as the Altcoin market capitalization has recently dropped below $100 billion.

Nvidia (NVDA) Stock Is Growing Fast in 2024 and Showing Signs of a Bubble

Nvidia (NVDA) stock is a major representative of the so-called "AI stock" wave in 2024. Take Apple's recent stock as an example. As the company entered the AI market through cooperation with OpenAI, AAPL's market value increased by $600 billion. NVDA's market value has risen by nearly 900% in the past two years, surpassing Google and Amazon to become the world's top 4 asset by market value (after gold, Microsoft, and Apple).

The Financial Times believes that this phenomenon is a sign of bubble growth, which forms when investors overestimate the potential of something and place high hopes on it. It is not clear what the impact will be if the AI bubble bursts, but the positive correlation between US stocks and Bitcoin suggests that this could have a serious impact on the entire crypto market.