Bitcoin (BTC) has formed a new resistance level at $63,000. However, the current resurgence in network activity suggests that a rally beyond this level is possible.

So far, July has been characterized by an increase in Bitcoin network activity.

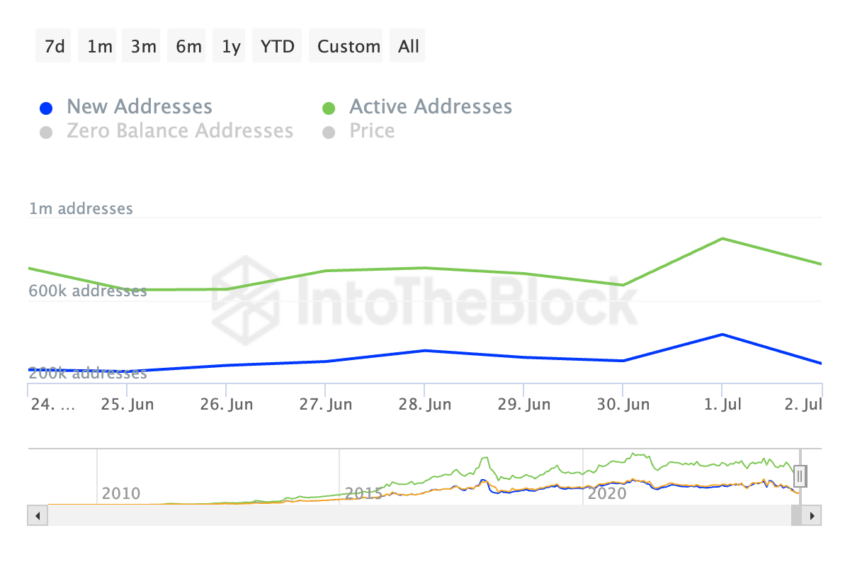

Bitcoin Witnesses Surge in Daily Active Addresses

As of July 1, the total number of unique addresses participating in at least one transaction involving major cryptocurrency assets was 902,000. This represents a 34% increase from the 674,000 daily active addresses on the Bitcoin network recorded on June 30 .

Additionally, the number of newly created addresses for Bitcoin transactions increased by 42%, reaching 434,000 on the day.

An increase in daily active addresses and new addresses for an asset is a positive sign. This means more users are interacting with the asset and new investors are entering the market.

A surge in network activity for an asset is one of the first indicators of a potential price increase. Juan Pellicer, principal researcher at cryptocurrency research firm IntotheBlock, recently spoke to BeInCrypto about the importance of increased activity on the Bitcoin network:

“This is a hopeful sign for Bitcoin, as on-chain activity has been on a noticeable decline since March of this year.”

Separately, BTC whales have stepped up their accumulation over the past month. On-chain data shows that over the past 30 days, large BTC holders have purchased 55,000 BTC, worth over $3 billion at current market prices.

Read more: 5 Platforms to Buy Bitcoin Mining Stocks After Halving in 2024

According to Pellicer, this accumulation behavior was strongest recently when Bitcoin fell to $60,000, indicating buying pressure from large holders at this level .

Bitcoin Price Prediction: Caution Required

Although BTC's network activity has recently surged, there is still a risk that the downtrend will continue. The value of the leading coin, which is trading at $60,276 at press time, has fallen 13% in the past 30 days.

BTC is trading below its 20-day exponential moving average (EMA) at its current price. It has been trading below this key moving average since June 11th.

An asset's 20-day EMA tracks its average price over the last 20 trading days. When the price falls below this level, it is generally considered a bearish signal. This means that the price of the asset is making lower lows compared to its average price over the past 20 days.

If this trend continues, the BTC price could fall to $58,698.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, if the sentiment towards King Coin changes from bearish to bullish , the price of the coin will rise to $61,839, thus invalidating the above prediction.