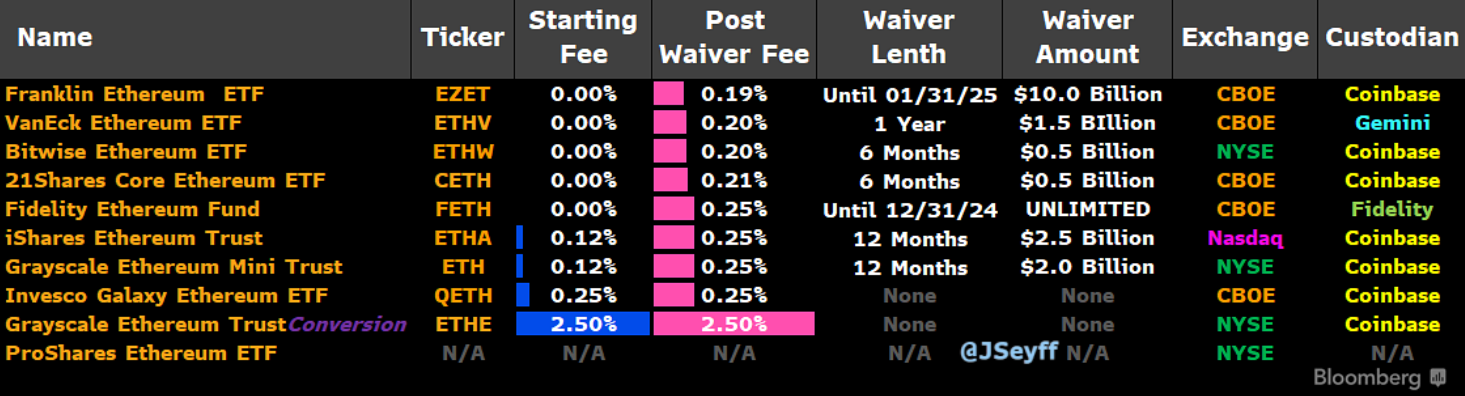

Yesterday, issuers successively announced the fees for Ethereum spot ETFs, and 7 of the 10 funds enjoy fee reductions. The SEC has also approved Form 19b-4 for the Grayscale Mini and ProShares Ethereum ETFs. Bloomberg ETF analyst James Seyffart believes that this means that ten Ethereum spot ETFs will be launched at the same time on 7/23.

Table of contents

ToggleSEC approves Grayscale Mini and ProShares Ethereum ETFs

The U.S. Securities and Exchange Commission ( SEC ) yesterday approved two Ethereum spot ETFs, Grayscale Ethereum Mini Trust and ProShares Ethereum ETF, to be listed on the Arca electronic trading platform of the New York Stock Exchange (NYSE Arca).

The 19b-4 forms for the other eight Ethereum spot ETFs have been officially approved at the end of May. Bloomberg ETF analyst James Seyffart believes that this means that the ten Ethereum spot ETFs will be launched at the same time on July 23.

Grayscale EHTE and mini version of ETH

The mini version of Ethereum ETF (code: ETH) applied by Grayscale automatically converts 10% of the assets of the original Grayscale Ethereum ETF (code: ETHE) into ETH. ETHE currently has $10 billion in assets. Therefore, ETH should essentially start its life with $1 billion in assets. Grayscale, which has always maintained high fees, still maintains the original 2.5% fee for ETHE, but the mini version of ETH has adjusted the fee rate to 0.12% for the first 12 months (or the first 2 billion US dollars). This may help ease the outflow of Grayscale funds.

As the fee war begins, BlackRock also introduces discounts and exemptions

According to the compilation by Bloomberg ETF analyst James Seyffart, the Ethereum spot ETF fee war has begun, and 7 out of 10 funds enjoy fee reductions. The price after the preferential period has also been reduced. Except for Grayscale's EHTE, the maximum price is only 0.25%, which is lower than the previous Bitcoin spot ETF.

Semiconductor stocks fell across the board amid rumors that the Biden administration is considering imposing tighter trade restrictions. The S&P 500 index fell 1.39%, and the Nasdaq index, which is dominated by technology stocks, fell 2.77%. Cryptocurrencies are relatively resilient. Yesterday, issuers successively announced the fees for Ethereum spot ETFs, which are expected to be officially launched on July 23.

Table of contents

ToggleThe United States considers implementing FDPR, and semiconductors plummet across the board

According to Bloomberg , citing people familiar with the matter, the United States is considering whether to implement a measure called the Foreign Direct Products Rule (FDPR) in order to seek influence with allies. The rule allows the United States to impose controls on foreign-made products even if they use minimal amounts of U.S. technology.

The move, seen as draconian by allies, would restrict Japan's Tokyo Electron Ltd. (TEL) and the Netherlands' ASML Holding NV, both of which are trying to suppress their business in China. Produces wafer manufacturing machinery important to the semiconductor industry. The United States is raising the idea with officials in Tokyo and The Hague, people familiar with the matter said, and that outcome is increasingly likely if the two countries do not tighten measures against China.

ASML (stock code: ASML) plunged more than 12% yesterday, TSMC ADR (stock code: TSM) fell nearly 8%, and NVDA (stock code: NVDA) fell more than 6%.

Ethereum spot ETF announces expense ratio and is expected to be officially listed on 7/23

Yesterday, issuers successively announced the fees for Ethereum spot ETFs. According to Bloomberg ETF analyst James Seyffart, 7 out of 10 funds enjoy fee exemptions. It is expected to be officially launched on July 23.

Cryptocurrencies relatively resilient, BTC 64K, ETH 3,400

Cryptocurrencies have been relatively resilient, with Bitcoin reaching as high as $66,128 yesterday and currently holding steady above $64K. Ethereum hit a high of $3,517 yesterday and is currently hovering around $3,400.