Several Ethereum spot exchange-traded funds (ETFs) are scheduled to begin trading on July 23, according to the Chicago Board Options Exchange (Cboe).

This announcement marks a significant moment in the evolution of Ethereum (ETH) into a mainstream investment asset.

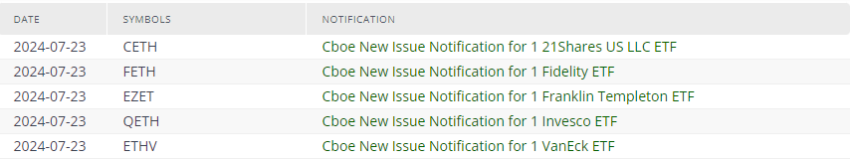

Fidelity and VanEck One of Five New Ethereum ETFs Launching at Cboe

Several high-profile funds are scheduled to begin trading next week, Cboe said. These include the Fidelity Ethereum Fund, Franklin Ethereum ETF, Invesco Galaxy Ethereum ETF, VanEck Ethereum ETF, and 21Shares Core Ethereum ETF.

This development comes after the U.S. Securities and Exchange Commission (SEC) approved the Grayscale Ethereum Mini Trust and ProShares Ethereum ETF for listing on the New York Stock Exchange (NYSE) 's Arca platform earlier this week.

Read more: Ethereum ETF explained : What it is and how it works

The journey toward this launch date began last May when the SEC approved Form 19b-4 for these ETFs. However, the company still needed a registration statement to become effective before it could officially launch.

Eric Balchunas, Bloomberg's senior ETF analyst, previously noted that companies would "request for effect" on Monday. He expected the ETF to begin trading on July 23.

To prepare for launch , potential issuers plan to update their fee structures and temporarily waive fees. For example, Fidelity announced that it will waive its 0.25% fee until the end of 2024.

VanEck also waives fees for one year if you have more than $1.5 billion in assets. Likewise, 21Shares does not charge a 0.21% fee for the first six months or until the fund's assets reach $500 million.

Industry experts believe the success of the Ethereum ETF's debut week could set the tone for future market developments. Danny Chong, co-founder of Trenchis, shared his perspective on the potential market impact in an interview with BeInCrypto. He believes spot ETF inflows could have a bigger impact on Ethereum than on Bitcoin due to Ethereum's rapidly expanding ecosystem and additional utility.

“The ETH/BTC price ratio is already showing positive movement as investors anticipate the imminent launch of an Ethereum ETF. […] ],” he noted.

Despite this optimism, Chong pointed out that the Ethereum spot ETF did not meet industry expectations when it was launched in Hong Kong. However, with a larger investor base in the US, the upcoming ETF is expected to perform better.

Read more: How to invest in Ethereum ETF?

Optimism about the imminent launch of this Ethereum ETF also has implications for market impact. Experts believe these funds could influence future cryptocurrency regulation in the United States .

Additionally, many in the cryptocurrency community are already shifting their attention to the next step. There is speculation about the possible approval of the Solana (SOL) ETF and other cryptocurrency-based ETFs.