Author: Tom Mitchelhill, CoinTelegraph; Translated by: Deng Tong, Jinse Finance

US President Joe Biden shocked markets by announcing he would not run for a second term as president.

Now, some analysts say his last-minute move could boost Bitcoin and crypto assets in the coming months, while others believe investors should curb their excitement for now.

According to TradingView data, Bitcoin’s price fell 2.8% immediately after the news but has since rebounded from the $65,800 mark, but has quickly recovered by more than 3.6% in the past eight hours.

After Biden announced his candidacy, the price of Bitcoin first plummeted, and then rose sharply. Source: TradingView

Josh Gilbert, market analyst at eToro, said Biden’s sudden move was a “win for crypto assets” and that the increase in Trump’s re-election chances represented a “huge boost for the asset class,” adding:

“The longer we see Trump staying ahead in the election, the more crypto assets will price in his victory.”

“With only three months left in this election, it’s hard to imagine Kamala Harris or any other Democratic candidate overturning Trump’s lead in the polls, but a lot can happen in that time, so nothing is impossible,” he explained.

Trump has recently made Bitcoin and cryptocurrencies a key part of his reelection campaign, announcing on June 14 that he would end the Biden administration’s “war on cryptocurrency” if elected president.

Markus Thielen, head of research at 10X Research, said Bitcoin could further establish itself as a strategic reserve asset if Trump becomes a crypto-friendly president.

In a July 21 report, Thielen wrote that the U.S. government holds just 212,800 bitcoins, worth about $15 billion, compared to about $600 billion in gold reserves. If the government doubled its bitcoin holdings, it would “almost equal” the impact on the price of net inflows into bitcoin spot exchange-traded funds (ETFs) so far this year.

Looking ahead, Gilbert said he expects the price of Bitcoin to move higher, pointing to the upcoming launch of a spot Ethereum ETF in the United States as one of the main catalysts for growth in the overall market.

Don't get too excited about Trump's victory

However, some analysts said Biden’s recent move might not lead to an immediate surge in cryptocurrencies.

Swyftx analyst Pav Hundal warned that while Biden’s withdrawal could increase Trump’s chances of winning, it is difficult to directly link this to the current price action rebound in the broader cryptocurrency market.

“As we can see from the experience of bitcoin ETFs, there can be a temporary lull in prices before the upward trend continues,” he said.

“The recent surge can likely be attributed to early Ethereum ETF speculation, and it is important for investors to remain cautious and not get overly excited in the short term.”

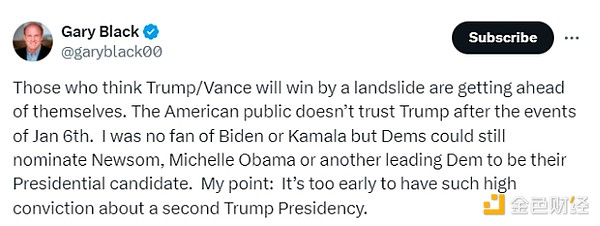

Likewise, Future Fund managing partner Gary Black warned his 433,000 followers on X that Trump winning the presidential election was far from a foregone conclusion.

“Those who think Trump/Vance will win in a landslide are being too hasty,” Black said in a July 22 post to X.

Source: Gary Black

"After the events of January 6, the American public no longer trusts Trump. I am not a fan of Biden or Kamala, but the Democratic Party can still nominate Newsom, Michelle Obama or another Democratic leader as the presidential candidate."

“It’s too early to have such high confidence that Trump will be re-elected as president.”