BlackRock's iShares Bitcoin Trust (IBIT) achieved a milestone this Monday, recording $526 million in inflows. This event marks the largest single-day gain for the ETF since March 13, 2024.

Notably, 7,759 bitcoins were added, marking IBIT's 7th largest daily inflow.

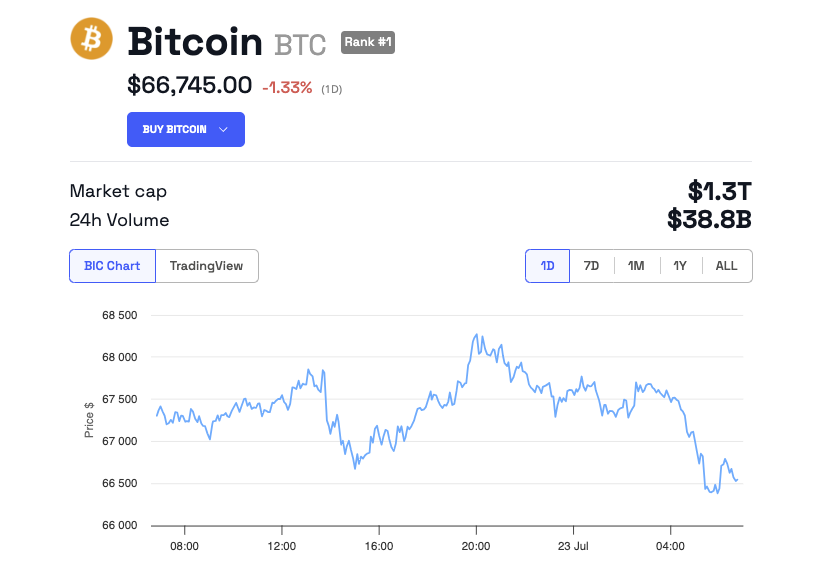

Bitcoin Price Movement Neutral Despite Strong Inflows

With daily mining volume of only 450 BTC, total ETF acquisitions amounted to approximately 7,860 BTC, or approximately $533 million. This demand shock indicates positive momentum for Bitcoin.

Meanwhile, IBIT has now surpassed Nasdaq index fund QQQ in annual inflows. Analysts expect IBIT to soon overtake Vanguard's Total Stock Market ETF in terms of inflows.

“There is constant demand for Bitcoin through ETFs. This is truly unprecedented,” Spencer Hakimian said on Twitter.

Read more: How to Trade Bitcoin ETF: A Step-by-Step Approach

In contrast to IBIT's success, other Bitcoin funds such as Fidelity's Wise Origin Bitcoin Fund (FBTC) and Vanek Bitcoin Trust (HODL) have reported mixed results. In particular, FBTC recorded the second highest inflow of the day at $23.7 million. On the other hand, HODL had an outflow of $38.4 million, showing that investor confidence differed by fund.

But Bitcoin is solving other problems as well. In particular, the infamous Bitcoin exchange Mt. Gox transferred 42,587 BTC, worth approximately $2.84 billion, to two wallets. The move is part of ongoing repayments to creditors and marks another chapter in a long resolution process.

Earlier, when Mt. Gox moved BTC to a new wallet, cryptocurrency exchange Kraken prepared a plan to repay creditors . So today's deal suggests more redemptions.

At the same time , the U.S. government is actively managing its Bitcoin holdings. Taking advantage of the recent price rise , he sold 58.74 BTC through Coinbase Prime for approximately $3.96 million. This year alone, the government sold 6,261 BTC at an average price of $62,538, for a total of $392 million.

“The US government occasionally moves/sells some BTC, but the amounts are generally not large. “FUD related to the U.S. government is often exaggerated,” Spot on Chain said.

Despite these large transactions and active market participation, the Bitcoin price has fallen 1.33% and currently stands at approximately $66,745.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, Bitfinex analysts remained optimistic in an email to BeInCrypto. Bitfinex analysts noted that a decline in the Bitcoin exchange reserves indicator, which tracks Bitcoin holdings held in exchange wallets, suggests investors are withdrawing assets for long-term storage rather than selling. This behavior usually precedes supply pressures and can potentially push prices higher.

A Bitfinex analyst told BeInCrypto, “Considering the uncertainty caused by the unclear Democratic candidate, it is expected to be a week full of news-centered volatility, with major topics such as the election, the launch of the Ethereum ETF, and the receipt of coins by Mt. Gox creditors. “He said.