Author: ECOINOMETRICS

Compiled by: TechFlow

Today's content will include:

Bitcoin ETF is gaining momentum.

ETH vs BTC ETFS, comparing launches.

Strong growth in the U.S. economy.

Each topic has an explanation and a diagram, let's take a deeper look.

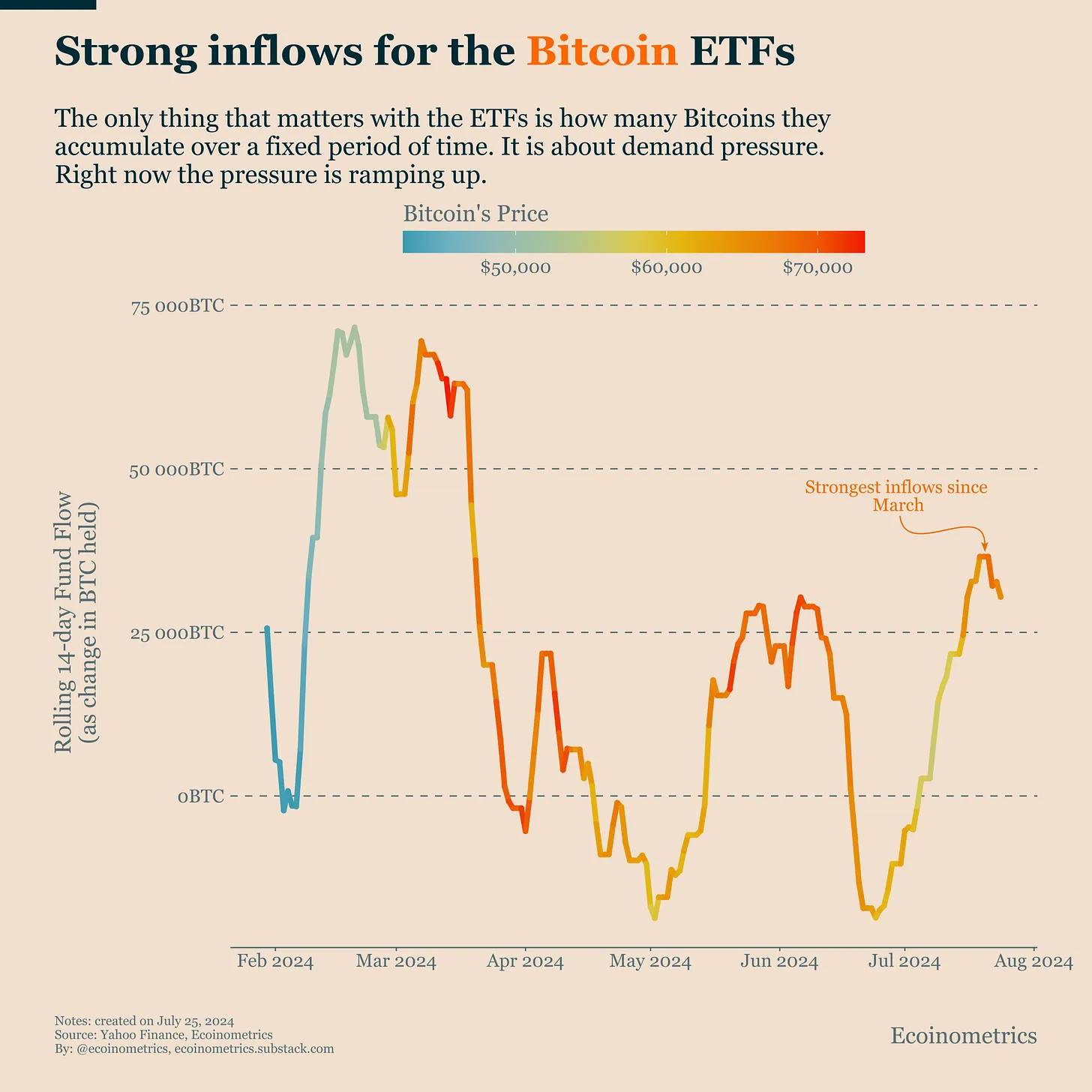

Bitcoin ETF is gaining momentum

If you ignore the stock market, it seems like everyone is having a good week.

First up is the Bitcoin ETF.

Bitcoin ETFs just saw their strongest inflows since March (cumulative flows over a 14-day rolling window). If this trend continues, Bitcoin may eventually be able to break out of this price range.

The more funds that flow in per unit time, the greater the demand pressure on the liquidity pool, and the more likely we are to see a surge in BTC prices.

(The chart shows strong inflows into BTC ETFs. The most important thing about ETFs is how much Bitcoin they have accumulated over a fixed period of time, which involves demand pressure. At present, this pressure is increasing.)

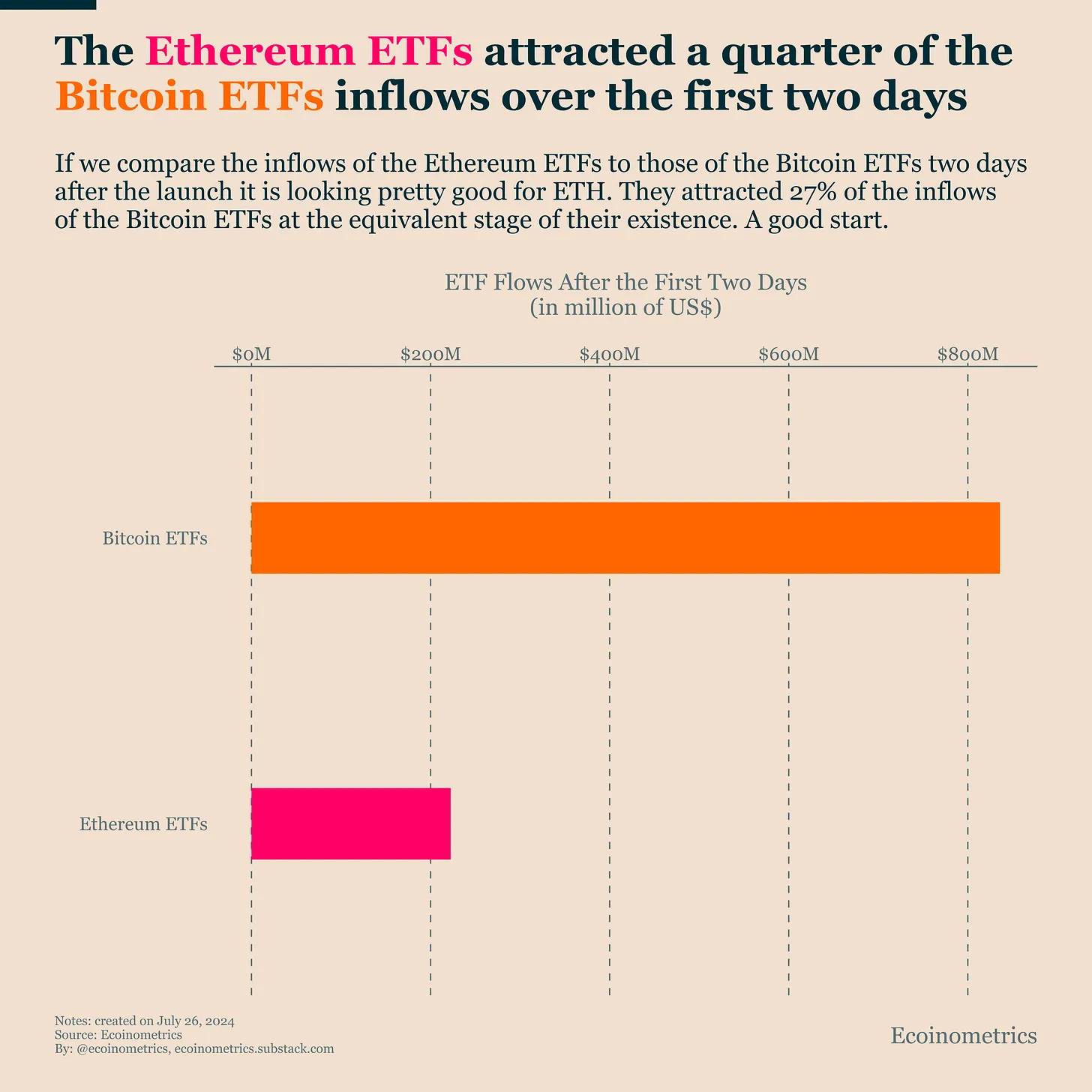

Ethereum ETF vs. BTC ETF: Issuance Comparison

The spot Ethereum ETF has performed quite well so far this week.

They have just been launched and the inflows they are attracting look good to me.

In the chat log below, you can see a comparison between the two:

Bitcoin ETF net flows in first two days

Ethereum ETF net flows in the first two days of this week.

The Ethereum ETF has managed to attract slightly more than a quarter of the funds that Bitcoin attracted during the same period.

Given that ( as I describe here ) the Ethereum ETF is less attractive than the Bitcoin ETF, this is a nice surprise.

let us wait and see.

(The chart shows ETF inflows in the first two days. The Ethereum ETF attracted a quarter of the Bitcoin ETF inflows in the first two days. If we compare the inflows of the Ethereum ETF and the Bitcoin ETF in the first two days after launch, ETH performed quite well. They attracted 27% of the Bitcoin ETF inflows in the corresponding period. This is a good start.)

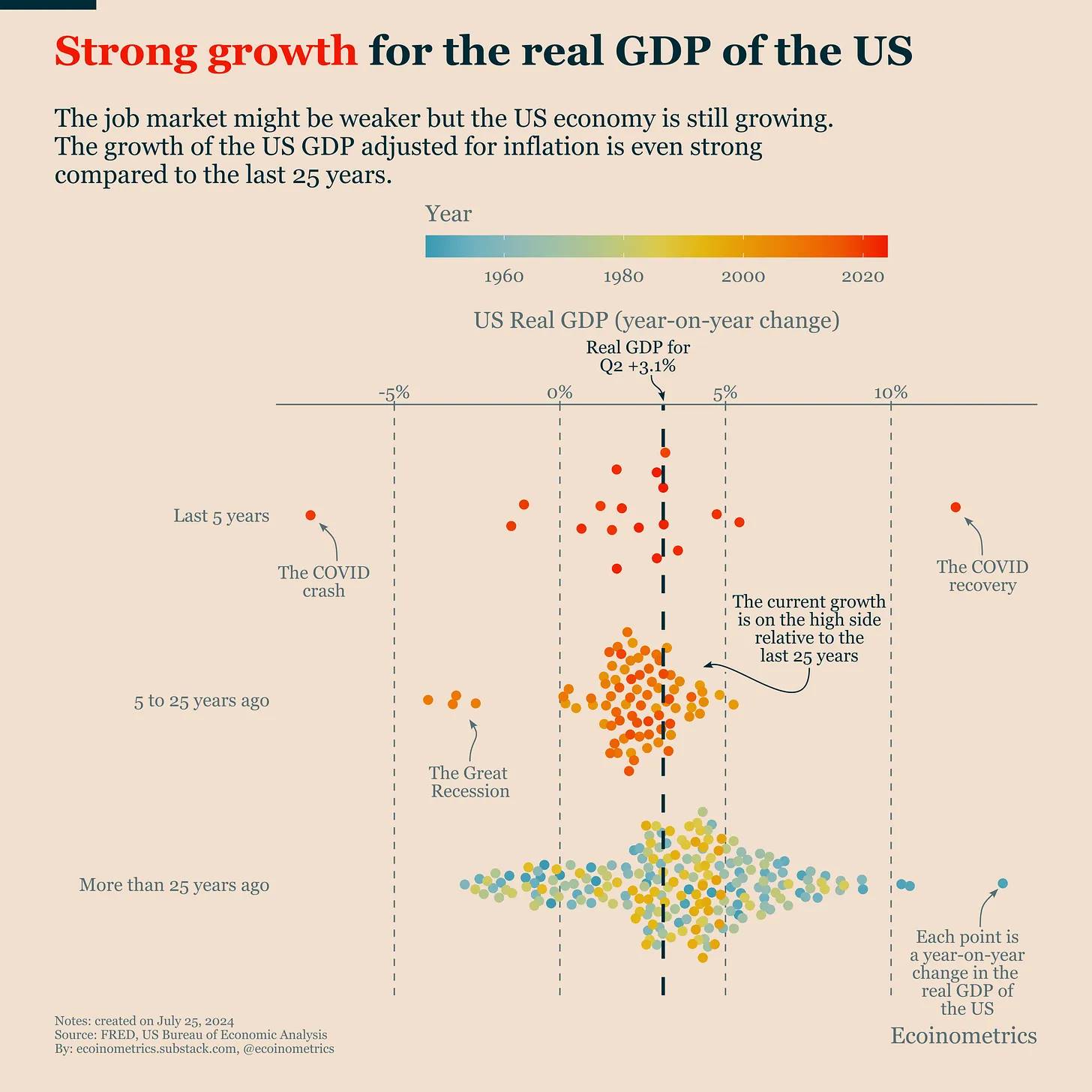

Strong economic growth in the United States

When I look at what's happening in the job market, I often wonder if the U.S. is heading for a recession.

But when I see that real U.S. GDP (adjusted for inflation) is up 3.1% year over year, I think, "Well, yeah." I think, "Well, okay, maybe it's not that simple."

It's never been like that. If you look at history, it's virtually impossible to predict next quarter's GDP from last quarter's GDP. So a strong second quarter doesn't mean it's going to be smooth sailing for the rest of the year.

Regardless, we did see another example of good news being bad news in the stock market. This is because investors, as always, are focused on the actions of the Federal Reserve. Any news that threatens a rate cut will have a negative impact on risk assets.

Ultimately, monetary policy plays too large a role in financial markets. There is no need to fight it.

(The graph shows US real GDP. US real GDP is growing strongly. Despite the weak job market, the US economy continues to grow. US GDP growth adjusted for inflation has performed well over the past 25 years.)

That’s all for today, I hope you liked it.