Author: Crypto, Distilled, Crypto KOL; Translation: Jinse Finance xiaozou

Coinbase just released their “Crypto Outlook” report for the third quarter of 2024. I’ve read through the entire 60-page report for you and summarized the 10 points you need to know below.

1. MVRV (market value and realized value ratio) and market trends:

When MVRV is above its 365-day average, it signals a strong uptrend and support at MVRV provides a buying opportunity. Currently, MVRV has bounced off the support, suggesting that the uptrend remains intact.

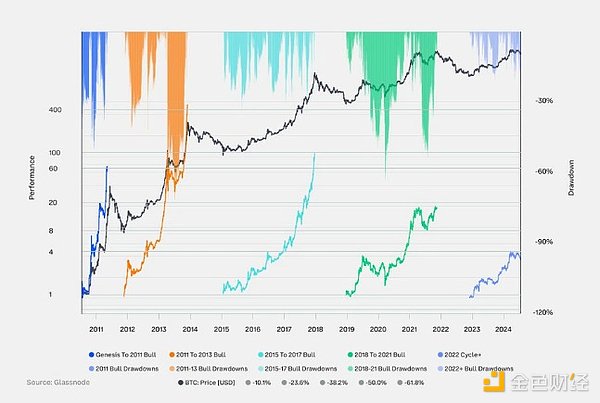

2. BTC investment return rate:

BTC has gone through 4 market cycles, each with its own bull and bear phases. This cycle began in 2022, with BTC prices up 400% from the lows in November 2022. This cycle is similar to the 2018-2022 cycle, when BTC prices rose 2,000% from the lows.

3. Smaller decline:

BTC bull market cycles are usually characterized by exponential rises and sharp declines. This cycle is different from previous ones, with smaller declines: 8 declines of 5%-20%, 2 declines of 20%-30%, and no decline of more than 30%.

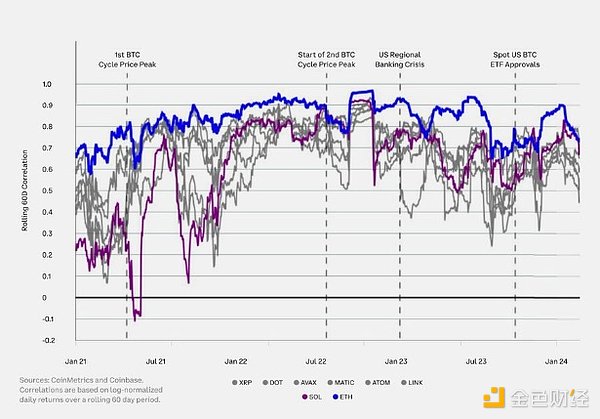

4. Declining correlation of cryptocurrencies:

Crypto asset correlations declined in the second quarter: ETH's correlation was 0.7, and some Altcoin were even below 0.5. This decoupling of correlations signals a deeper understanding of token fundamentals. With regulatory clarity and institutional adoption, correlations are expected to decline further.

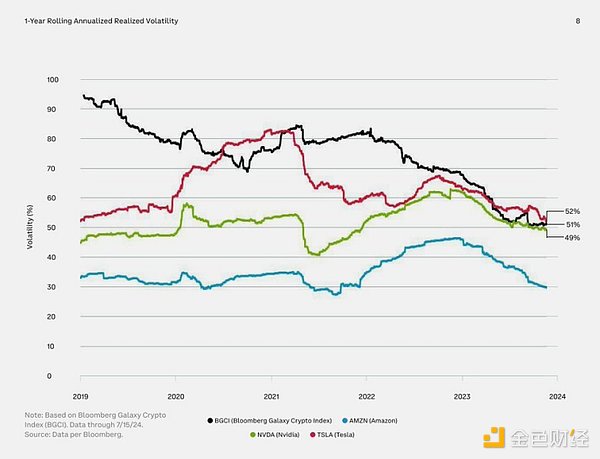

5. Fluctuation Perception and Reality:

From a perception perspective, digital assets are too volatile for many investors. The reality is that cryptocurrencies are as volatile as some of the most widely held large-cap tech stocks.

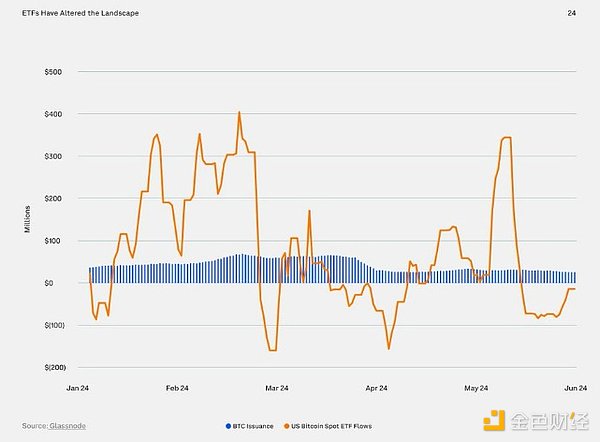

6. Impact of spot ETFs :

Spot ETFs have driven a large amount of new demand for BTC, while new BTC supply is still limited to miner rewards. Since spot ETFs began trading, ETF demand has greatly exceeded BTC issuance.

7. ETH market cycle:

ETH has gone through two complete market cycles. This cycle began in 2022, and ETH has risen by more than 240% since November 2022. This cycle is similar to the 2018-2022 cycle, with ETH prices rising 6,000% from their lows.

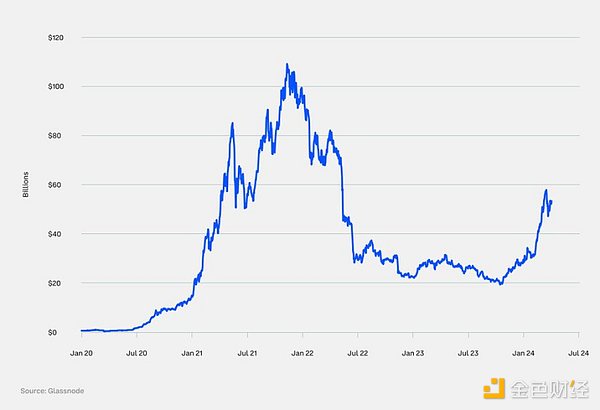

8. ETH Total Locked Value ( TVL ) :

TVL tracks the value of Altcoin and stablecoins in smart contracts and dApps. It reflects financial activity and liquidity. In the second quarter, TVL grew by 9%, indicating increased activity on the Ethereum blockchain.

9. FTX Cash Distribution:

FTX will distribute cash, which, if reinvested by the recipient, could result in a large influx of crypto into the market. Key dates: August 16 (trustee vote), October 7 (court approval deadline).

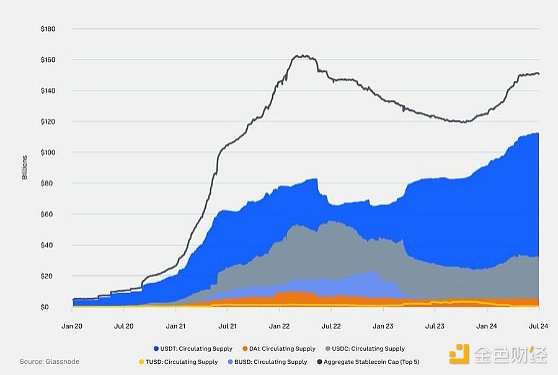

10. Stablecoins

The MC (market cap) of stablecoins is $162.5 billion, up $2 billion in two weeks and exceeding the level before 3AC. Stablecoins reflect the liquidity of cryptocurrencies and are a key long-term price prediction indicator. With capital inflows, the bearish view is difficult to sustain.