Author: Defi_Maestro

Compiled by: TechFlow

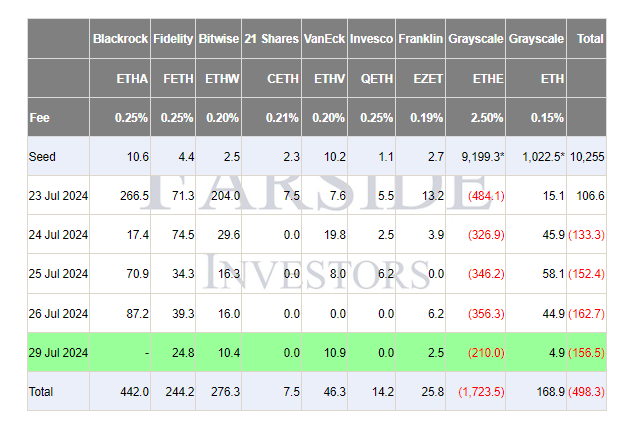

$ETH ETF inflows look pretty good, with the latest net outflow being $97.9m ($ETHA inflows of $58.6m not yet updated in the table)

TechFlow Note:

Different investment institutions or products are listed at the top of the table, including Blackrock, Fidelity, Bitwise, 21Shares, VanEck, Invesco, Franklin and two Grayscale products.

The second line shows the code of each product, such as ETHA, FETH, ETHW, etc.

The third line is the management fee rate of each product, ranging from 0.15% to 2.50%.

The fourth row represents the initial or seed funding, with values ranging from 1.1 to 10,255.

Next is the daily data from July 23 to July 29, which may represent inflows or outflows.

Notably, the Grayscale ETHE product appears to have seen significant outflows, with negative values almost every day, totaling -1,723.5.

In contrast, other products such as Blackrock’s ETHA and Fidelity’s FETH showed positive inflows during this period.

July 29 (bottom row) is highlighted in green, probably indicating that this is the most recent data or a day of special interest.

Overall, while some products saw inflows, overall there appeared to be net outflows during this period, totaling -498.3.

$ETHE outflows began to slow, with net outflows of $210M.

Total outflows were 19.8% from an initial AUM of $9.2 billion.

Current $ETHE asset holdings should be close to $7.4 billion.

Since the inception of the $ETH ETF, we have witnessed a 5% decline from the initial price of $3490, with total net outflows of $440 million.

The ETH to BTC chart appears to have bottomed, with $ETH recovering from its recent decline following Trump’s speech on BTC.

personal idea

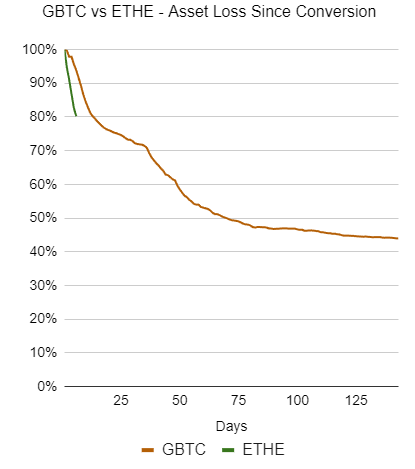

Given that initial outflows from $ETHE were faster than $GBTC, we expect outflows to begin to slow over the next two weeks.

Outflows from $ETHE are expected to stabilize around 40-50% of the initial $9.2 billion in AUM, or approximately $4.5 billion to $5 billion.

As investors notice that outflows from $ETHE slow down, one can expect inflows to start increasing.

Expect some positive inflows into ETH's overall liquidity to match the slowing outflows from $ETHE.

The general feeling is that now is a good time to set up a $ETH buy order as it is expected to gradually gain strength over the next two weeks.

Again, this is not financial advice.

I personally would add more $ETH longs and keep a close eye on ETF liquidity.