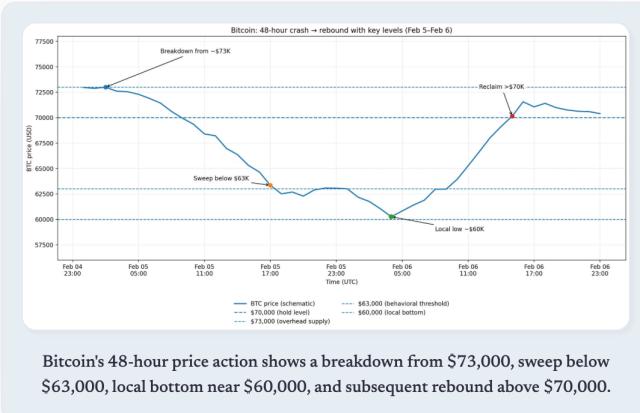

Bitcoin started a new wave of decline at 3 o'clock in the morning today (1), and reached a minimum of $64,359 before nearly 9 o'clock earlier. As of this writing, it has not rebounded significantly, and is now at $64,581, falling in the past 24 hours. 2.62%.

As the Federal Reserve's FOMC meeting in the early morning decided to freeze interest rates for the eighth time, and Chairman Jerome Powell also hawkishly paved the way for an interest rate cut in September, which stimulated the US stock market to rise sharply, at this time, Bitcoin bucked the trend and fell, causing many bulls to lose money.

At present, it seems that the upward trend of Bitcoin since the beginning of July from 53,000 US dollars is entering a correction. If it fails to hold the previous low of 63,300 US dollars (which is also the moving average intensive area), it may continue to test the 60,000 US dollars mark. After all, the currency price broke through very quickly at that time, and there were not many changes of hands. Investors are advised to be cautious.

Ethereum holds on to $3,200

Part of the trend of Ethereum is close to that of Bitcoin. At the time of writing, it was trading at $3,222, down 1.96% in the past 24 hours.

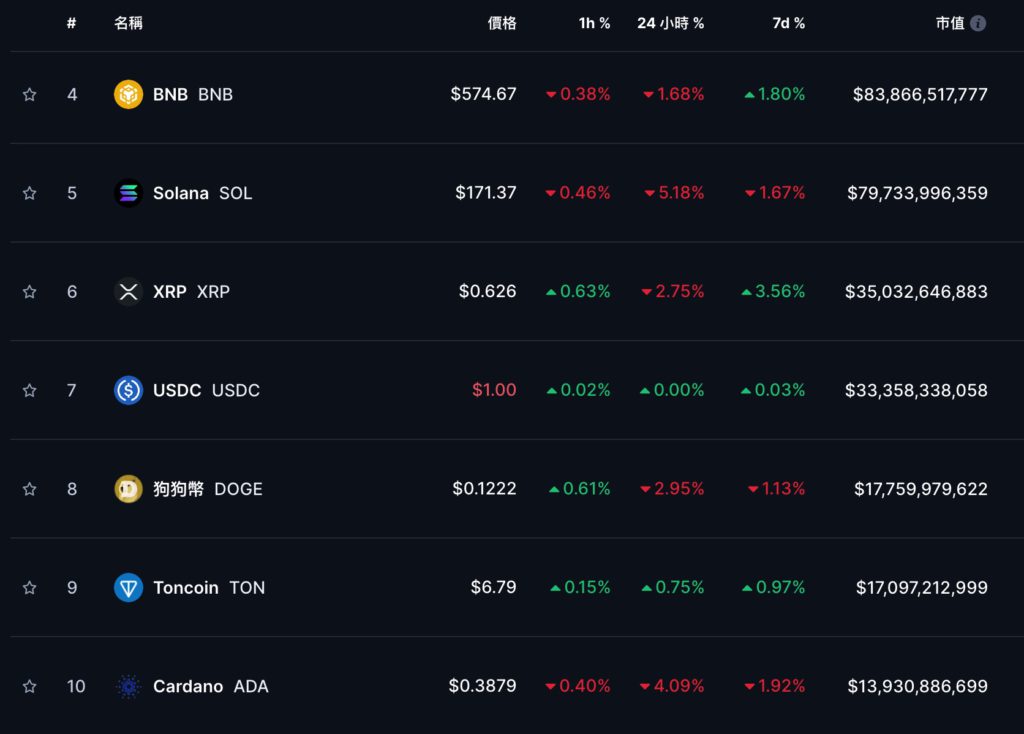

Top 10 Token Performance

Most of the other top ten tokens also fell. The biggest increases were SOL and ADA, which fell 5.18% and 4.09% respectively in the past 24 hours. The only one that bucked the trend was TON, which rose 0.75% in the past 24 hours.

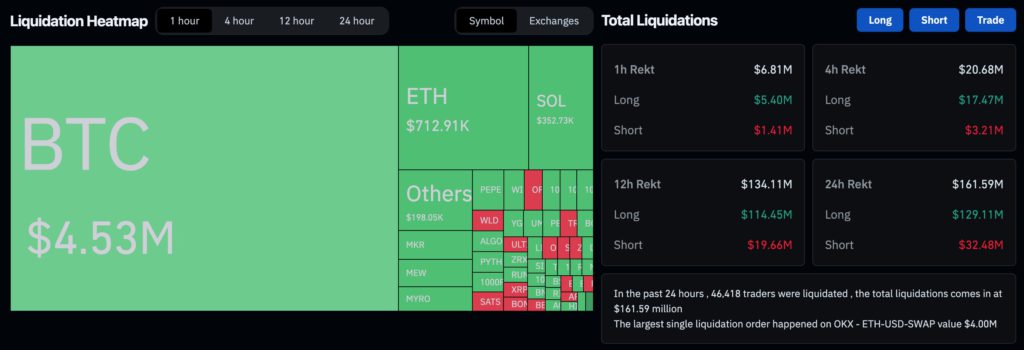

The entire network liquidated US$160 million in the past 24 hours

According to data from Coinglass, in the past 24 hours, the total amount of cryptocurrency liquidation across the entire network was approximately US$160 million, and more than 46,000 people were liquidated (long positions accounted for nearly US$129 million).