Author: Zoltan Vardai, CoinTelegraph; Translated by: Deng Tong, Jinse Finance

Traders and market analysts are divided over Bitcoin’s next potential macro top, with the more optimistic forecasts suggesting it could reach $120,000. Can Bitcoin break above the $71,500 mark on a weekly close?

Can the price of Bitcoin reach a maximum of $120,000?

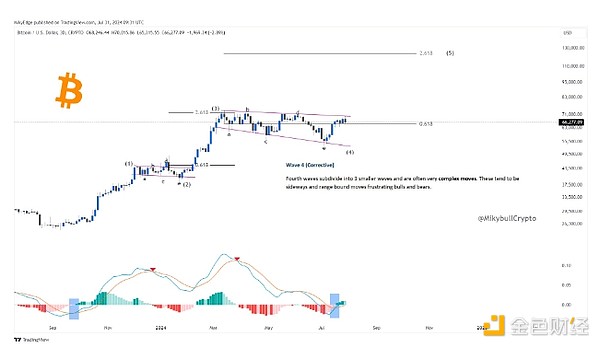

According to technical analysis by cryptocurrency trader Mikybull, the price of BTC may be about to enter the next upswing in its bull cycle, with the price of the world’s first cryptocurrency set to break through the $120,000 mark.

The popular trader wrote in a July 31 post to his 71,000 followers:

“Bitcoin is gearing up for its next leg higher, taking prices to over $120,000. Buckle up.”

BTC/USD, 3-day chart. Source: Mikybull

However, more conservative estimates suggest that the mark below $100,000 could be a macro top. For example, based on technical chart patterns, cryptocurrency analyst Mags expects Bitcoin’s next major milestone to be above the $95,000 mark.

The analyst wrote in a July 31 post on X:

“BTC is still trading in a descending expanding wedge pattern. The price is consolidating near the overhead resistance line and a breakout could result in a sharp rise. The technical target of the pattern is $95,700.”

BTC/USD, falling expanding wedge pattern. Source: Mags

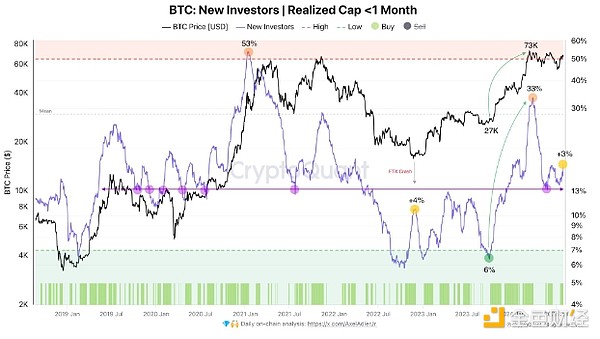

A 3% increase in new Bitcoin investors from the $57,000 level fueled the bullish sentiment.

However, according to cryptocurrency researcher and proven CryptoQuant author Axel Adler, as we reach the peak of the Bitcoin cycle, new investors could increase by 50%, he wrote in a July 31 post on X:

“From the $57,000 level, the market added 3% of new investors — a pretty significant number considering that the metric grew 4% after the FTX crash. As prices rise, the main influx of new investors will resume, and at the top of the cycle it should exceed 50%.”

BTC: New investors, realized market cap, 1 month. Source: Axel Adler

Bitcoin needs weekly close above $71,500

According to prominent analyst Rekt Capital, Bitcoin needs a weekly close above the $71,500 mark to confirm the next leg up in the bull cycle.

In a July 29 post on X, the analyst wrote that Bitcoin is likely to remain sideways for the next few weeks:

“A weekly candle close above ~$71,500 could initiate a breakout from the re-accumulation range. However, history suggests Bitcoin should consolidate within this re-accumulation range for a few weeks.”

BTC/USD, 1-week chart. Source: Rekt Capital

The analyst added that a prolonged period of consolidation would help bring Bitcoin in sync with previous historical halving cycles, meaning it would peak later in the cycle.

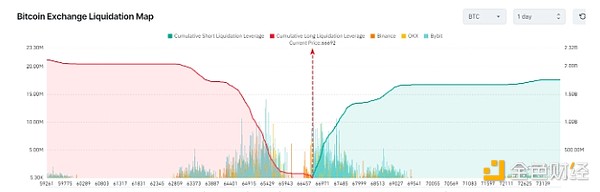

However, Bitcoin faces huge resistance at the $67,000 and $67,500 levels. According to CoinGlass, if Bitcoin breaks through $67,000, more than $940 million worth of accumulated leveraged short positions will be liquidated.

Bitcoin exchange liquidations chart. Source: CoinGlass

If the Bitcoin price breaks above $67,500, total short liquidations will exceed $1.4 billion.