Author: Tom Mitchelhill, CoinTelegraph; Translated by: Tao Zhu, Jinse Finance

Business intelligence company MicroStrategy purchased an additional 12,222 Bitcoins for $805 million in the second quarter of this year, bringing its total Bitcoin holdings to 226,500 BTC — worth $14.7 billion at current prices.

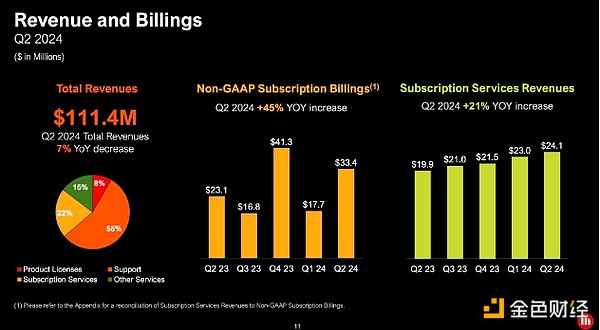

During its second-quarter earnings call, MicroStrategy reported a massive loss of $5.74 per share on quarterly revenue of $111.4 million, down 7% year over year.

That was well below analysts' expectations, who expected a quarterly loss of $0.78 per share on revenue of $119.3 million, according to Bloomberg survey data.

MicroStrategy reports second quarter revenue decline of $111.4 million. Source: MicroStrategy

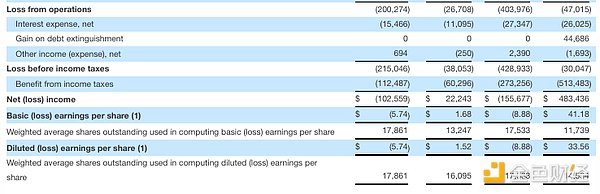

Notably, the company reported a second-quarter net loss of $123 million, a slight improvement from a net loss of $137 million in the same period last year.

MicroStrategy reports second quarter net loss of $123 million. Source: MicroStrategy.

The company said it holds a total of 226,500 bitcoins, acquired at a cost of $8.5 billion and an average price of $36,821 per bitcoin.

The company also announced a new key performance indicator called “Bitcoin Yield,” which represents the percentage change over time in the ratio between the company’s Bitcoin holdings and its diluted outstanding shares.

Diluted shares outstanding include all of the Company's common shares and any additional shares resulting from convertible notes or the exercise of stock options.

MicroStrategy said its BTC yield is currently 12.2% year-to-date, noting that its target yield will be between 4% and 8% per year over the next three years.

“The Company uses BTC yield as a KPI to help evaluate the performance of its strategy to acquire Bitcoin in a manner that the Company believes is beneficial to its shareholders,” the company said in a statement.

The company also confirmed that its 10:1 stock split, originally announced on July 11, will take effect on August 7.

Will you buy more Bitcoin in the future?

MicroStrategy said it would file a registration form for a $2 billion stock offering to raise more money, but did not disclose how the proceeds would be used.

Historically, MicroStrategy has raised funds with the goal of buying more Bitcoin.

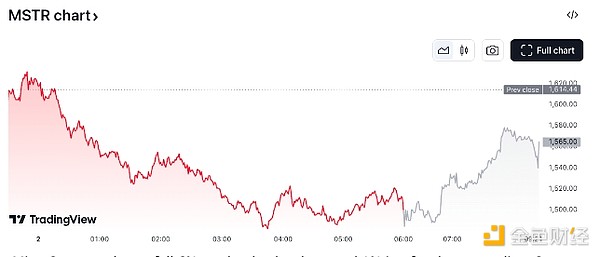

MicroStrategy shares are currently trading at $1,500, down 6% on the day. The company’s shares rebounded 1.1% in after-hours trading after the company reported second-quarter earnings, according to TradingView data.

MicroStrategy shares fell 6% on the day but rebounded 1% in after-hours trading. Source: TradingView