According to Bloomberg , the U.S. cryptocurrency exchange Coinbase announced its second-quarter financial results after the market closed on Thursday (1st) Eastern Time, with total revenue reaching $1.45 billion, slightly higher than analyst expectations. After accounting for impairment losses on the value of cryptocurrencies held in the portfolio ($319 million, mostly unrealized losses), net income was approximately $36 million, with EPS of 14 cents, following a loss in the year-earlier period.

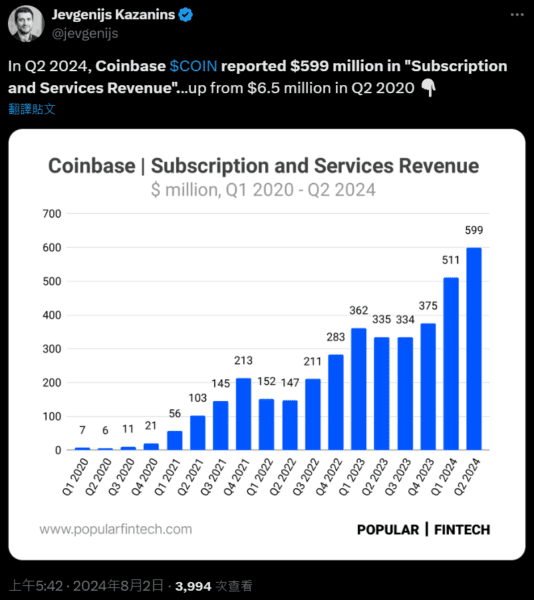

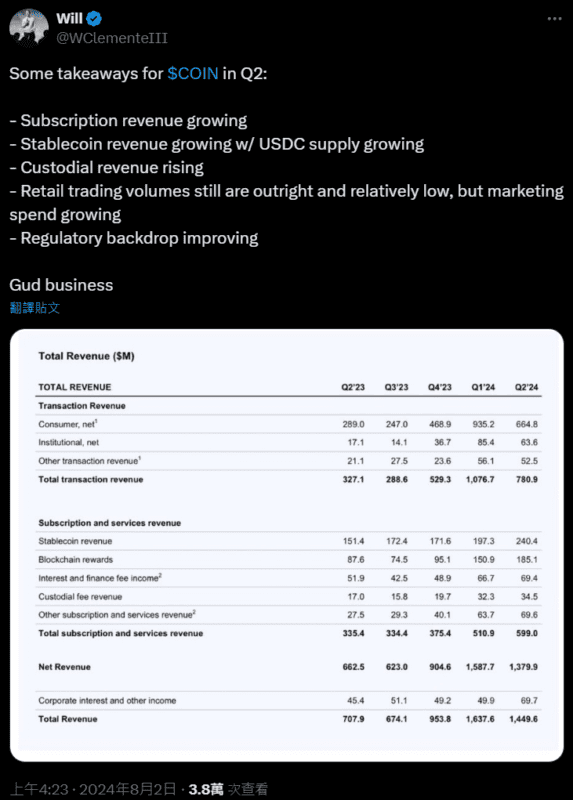

Coinbase's subscription and services revenue reached nearly $600 million in the second quarter. The company said in a shareholder letter that it generated about $210 million in total transaction revenue in July and expects subscription and services revenue in the third quarter to be between $530 million and $600 million. Coinbase's non-trading businesses have become more important in driving growth amid a trading slowdown, such as interest income tied to its U.S. dollar stablecoin USDC.

"Spot market trading is volatile, there will be ups and downs, and our energy is being invested in creating more and more diversified revenue streams." Coinbase Chief Financial Officer Alesia Haas said in an interview: "This is a strong quarter for Coinbase execution. Our results demonstrate that we are a company that can operate in a variety of market conditions and have the ability to diversify our revenue."

Coinbase's revenue fell 11% compared with the first quarter as the cryptocurrency rally slowed. The company generates most of its revenue from trading fees, and as Bitcoin prices have been trending lower after hitting a record high in March, many retail traders are taking a wait-and-see approach.

“Coinbase’s recovery in profitability should be sustainable, even amid subdued activity and stabilizing cryptocurrency prices,” analysts at Bloomberg Intelligence wrote in a note.

Coinbase still faces uncertainty over a lawsuit filed against it by the U.S. Securities and Exchange Commission (SEC) last year. This fall’s U.S. elections add another variable as Coinbase and other cryptocurrency companies try to push new crypto-friendly regulations through legislators.

Coinbase (COIN) shares closed at $212.64 on Thursday, rising nearly 3% in after-hours trading. COIN's stock price has risen approximately 22% this year.