On July 30, Starknet’s ecological derivative DEX ZKX claimed that it would cease operations due to serious imbalances in revenue and expenditure. It was questioned and denounced by the community. You must know that the agreement was officially announced to have received US$7.6 million in strategic financing more than a month ago. .

In fact, due to multiple tests such as tight funding, liquidity risks and industry recession, the survival index of encryption projects has soared, even if they were once favored by capital. According to a CoinGecko report at the beginning of this year, 14,039 cryptocurrencies have "died" since 2024, accounting for more than 50%, and most of the projects occurred during the bull market from 2020 to 2021. During the last bull market alone, approximately 70% of the 11,000 crypto projects ceased operations.

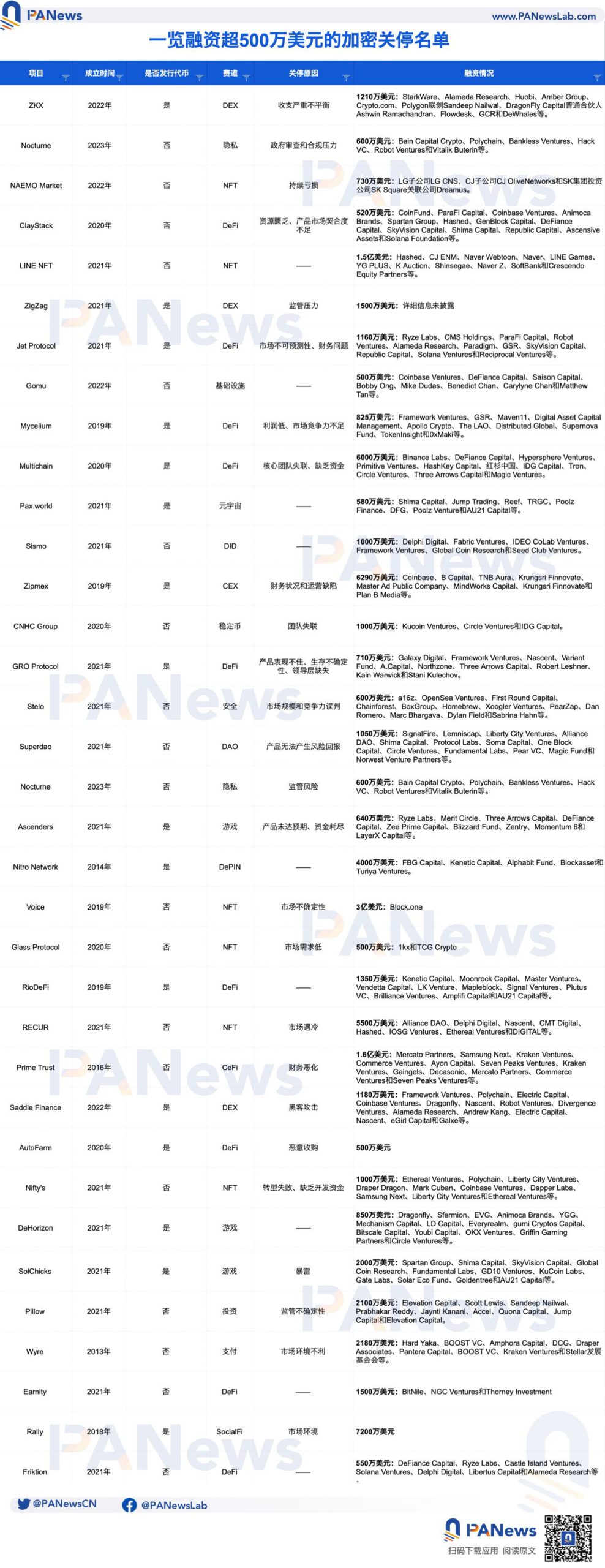

This article, PANews, has compiled 35 "exit" projects that have raised more than $5 million from last year to the present. Many of them have been favored by well-known capital or are backed by giants, mainly involving NFT, DeFi and games. And among these shutdown projects, there are veterans who are declining, and there are rookies who have suddenly collapsed. Most of them came to an end due to financial problems, market recession, regulatory pressure, and low product adoption rates.

The cumulative financing of closed projects exceeds 1.1 billion US dollars, and DeFi, NFT and games are facing difficulties in survival

The cumulative financing of closed projects exceeds 1.1 billion US dollars, and DeFi, NFT and games are facing difficulties in survival

Although the crypto market has moved towards the stage of capital "control", financing alone does not mean that it can successfully overcome the bubble cycle. According to incomplete statistics from PANews , since 2023 to date, 35 projects in the crypto market that have raised more than US$5 million have been shut down. The cumulative financing amount of these projects is nearly US$1.17 billion, with an average amount of approximately US$34 million. Among them, the three projects with the highest financing are Voice, Prime Trust and LINE NFT, which have received a total of more than US$600 million in financing.

"The trend is good for a while, and the crematorium is reviewed." Although there are many successful cases of overcoming industry risks, the investment market is so cruel. Judging from the tracks of these bankrupt projects, DeFi, NFT and the gaming field are the first among them, and they are the main narrative of capital betting. The number of failed projects in these three areas accounted for 22.8%, 11.4% and 8.5% respectively, and the investment amounts were approximately US$170 million, US$530 million and US$35 million respectively, accounting for approximately 62.8% of the total financing of closed projects. %.

Behind these high-amount financings, there are many star-level VCs, such as Coinbase Ventures, Paradigm, Binance Labs, Sequoia China, Circle Ventures, Galaxy Digital, a16z, Polychain, as well as bankrupt Alameda Research and Three Arrows Capital, among which Coinbase Ventures, Alameda Research, Three Arrows Capital, and Polychain are the most frequent contributors to "thundering", and have all participated in at least three failed projects. Of course, this is also closely related to their high-frequency investment activities.

In addition, judging from the establishment timeline, projects launched between 2020 and 2021 have the highest failure rate, accounting for approximately 61.7% of the total statistics, and have received a total of more than US$430 million in financing. Among them, 16 failed projects all came from 2021, mainly DeFi and NFT projects.

Amid the tide of crypto bankruptcy, these factors have become the main triggers

In the rapidly changing encryption market environment, the failure cases of these encryption projects undoubtedly serve as a wake-up call for the industry. Overall, the vast majority of projects are related to market cooling, financial difficulties, tightening regulations and insufficient product penetration.

The prosperity of the industry is an important factor affecting the survival and development of projects. Especially in the "cold winter" environment, successful "survival" has become a difficult problem for major projects. According to PANews statistics, at least five projects had to cease operations due to market conditions.

Take the NFT market as an example. As we all know, the NFT market continues to show a downward trend after the craze subsides, and market demand becomes increasingly sluggish. According to a recent report by data tracking platform CryptoSlam, the current monthly sales of the NFT market have dropped to US$393 million, the lowest monthly sales since November 2023. With this kind of transaction shrinking significantly, the NFT market will inevitably see a wave of shutdowns, even though many of them have strong backend backgrounds and huge financing.

For example, LINE NFT, an NFT market owned by Japanese communications giant LINE, terminated its services after only two years of implementation despite receiving high-level financing of approximately US$150 million; NAEMO Market, which is backed by Bithumb Meta, a metaverse company under Bithumb, also It has ceased operations due to continuous losses since its establishment, which also led to investments of approximately US$7.3 million from several large Korean companies including LG subsidiary LG CNS, CJ subsidiary CJ Olive Networks, and SK Group investment company SK Square affiliate Dreamus. It came to nothing; the NFT brand experience platform Recur, which had received US$55 million in financing, also closed after more than two years of execution due to unforeseen challenges in the NFT market and changes in the business landscape.

At the same time, although financing can alleviate the "blocking points" of project survival and development to a certain extent, it is difficult to obtain sustainable survival space without a benign and viable survival model. According to PANews statistics, at least 7 projects were closed due to the fact that the expected revenue could not cover the expenditure costs or even exceeded the financing funds.

For example, ZKX received a total of US$12.1 million in two rounds of financing, but still chose to cease operations because it could not find an economically feasible path. According to its founder, ZKX’s decision to cease operations was based on several key factors, including user participation. The platform's revenue is almost unable to cover wages and other basic operating costs, and the current token value cannot continue to support the protocol. Of course, this status quo is related to the current "boycott" of VC coins by retail investors. In fact, the huge amount of selling pressure that has yet to be unlocked has made VC coins increasingly lose "popular support" in this bull market. This investment background has instead become a constraint on the development of encryption projects. "Invisible shackles".

The same problem also occurs with the liquidity staking platform ClayStack. After more than 3 years of continuous operation, more than 6 product audits, and a seed round of financing of up to 5.2 million US dollars, this platform has failed due to lack of resources and product-market fit. Du was not enough to announce its gradual shutdown in May this year; Via Protocol, a cross-chain liquidity aggregation protocol that received US$1.2 million in financing, also chose to terminate cooperation because it could no longer afford the server costs;

Financial difficulties have also eroded the value of the project to a great extent, and even ultimately faced the risk of bankruptcy. Among the above failed projects, 5 projects faced survival difficulties due to funding problems. For example, projects such as Jet Protocol, which received US$11.6 million in financing from Paradigm and others, the DAO establishment platform Superdao, and the chain game project Ascenders all ran into financial difficulties and chose to close down.

In addition, regulatory compliance is also a major challenge that encryption projects are facing. In fact, as the size of the encryption market continues to grow, global regulatory sledgehammers are frequently attacking, relevant compliance requirements are becoming increasingly strict, and relevant projects are facing increasing pressure from supervision and review. Among statistical projects, at least five projects were eventually closed due to regulatory factors.

For example, Nocturne, a privacy protocol founded in 2023, decided to gradually shut down in June this year after receiving $6 million in support from investors including Bain Capital Crypto, Polychain, Bankless Ventures, Hack VC, Robot Ventures and Vitalik Buterin. The decision comes after the Privacy Protocol, which was formed earlier last year, ceased operations due to regulatory pressure. For another example, after receiving $21 million in financing, the crypto investment application Pillow was forced to be submerged in the torrent of crypto history due to regulatory uncertainty.

Of course, some also went bankrupt due to black swan events such as loss of contact with the core team, hacker attacks, and investment thunderstorms. Among these 35 closed projects, many projects collapsed without warning, and some of the currency issuance projects caused huge losses to investors. For example, the Metaverse game ecosystem DeHorizon and the Metaverse project Pax.world have not released any announcements. The tokens have now almost reached zero and have not even been listed on centralized exchanges.

It is worth mentioning that although after bankruptcy due to different reasons, some projects that were actively closed also provided positive aftermath plans compared to the projects that were directly rugged. For example, ZKX closed all market positions and returned all funds to everyone. users’ trading accounts, LINE NFT will return all assets on sale after closure, etc.