The U.S. Department of Labor released the latest employment data last night. The number of non-farm payrolls in the United States in July was only 114,000, which was far lower than market expectations. The U.S. non-farm unemployment rate also climbed to 4.3% in July, a three-year high. These data show that the U.S. job market is weak.

After the July non-farm payrolls data was released, the U.S. stock market suffered a sharp decline yesterday. Many investors were worried that the dismal employment data would bring down the U.S. economy, and they evacuated their assets from U.S. stocks. However, what many people are concerned about is, where did the capital outflow from the US stock market go? In fact, the current overall economic situation has encountered two major factors that have caused a large amount of hot money to flow. One is the fear of economic recession, and funds are turning to safe-haven assets. The second is the "free entry of large international capital into the stock market" caused by Japan's interest rate hike. "Money" is not as strong as it used to be.

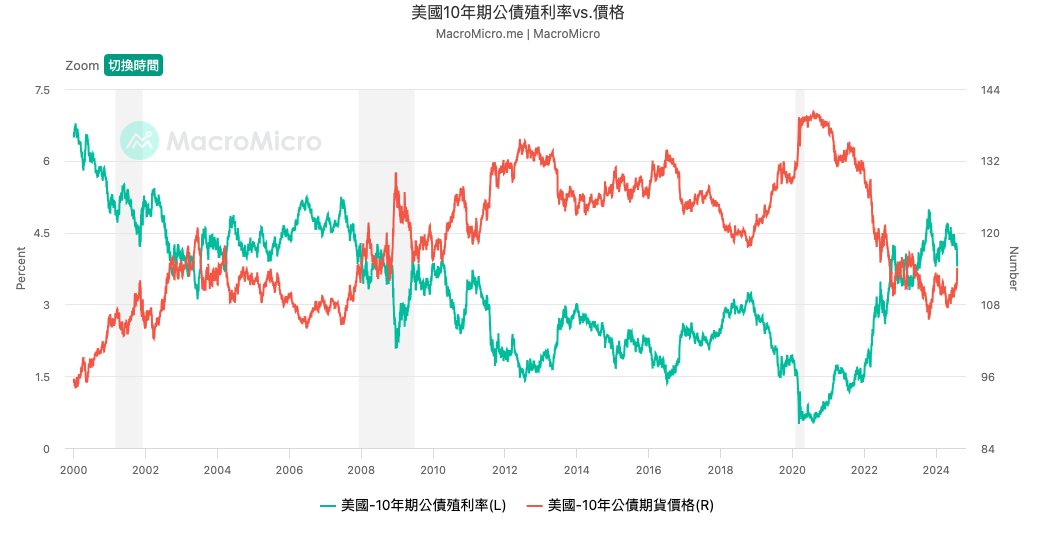

U.S. bond yields plummet, U.S. bond prices surge

Since March 2022, the U.S. Federal Reserve has embarked on the most aggressive interest rate hike cycle in decades. It was not until September last year that the Fed decided to suspend the pace of interest rate increases and kept the federal benchmark interest rate unchanged at a range of 5.25% to 5.50%. , interest rates have been frozen for eight consecutive years. During this period, U.S. bond yields have also continued to rise, once reaching a record high in more than ten years.

However, as the release of non-farm payrolls data fueled expectations that the Fed would cut interest rates quickly, U.S. bond yields also plummeted:

- The 2-year U.S. Treasury yield, which is most sensitive to Fed interest rates, plummeted 29.2 basis points to 3.871% from the previous value of 4.163%, hitting the lowest level since May 4 last year.

- The benchmark 10-year U.S. Treasury yield also plummeted 18.2 basis points to 3.795% from the previous value of 3.977%, hitting the lowest level since July last year.

- The 30-year U.S. Treasury yield plummeted 15.9 basis points to 4.11% from the previous value of 4.27%, falling to the lowest level since February this year.

In addition, due to market interest rate cut expectations and concerns about economic recession, many funds began to accelerate their withdrawal from risky assets (stocks, cryptocurrencies) and instead bought U.S. Treasury bonds and other safe-haven assets.

Arbitrage strategy collapses after yen rate hike

Although a series of U.S. data has deepened concerns about economic recession, it may be the trigger for the flight of funds from U.S. stocks. However, Russell Napier, co-founder of the investment research portal ERIC, said that the Bank of Japan's shift from ultra-loose monetary policy to tightening, triggering the collapse of the yen's "carry trade", may be the main reason.

Napier went on to say that the recent surge in the yen has put investors under increasing pressure to repay yen loans, and they have to sell assets previously purchased with yen, such as popular U.S. technology stocks. The surge in unwinding of this yen carry trade has weighed on U.S. stock prices, while U.S. Treasury yields have continued to fall.

The most well-known example of using the Japanese yen for "arbitrage trading" is the American stock investor Warren Buffett. Berkshire Hathaway, the investment company controlled by Buffett, has issued yen bonds eight times as of April this year, and has used most of the raised funds to invest in Japanese stocks.

However, now that the Bank of Japan has announced a rate hike, the market expects that the yen, which is significantly undervalued, will continue to appreciate in the future. By then, the yen arbitrage strategy adopted by many investors and investment institutions will completely collapse, which also means that the investment in global stock markets will be significantly reduced.