Trump has managed to get people excited this past week by mentioning a BTC strategic reserve, but never fully committed to it. Let’s face it, the US will never announce a purchase of BTC before actually buying it, and anyone who does so would be foolish because it would get preempted. Most likely, they will continue to hold onto the BTC they seized. This means they get the best Bitcoin accumulation strategy, just seize it for free from criminals and continue to hold onto it. They won’t lose money.

Why spend tax dollars when you can do it so easily?

On the other hand, the previous owner of the real DOGE, Kabosu, got a new dog named Neiro, and there was a huge drama between the different tokens, and who was first between the 2 Neiros on SOL and the 1 Neiro on ETH, which caused huge fluctuations.

At this point, it looks like ETH Neiro is the winner, but given how dramatic this thing is, you never know how it will turn out.

Market Hotspots

- Pump Fun Earn Ethereum in 24 Hours

- Compound Finance suffered a governance attack, losing $25 million

- Drama about the “ new doge ” and subsequent two “Neiro” tokens

- Dinero Protocol announces partnerships with Galaxy and Nomura/Laser Digital

- Moonshot memecoin trading app now available on Google Play in over 130 countries

- SEC Seeks to Amend Complaint Against Binance to No Longer Deem SOL a Security

- Pump fun competitor launched, lets you create memecoins via Twitter

Capital flows

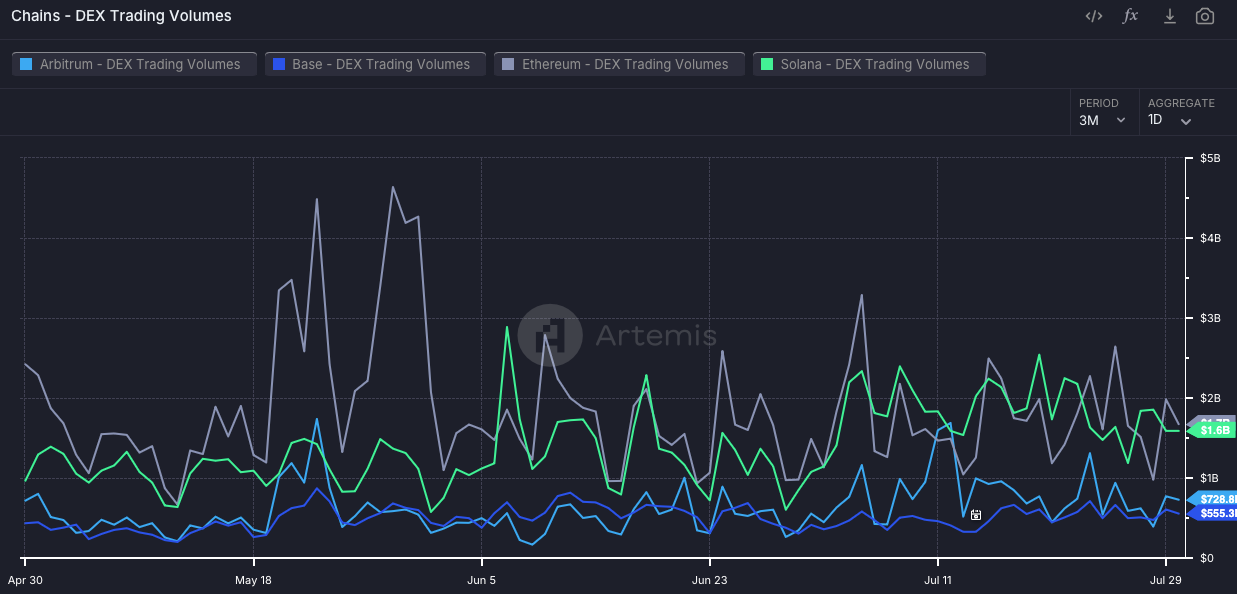

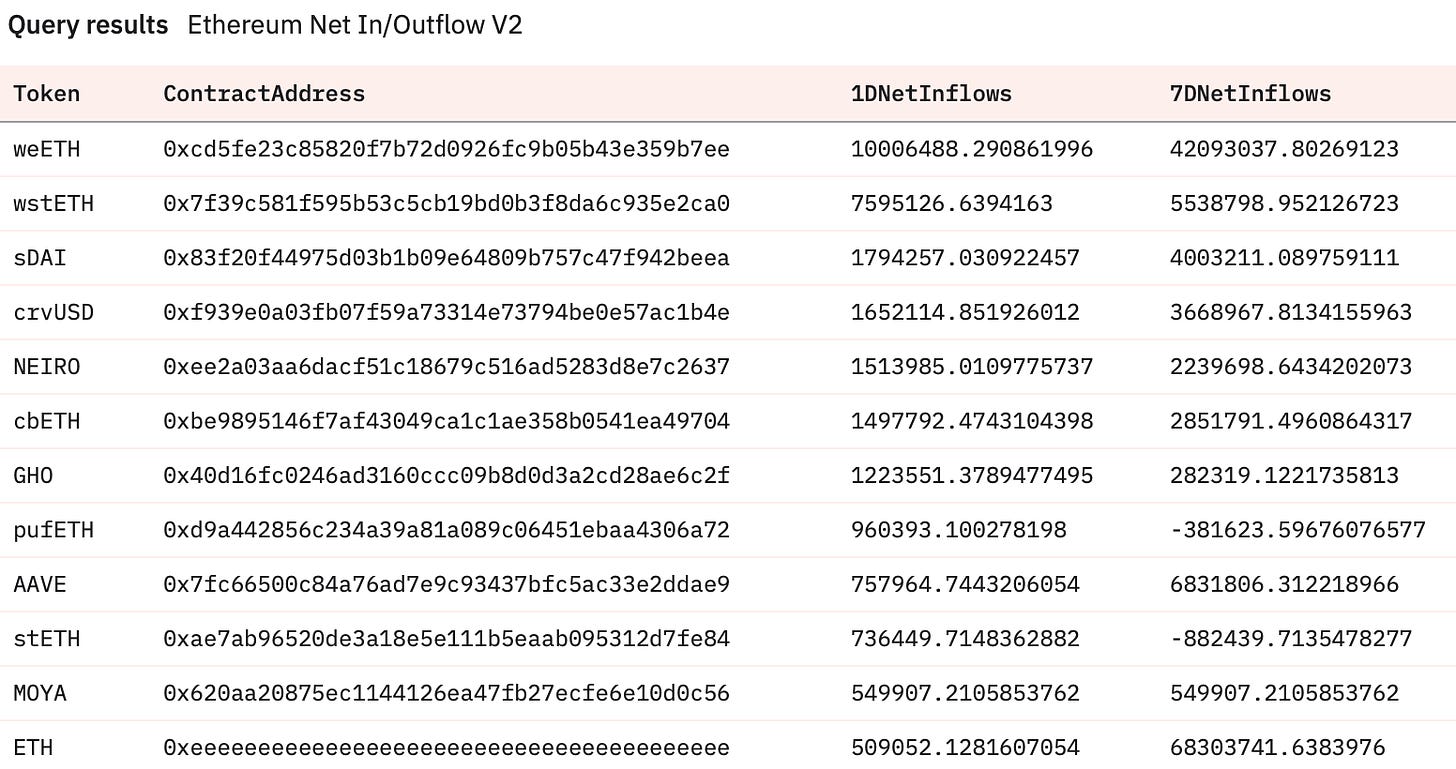

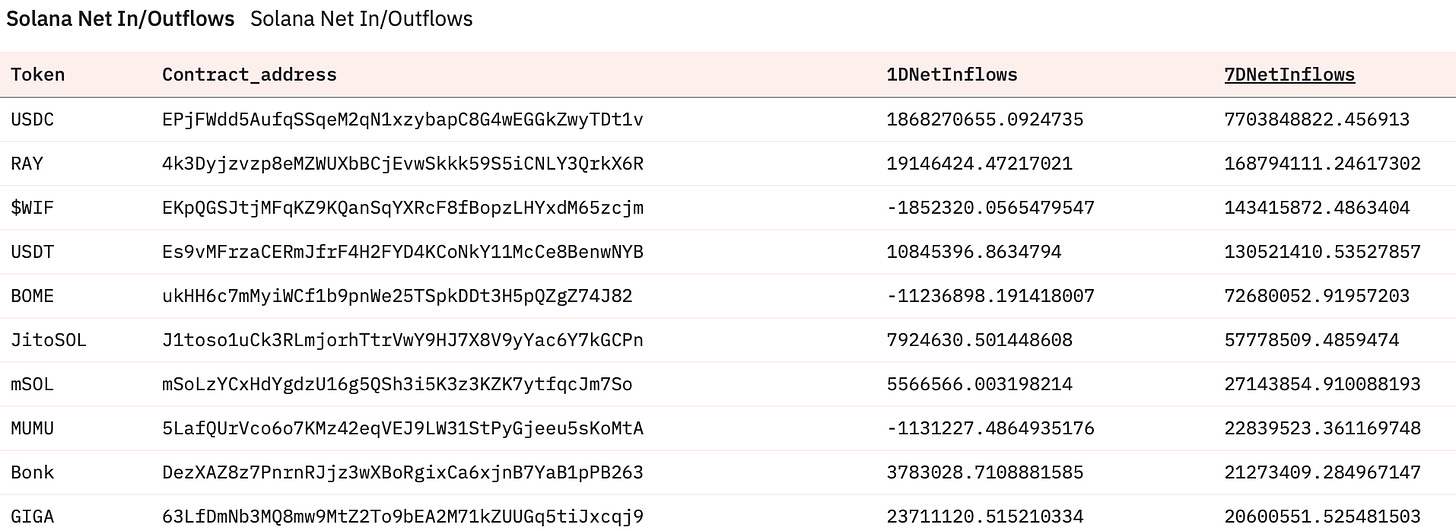

Ethereum and Solana are still in a head-to-head battle over who can attract the most capital. Given the drama over the weekend regarding Neiro, there is no doubt that a lot of capital has been pouring into Solana to catch up with the move. And if you look more closely, you can see that capital has fallen back over the past 24 hours as people are now more focused on ETH.

DEX Trading Volume

DEX volumes surged over the weekend but are down again this week as we try to get out of the long summer doldrums. If you haven’t bought anything yet, now is the time, as time is running out for on-chain to truly wake up again. Get ready.

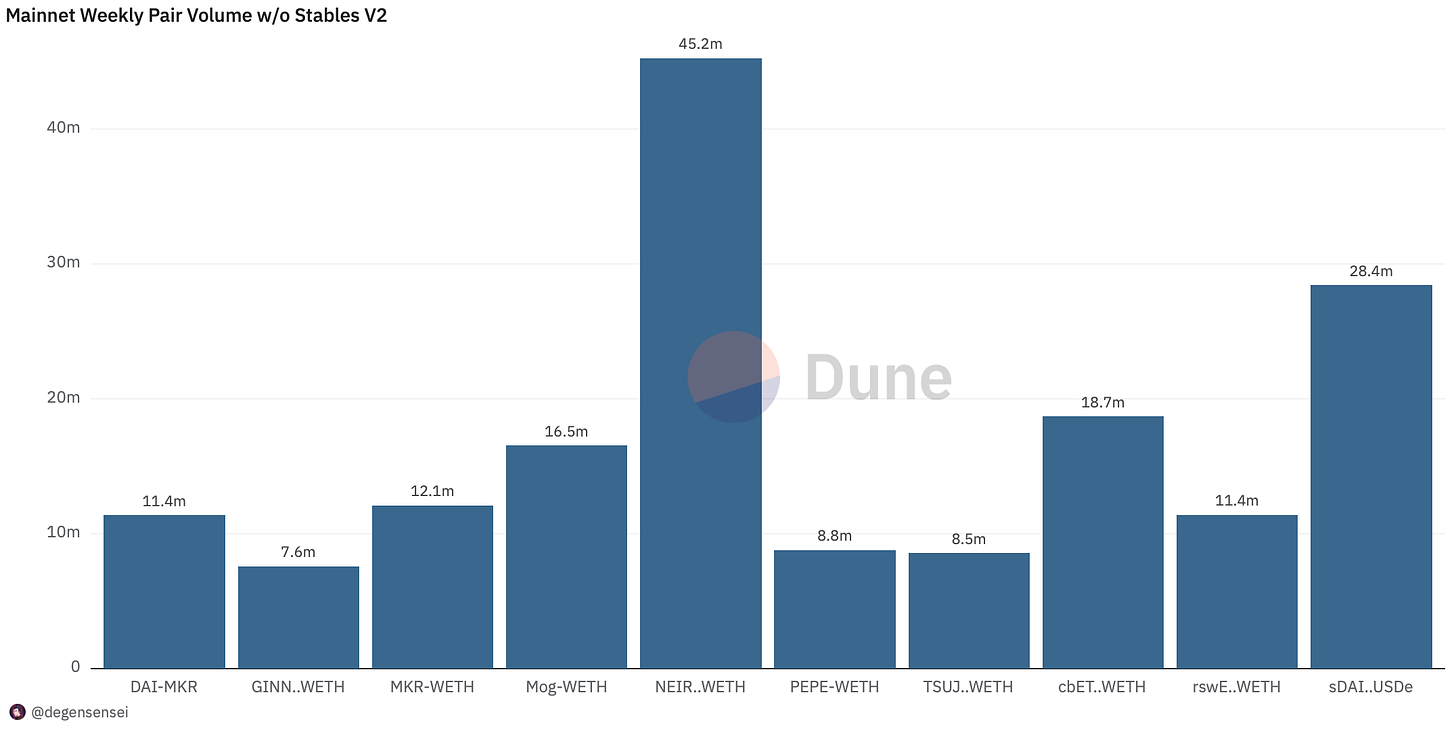

After all this drama, it’s not surprising to see NEIRO dominating ETH volume, and it’s likely to continue to do so for a while as long as ETH on-chain prices start to trend upward. MOG and MKR lag behind it, while PEPE and TSUJI have also received some attention. MKR’s strength cannot be underestimated, and memecoin has been the theme of the cycle so far.

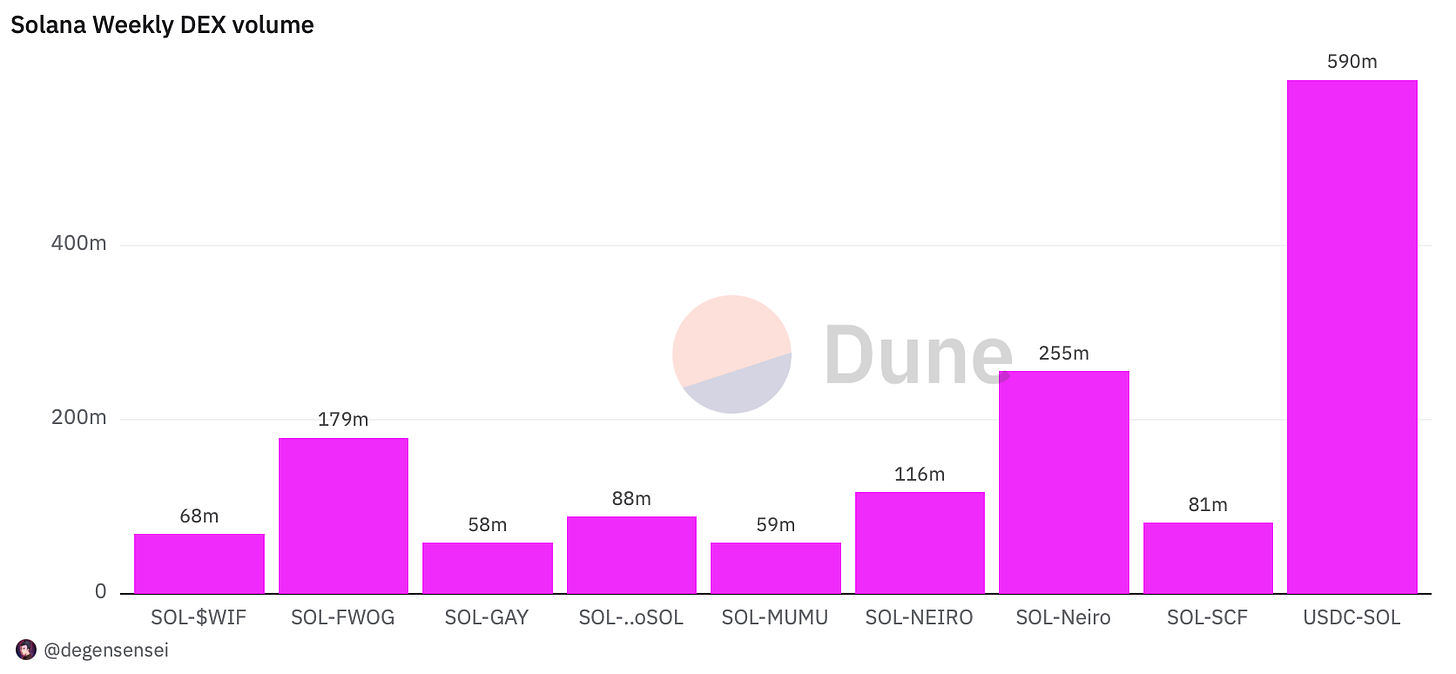

NEIRO has also been dominating on SOL, and while it’s outperforming ETH by a wide margin, the drama between the two different NEIROs on Solana means they’re cannibalizing each other, and NEIRO on ETH is probably the winner right now. FWOG has also been a strong winner, reaching a 40m market cap in 1 day, while GAY is a CEX-listed token, so it shows up here.

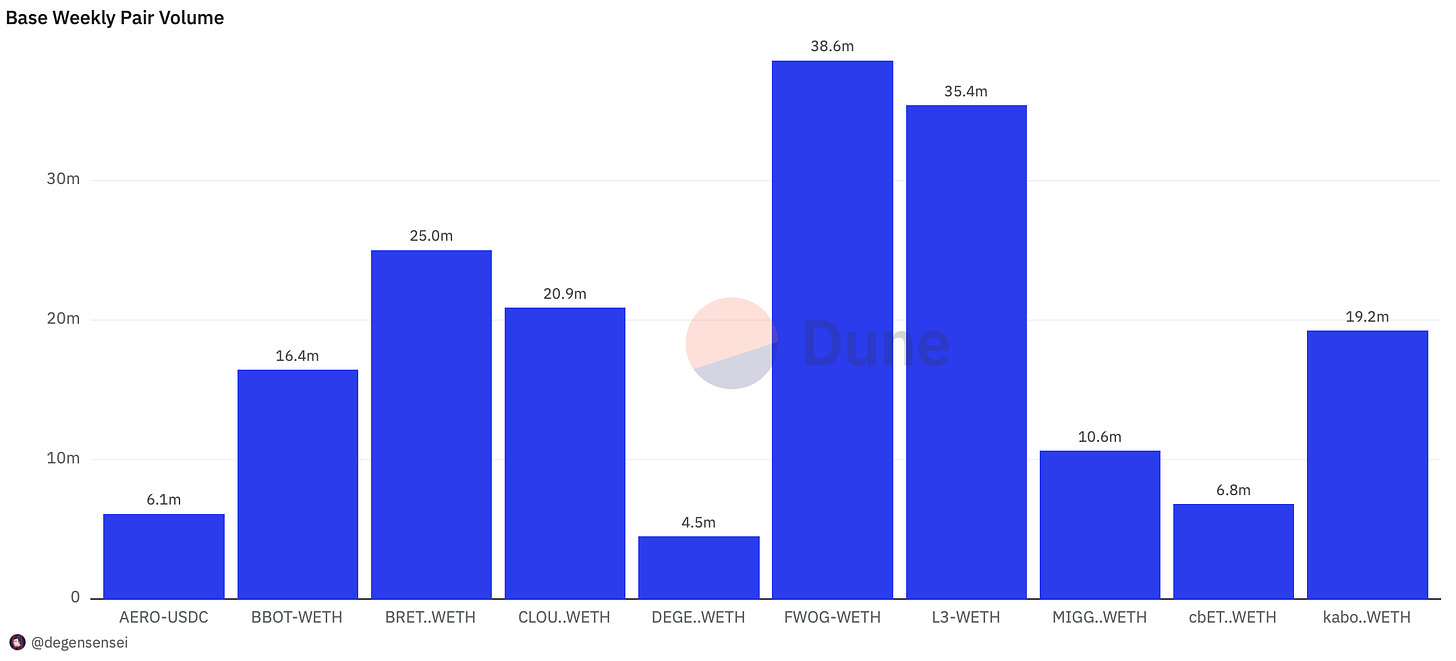

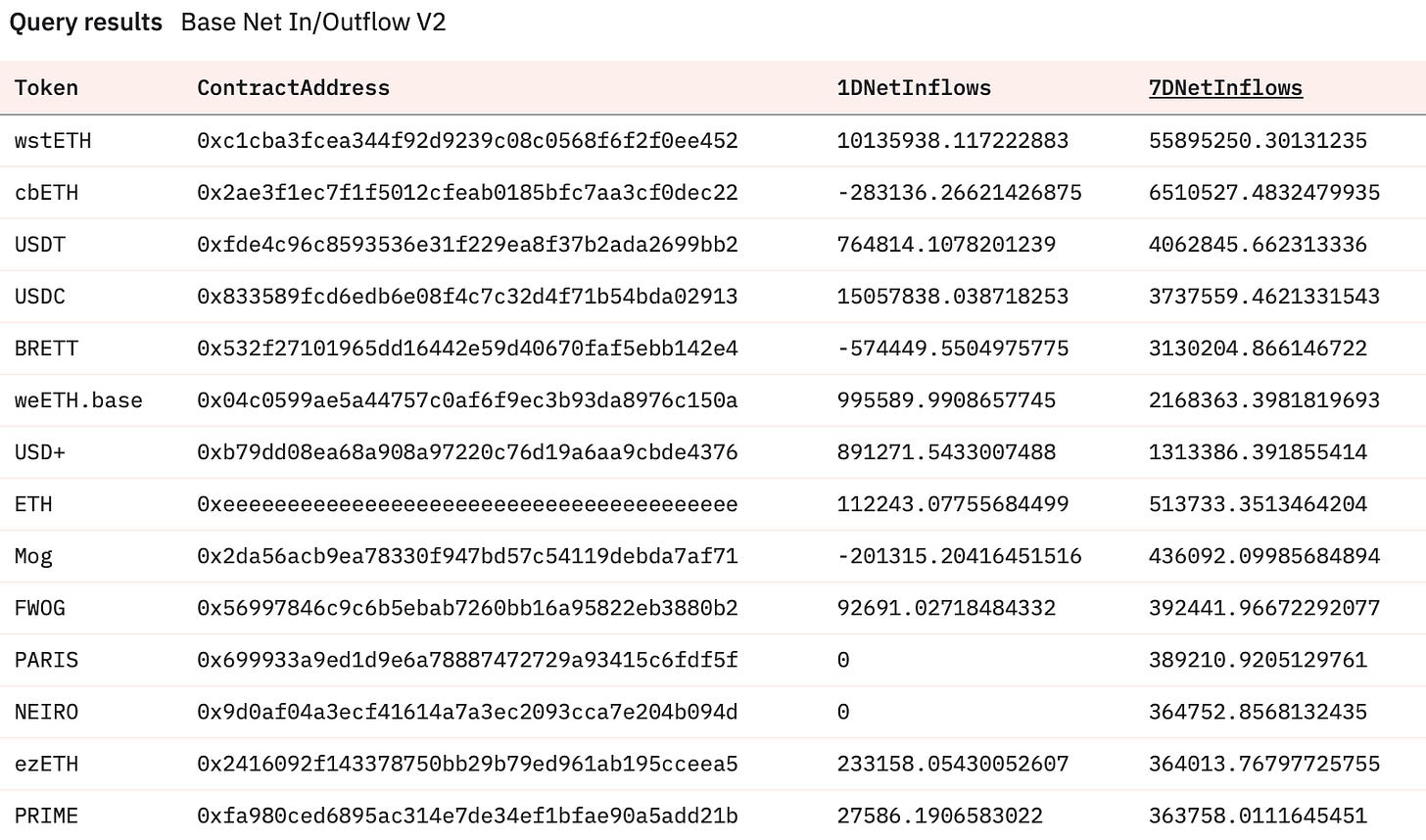

AERO slowing down means the entire Base ecosystem slowing down as well. FWOG, a competitor on Solana, received many bids in one day and they tried to force Neiro to stage a drama again, but failed the second time. Brett is the only token that remains resilient while other tokens in the ecosystem have been losing.

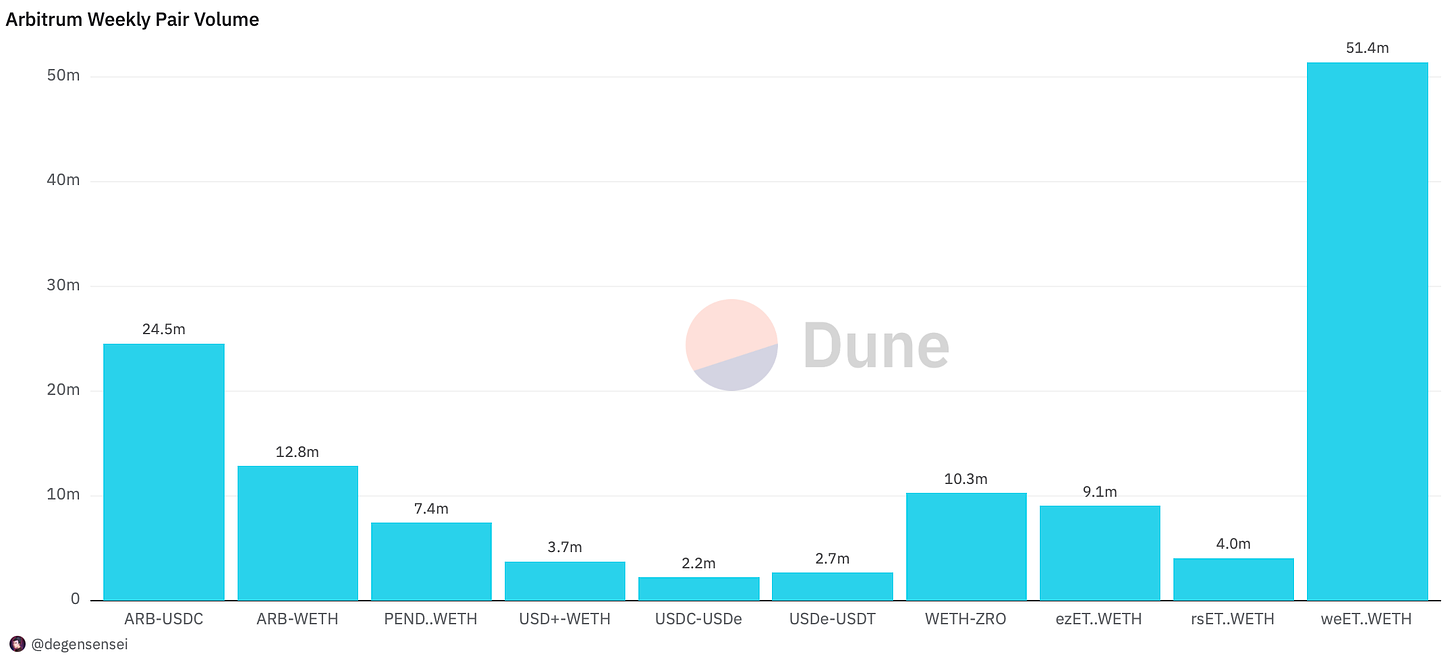

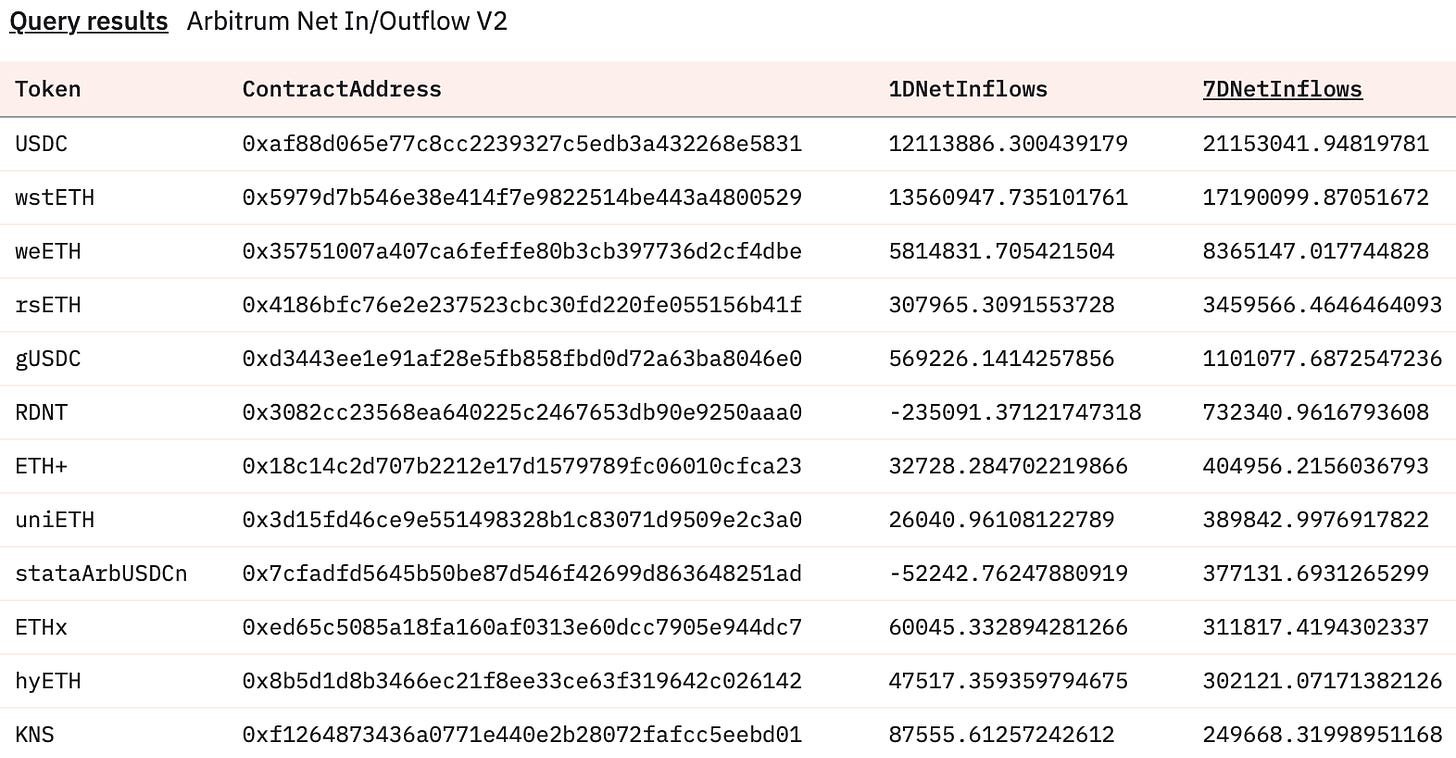

Not a whole lot has changed on Arbitrum over the past week, with trading volumes plummeting across the board. It’s rare to see ARB token volumes as low as these, and while ZRO is the flag bearer for the stronger tokens in the ecosystem, interest has waned and the token has suffered as a result.

NFT Trading Volume

Ordinals are in free fall, with the only NFTs showing some strength right now being Pudgy Penguins, BAYC, and CryptoPunks, while the rest of the market is in the doldrums. Ordinals hype peaked before the Bitcoin halving and has not recovered since.

There’s a general lack of enthusiasm in the NFT market, and it may be a while before we see any significant activity again.

Currently, they have been replaced by the more liquid and parasitic memecoins.

Net Inflow

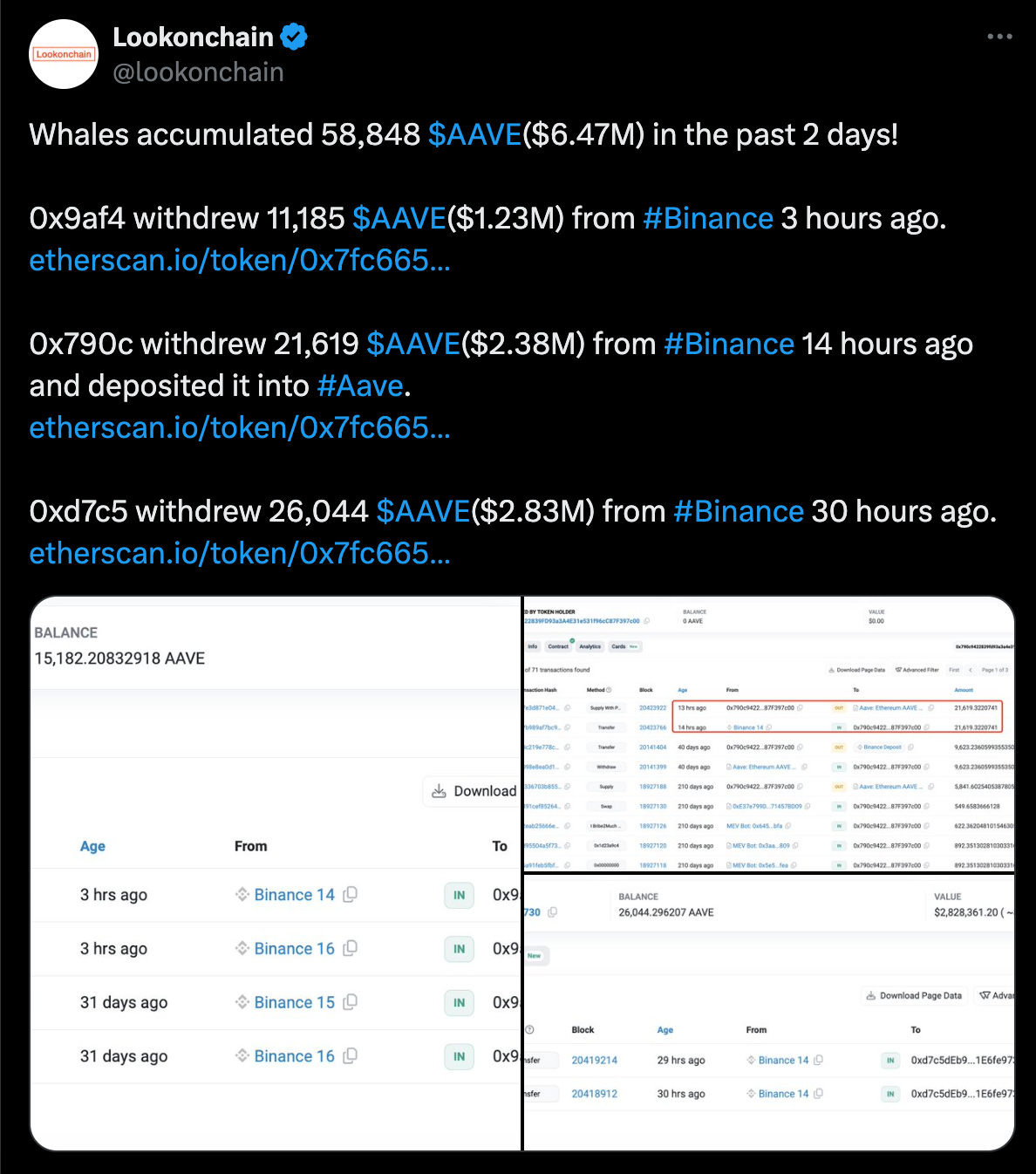

We haven’t really entered risk-on mode yet as people are still very conservative about what to buy, the only Altcoin that have received a lot of bids in the past week are NEIRO and AAVE, with MOYA acting as a little beta test for NEIRO generating a lot of volume. Other than that, people are taking advantage of the sideways market in ETH derivatives, stablecoins, and farming.

RAY has seen the most inflows over the past week, which is not what you expect to see in an ecosystem where people only talk about memes. This could indicate that the ecosystem tokens may be undervalued compared to the activity these memecoins are generating. WIF continues to attract a lot of buyers at these levels, while BOME is a forgotten meme that has attracted a lot of capital over the past week. MUMU is undoubtedly the strongest performer in the ecosystem, while Bonk and GIGA continue to make steady progress.

The same is true for Base, where most bids went to BRETT, dwarfing other bids in the ecosystem. Base needed something to revive an ecosystem that had been stagnant for a while.

The Arbitrum ecosystem is no different than the others. The only token that stands out and gets a small amount of traffic is RDNT, but other than that, there’s really not much to see here.

On-chain address tracking

Whales like AAVE, most likely because they recently announced a proposal that they intend to buy back their tokens when reasonable growth metrics are reached. Considering Aave is now profitable and similar proposals were a strong catalyst for MKR, it is not surprising that people are interested again, as a useless governance token is about to become a useful token.

Here is the address for the curious:

0xd7c5dEb9fA0aC9Ab71cf5f53CB380BF1E6fe9730

0x790c9422839FD93a3A4E31e531f96cC87F397c00

0x9af40209804D8A8d91EBF3EfA277641381684235

Token Unlock

- 1INCH — 0.01% of supply worth $222,400 on August 2

- GAL — August 2, 3.52% of supply worth $11.56 million

- W - August 3, 33.33% of supply valued at $147.27 million

- FORT — 0.01% of supply worth $76,900 on August 4

- LQTY - 0.51% of supply valued at $3,886,700 on August 4

- ENA — 0.87% of supply valued at $5.94 million on August 4

- MODE — August 5, 14.25% of supply, valued at $3.81 million

- MAVIA — 3.64% of supply valued at $1.96 million on August 6

That's it for this week, there's not much to do except remain patient and have faith in your strong convictions. The environment is not right for aggressive trading right now, so rest assured and prepare accordingly.